Elasticity of demand measures how sensitive the quantity demanded of a product is to changes in its price, income, or other factors. Understanding this concept helps businesses and policymakers predict consumer behavior and optimize pricing strategies. Discover how mastering elasticity of demand can benefit your decision-making by reading the full article.

Table of Comparison

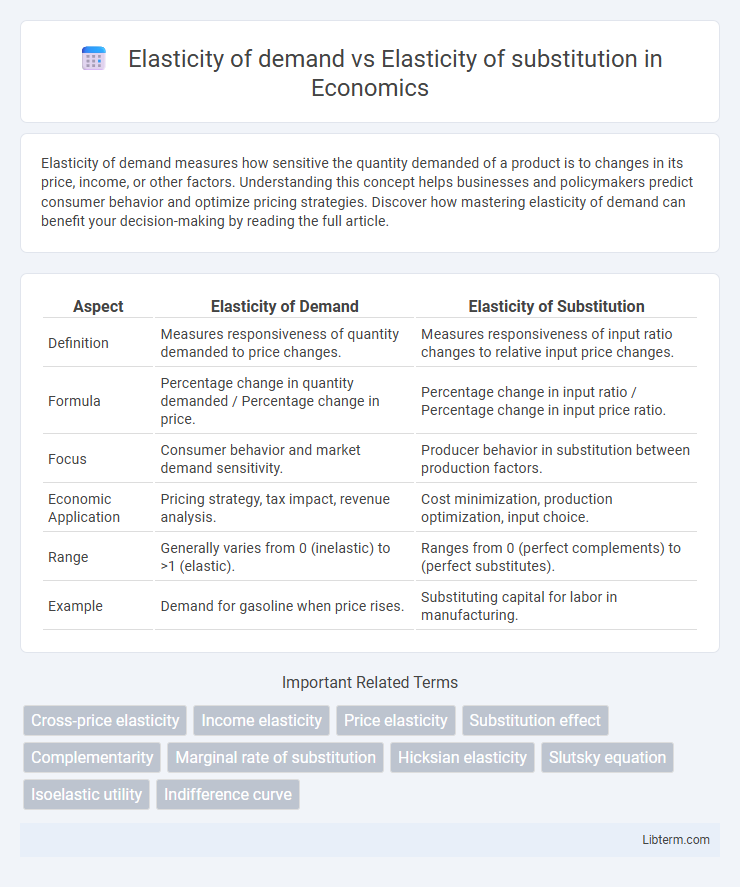

| Aspect | Elasticity of Demand | Elasticity of Substitution |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to price changes. | Measures responsiveness of input ratio changes to relative input price changes. |

| Formula | Percentage change in quantity demanded / Percentage change in price. | Percentage change in input ratio / Percentage change in input price ratio. |

| Focus | Consumer behavior and market demand sensitivity. | Producer behavior in substitution between production factors. |

| Economic Application | Pricing strategy, tax impact, revenue analysis. | Cost minimization, production optimization, input choice. |

| Range | Generally varies from 0 (inelastic) to >1 (elastic). | Ranges from 0 (perfect complements) to (perfect substitutes). |

| Example | Demand for gasoline when price rises. | Substituting capital for labor in manufacturing. |

Introduction to Elasticity in Economics

Elasticity of demand measures the responsiveness of quantity demanded to changes in price, highlighting consumer sensitivity and market dynamics. Elasticity of substitution captures how easily one factor of production can be replaced by another, influencing production decisions and cost structures. Both concepts play crucial roles in economic analysis by quantifying flexibility in consumption and production.

Defining Elasticity of Demand

Elasticity of demand measures the responsiveness of quantity demanded to changes in price, reflecting consumer sensitivity and the degree to which demand varies with price fluctuations. It is defined as the percentage change in quantity demanded divided by the percentage change in price, serving as a key indicator for pricing strategies and market analysis. Elasticity of substitution, by contrast, quantifies the ease with which consumers or producers can switch between different goods or inputs in response to changes in relative prices.

