The contract curve represents the set of efficient allocations in an Edgeworth box where no individual can be made better off without making someone else worse off. It illustrates the range of mutually beneficial trades between two parties, highlighting optimal resource distributions that maximize joint utility. Explore the full article to understand how the contract curve shapes economic negotiations and decision-making.

Table of Comparison

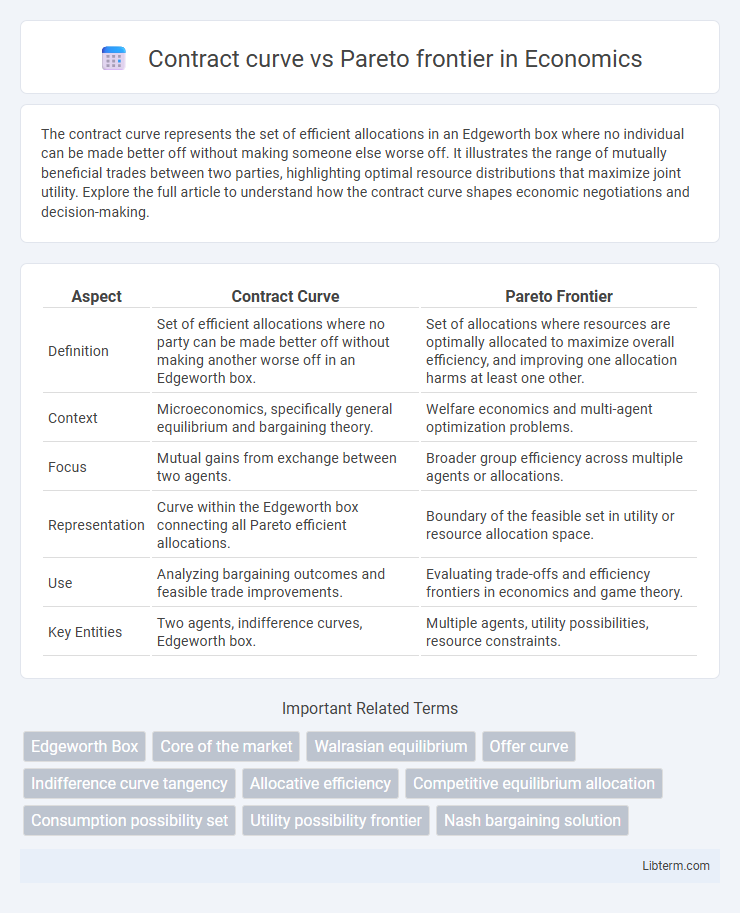

| Aspect | Contract Curve | Pareto Frontier |

|---|---|---|

| Definition | Set of efficient allocations where no party can be made better off without making another worse off in an Edgeworth box. | Set of allocations where resources are optimally allocated to maximize overall efficiency, and improving one allocation harms at least one other. |

| Context | Microeconomics, specifically general equilibrium and bargaining theory. | Welfare economics and multi-agent optimization problems. |

| Focus | Mutual gains from exchange between two agents. | Broader group efficiency across multiple agents or allocations. |

| Representation | Curve within the Edgeworth box connecting all Pareto efficient allocations. | Boundary of the feasible set in utility or resource allocation space. |

| Use | Analyzing bargaining outcomes and feasible trade improvements. | Evaluating trade-offs and efficiency frontiers in economics and game theory. |

| Key Entities | Two agents, indifference curves, Edgeworth box. | Multiple agents, utility possibilities, resource constraints. |

Introduction to Contract Curve and Pareto Frontier

The contract curve represents all efficient allocations where no party can be made better off without making another worse off in a two-agent exchange economy. The Pareto frontier, or Pareto boundary, delineates the set of allocations that are Pareto efficient, marking the maximum achievable utility combinations for involved agents. Both concepts are foundational in welfare economics, illustrating optimal resource distributions and the trade-offs between agents' utilities.

