Credit cards offer a convenient way to manage purchases, build credit history, and earn rewards such as cash back or travel points. Understanding interest rates, fees, and repayment terms is essential to avoid debt and maintain financial health. Discover how you can maximize the benefits of your credit card by reading the rest of this article.

Table of Comparison

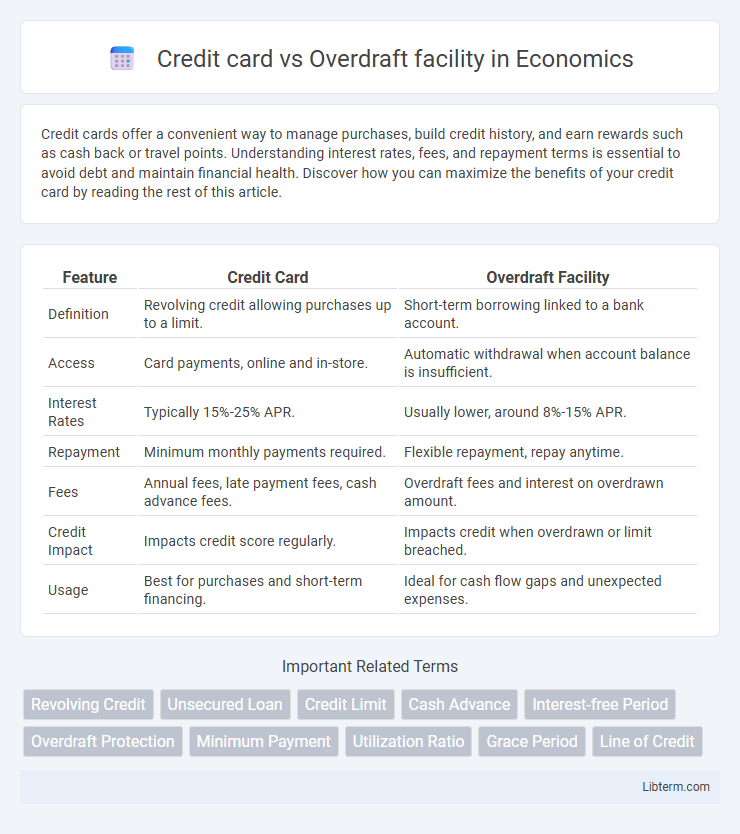

| Feature | Credit Card | Overdraft Facility |

|---|---|---|

| Definition | Revolving credit allowing purchases up to a limit. | Short-term borrowing linked to a bank account. |

| Access | Card payments, online and in-store. | Automatic withdrawal when account balance is insufficient. |

| Interest Rates | Typically 15%-25% APR. | Usually lower, around 8%-15% APR. |

| Repayment | Minimum monthly payments required. | Flexible repayment, repay anytime. |

| Fees | Annual fees, late payment fees, cash advance fees. | Overdraft fees and interest on overdrawn amount. |

| Credit Impact | Impacts credit score regularly. | Impacts credit when overdrawn or limit breached. |

| Usage | Best for purchases and short-term financing. | Ideal for cash flow gaps and unexpected expenses. |

Understanding Credit Cards and Overdraft Facilities

Credit cards offer a revolving credit line with preset limits, enabling users to make purchases or withdraw cash while managing repayments through monthly billing cycles. Overdraft facilities allow account holders to withdraw more funds than available in their bank account up to an approved limit, providing short-term liquidity with interest charged on the overdrawn amount. Both credit cards and overdrafts serve as convenient financial tools, but credit cards typically offer rewards and structured repayment options, whereas overdrafts provide immediate access to cash with flexible repayment terms tied directly to the account balance.

Key Features of Credit Cards

Credit cards offer a revolving line of credit that allows users to make purchases up to a set limit, with options for interest-free periods if balances are paid in full monthly. They come with benefits like rewards programs, fraud protection, and the ability to build credit history. Unlike overdraft facilities that typically have variable fees and are linked directly to a bank account overdrawing, credit cards provide structured billing cycles and clear credit terms.

Key Features of Overdraft Facilities

Overdraft facilities provide flexible borrowing by allowing account holders to withdraw beyond their current balance up to a predetermined limit, typically with interest charged only on the overdrawn amount. Key features include variable interest rates, repayment terms linked to account activity, and no fixed repayment schedule, offering convenience for managing short-term cash flow shortages. Overdrafts often come with fees such as arrangement fees or daily charges, making them suitable for temporary liquidity needs rather than long-term borrowing.

Application and Eligibility Criteria

Credit card applications typically require a good credit score, stable income, and proof of identity, with banks assessing repayment capacity and credit history before approval. Overdraft facility eligibility often depends on maintaining an active current account, satisfactory banking relationship history, and business or personal income verification. Financial institutions prioritize creditworthiness and account tenure to determine approval for both credit products.

Interest Rates and Fees Comparison

Credit cards typically carry higher interest rates, often ranging from 15% to 25% APR, along with annual fees and late payment charges that can increase the overall cost. Overdraft facilities usually have lower interest rates, around 10% to 15%, with fees primarily based on usage, such as daily or monthly overdraft fees, making them more cost-effective for short-term borrowings. Comparing interest rates and fee structures is crucial to determine the most economical option for managing short-term credit needs.

Flexibility and Repayment Options

Credit cards offer extensive flexibility by allowing users to make purchases up to a pre-approved limit with revolving credit, and repayments can be made in full or over time with interest applied on outstanding balances. Overdraft facilities provide flexible access to extra funds linked directly to a bank account, enabling users to cover short-term cash flow gaps with interest charged only on the overdrawn amount. While credit cards often have structured minimum monthly payments and variable interest rates, overdrafts typically have daily or monthly fees and more flexible repayment schedules without fixed instalments.

Impact on Credit Score

Using a credit card responsibly by maintaining low balances and making timely payments can positively impact your credit score by demonstrating creditworthiness. An overdraft facility, while convenient for short-term cash flow, can negatively affect your credit score if overused or if repayments are delayed, as it indicates potential financial stress. Monitoring utilization rates and repayment history on both credit cards and overdrafts is crucial for maintaining a healthy credit profile.

Suitability for Different Financial Needs

Credit cards are suitable for managing short-term expenses and making purchases with benefits like rewards and fraud protection, ideal for consumers seeking flexible repayment options and convenience. Overdraft facilities provide quick access to funds beyond the existing account balance, catering to those needing emergency cash flow or covering unexpected expenses without applying for a new loan. Choosing between the two depends on financial habits, with credit cards favoring planned spending and overdrafts fitting occasional cash shortages.

Security and Fraud Protection

Credit cards offer robust security features such as EMV chip technology, real-time transaction alerts, and zero liability policies to protect against unauthorized charges. Overdraft facilities typically rely on the security measures of linked bank accounts, providing less specialized fraud protection and making timely monitoring essential. Enhanced fraud detection systems integrated with credit cards reduce risks significantly compared to overdraft accounts, which depend more on customer vigilance for preventing misuse.

Pros and Cons: Credit Card vs Overdraft Facility

Credit cards offer flexible spending with rewards and fraud protection but may lead to high-interest debt if not managed properly. Overdraft facilities provide immediate access to extra funds linked to a checking account, often with lower interest rates than credit cards, yet can incur fees and swiftly accumulate debt if overused. Choosing between them depends on factors such as usage frequency, interest rates, repayment discipline, and specific financial needs.

Credit card Infographic

libterm.com

libterm.com