Exploring Elasticity of Substitution

Elasticity of substitution measures the responsiveness of the ratio of two inputs used in production when their relative prices change, highlighting the degree to which one input can replace another. This concept is crucial in production theory for understanding how firms adjust input combinations in response to changes in factor prices, influencing cost structures and output decisions. Compared to elasticity of demand, which focuses on consumer response to price changes, elasticity of substitution specifically addresses input flexibility and substitution possibilities within the production process.

Key Differences Between Demand and Substitution Elasticities

Elasticity of demand measures the responsiveness of quantity demanded to a change in price, reflecting consumer behavior and preferences for a specific good, while elasticity of substitution quantifies how easily consumers can replace one good with another in response to relative price changes. Demand elasticity is influenced by factors like necessity, availability of substitutes, and time, whereas substitution elasticity depends on the degree of similarity and interchangeability between goods in production or consumption. Understanding these differences is crucial for pricing strategies, market analysis, and assessing the impact of economic policies on consumer choices.

Mathematical Formulas and Calculation Methods

Elasticity of demand measures the responsiveness of quantity demanded to price changes, calculated using the formula \( E_d = \frac{\%\Delta Q_d}{\%\Delta P} \), where \( Q_d \) is quantity demanded and \( P \) is price. Elasticity of substitution quantifies how easily one input can be substituted for another in production, expressed by \( \sigma = \frac{d \ln (x_1 / x_2)}{d \ln (MRTS)} \), with \( x_1, x_2 \) as input quantities and MRTS as the marginal rate of technical substitution. Demand elasticity uses percentage change ratios based on observed price and consumption data, while substitution elasticity involves differential calculus on input ratios and MRTS derived from production functions.

Factors Influencing Elasticity of Demand

Elasticity of demand measures how quantity demanded responds to price changes, heavily influenced by factors like the availability of substitutes, necessity of the good, and proportion of income spent. A higher number of close substitutes increases demand elasticity, while essential goods typically exhibit inelastic demand. Consumer preferences, time horizon for adjustment, and the definition of the market also play critical roles in determining demand elasticity.

Determinants Affecting Elasticity of Substitution

Determinants affecting the elasticity of substitution include the degree of similarity between goods, availability of close substitutes, and consumer preferences, all of which influence how easily one input or product can replace another in consumption or production. Factors such as technology, input specificity, and the time horizon also play critical roles in determining elasticity of substitution, impacting the flexibility of producers to switch between inputs as relative prices change. Unlike elasticity of demand, which measures responsiveness of quantity demanded to price changes, elasticity of substitution specifically assesses the ease of substituting one factor of production for another based on relative factor price changes.

Real-World Examples and Applications

Elasticity of demand measures consumer responsiveness to price changes, exemplified by gasoline where a price hike typically leads to reduced consumption due to limited substitutes. Elasticity of substitution refers to how easily one input or good can be replaced with another, such as manufacturers switching between labor and machinery based on relative costs. In real-world applications, firms strategize pricing and production decisions by analyzing gasoline's demand elasticity for revenue optimization, while policymakers assess substitution elasticity to predict shifts between fossil fuels and renewable energy sources.

Implications for Pricing Strategies and Market Behavior

Elasticity of demand measures consumer responsiveness to price changes, directly influencing optimal pricing by indicating how price adjustments affect total revenue. Elasticity of substitution assesses how easily consumers switch between products when relative prices change, guiding firms on product differentiation and competitive positioning. Understanding both elasticities enables businesses to tailor pricing strategies that maximize profits and anticipate market shifts driven by consumer choices.

Conclusion: Importance in Economic Analysis

Elasticity of demand measures consumer responsiveness to price changes, while elasticity of substitution quantifies how easily one good can replace another in production or consumption. Understanding both concepts is crucial for accurately predicting market behavior, shaping pricing strategies, and designing effective economic policies. Their combined analysis enhances decision-making by revealing the flexibility of consumer preferences and production processes under varying economic conditions.

Elasticity of demand Infographic

libterm.com

libterm.com