Defining the Contract Curve

The contract curve represents the set of efficient allocations where two parties cannot be made better off without making the other worse off, lying within the Edgeworth box. It defines all possible Pareto improvements achieved through mutually beneficial trades between agents. The contract curve is a subset of the Pareto frontier, specifically mapping equilibria in exchange economies where individuals maximize utility given their initial endowments.

Understanding the Pareto Frontier

The Pareto frontier represents the set of allocations where no individual can be made better off without making someone else worse off, illustrating optimal efficiency in resource distribution. Contract curves, found within Edgeworth boxes, trace the locus of Pareto efficient allocations achievable through mutually beneficial trades between two agents. Understanding the Pareto frontier involves analyzing these allocations to identify the trade-offs and efficiency limits in multi-agent economic systems.

Key Differences Between Contract Curve and Pareto Frontier

The contract curve represents all efficient allocations of resources in a two-person exchange economy where no one can be made better off without making the other worse off, specifically within the Edgeworth box framework. The Pareto frontier extends this concept by encompassing all allocations across multiple agents or dimensions where improvements cannot be achieved without detriment to others, hence it represents the boundary of Pareto optimality in broader contexts. Key differences include the contract curve being confined to bilateral exchanges and interior allocations, while the Pareto frontier applies to multi-agent scenarios and diverse economic settings, highlighting their different scopes in welfare economics.

Graphical Representation in Economics

The contract curve in economics graphically represents all efficient allocations where no individual can be made better off without making another worse off, lying within the Edgeworth box. The Pareto frontier, or Pareto boundary, represents the set of optimal points in the utility possibility frontier where improvements cannot be achieved without trade-offs. Graphically, both curves depict efficiency, but the contract curve specifically maps negotiated agreements within an exchange economy, while the Pareto frontier captures the broader concept of optimal resource distribution in multi-agent settings.

Role in General Equilibrium Theory

The contract curve represents all efficient allocations in a two-agent exchange economy where no party can be made better off without making the other worse off, serving as a key concept in General Equilibrium Theory for analyzing mutually beneficial trades. The Pareto frontier generalizes this idea to multiple agents and goods, illustrating the set of allocations where no individual's utility can improve without reducing another's utility, crucial for characterizing optimal resource distributions in competitive markets. Both concepts underpin equilibrium analysis by identifying outcomes where markets clear and social welfare is maximized without further Pareto improvements.

Applications in Resource Allocation

The contract curve identifies all efficient allocations where no party can be made better off without making another worse off, crucial in bargaining and trade scenarios. The Pareto frontier represents the set of optimal resource distributions maximizing overall welfare, guiding policymakers in achieving efficient outcomes. Both concepts are applied in economics and game theory to optimize resource allocation, ensuring fairness and efficiency in markets and negotiation processes.

Efficiency and Optimality Explored

The contract curve represents all efficient allocations where no party can be made better off without making another worse off, embodying Pareto optimality within an Edgeworth box. The Pareto frontier extends this concept, illustrating the set of all Pareto efficient outcomes across different possible trade-offs between agents. Both concepts highlight economic efficiency, but the contract curve specifically details mutually beneficial exchanges, while the Pareto frontier maps the boundary of achievable optimal allocations.

Real-World Examples and Case Studies

The contract curve in economics represents the set of efficient allocations where no party can be made better off without making another worse off, often illustrated in exchange economies such as labor negotiations or trade deals. The Pareto frontier extends this concept by encompassing all allocations where resources are optimally distributed, including broader contexts like market competitions or welfare economics. Real-world case studies, such as the negotiation of international trade agreements or labor union contracts, demonstrate how both concepts guide optimal decision-making to balance competing interests while maximizing overall efficiency.

Conclusion: Choosing the Right Concept

The contract curve represents all efficient allocations where parties cannot improve without harming others, making it essential in bargaining and exchange scenarios. The Pareto frontier encompasses a broader set of allocations that are Pareto efficient, illustrating trade-offs among multiple agents in multi-objective optimization. Choosing the right concept depends on whether the focus is on mutually beneficial exchanges (contract curve) or overall efficiency across diverse criteria (Pareto frontier).

Contract curve Infographic

libterm.com

libterm.com