The permanent income hypothesis suggests that individuals base their consumption decisions on an estimate of their long-term average income rather than current earnings alone. This theory explains why consumption changes less than income over time and highlights the importance of expected future income in financial planning. Discover how this concept can influence your spending habits and economic behavior in the rest of the article.

Table of Comparison

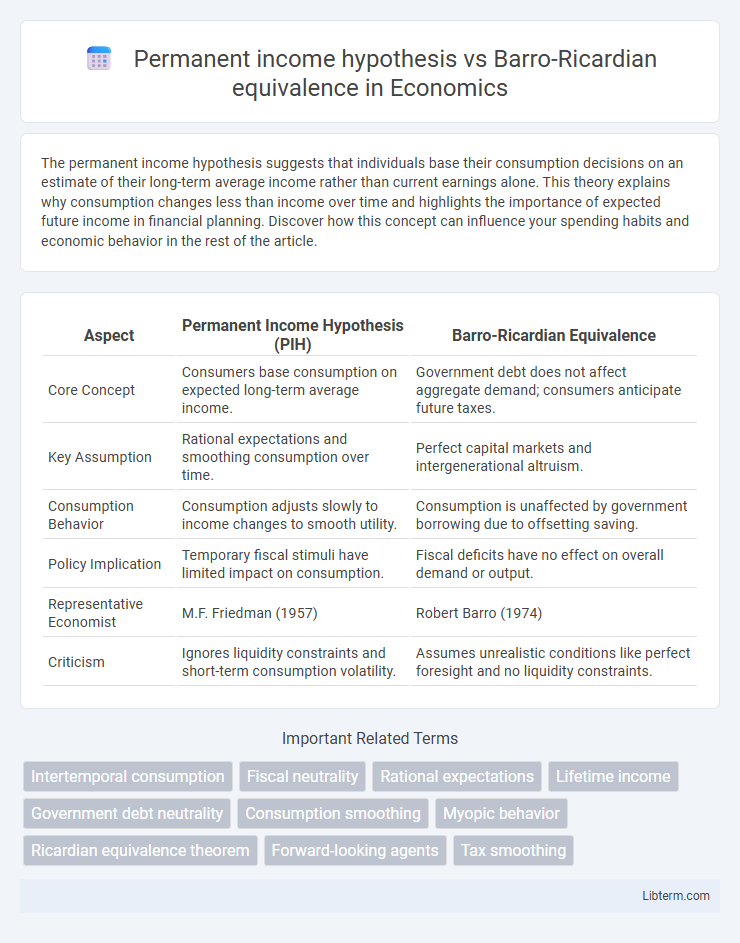

| Aspect | Permanent Income Hypothesis (PIH) | Barro-Ricardian Equivalence |

|---|---|---|

| Core Concept | Consumers base consumption on expected long-term average income. | Government debt does not affect aggregate demand; consumers anticipate future taxes. |

| Key Assumption | Rational expectations and smoothing consumption over time. | Perfect capital markets and intergenerational altruism. |

| Consumption Behavior | Consumption adjusts slowly to income changes to smooth utility. | Consumption is unaffected by government borrowing due to offsetting saving. |

| Policy Implication | Temporary fiscal stimuli have limited impact on consumption. | Fiscal deficits have no effect on overall demand or output. |

| Representative Economist | M.F. Friedman (1957) | Robert Barro (1974) |

| Criticism | Ignores liquidity constraints and short-term consumption volatility. | Assumes unrealistic conditions like perfect foresight and no liquidity constraints. |

Overview of the Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) posits that individuals base consumption decisions on their expected long-term average income rather than current income, smoothing consumption over time despite income fluctuations. Developed by Milton Friedman, this theory suggests that temporary changes in income have minimal impact on consumption patterns, as consumers save or borrow to maintain stable spending. PIH contrasts with the Barro-Ricardian equivalence, which argues that government borrowing does not affect overall demand since individuals anticipate future taxes and adjust their savings accordingly.

Key Assumptions Behind Permanent Income Hypothesis

The Permanent Income Hypothesis assumes that individuals base consumption decisions on their expected long-term average income rather than current income, implying perfectly rational and forward-looking behavior with access to credit markets. It presupposes stable preferences, access to capital markets without borrowing constraints, and the ability to smooth consumption over time despite income fluctuations. This contrasts with Barro-Ricardian equivalence, where government debt is viewed as future taxes, implying that consumers fully internalize government budget constraints and adjust their saving accordingly.

Understanding Barro-Ricardian Equivalence

Barro-Ricardian equivalence posits that government debt does not affect overall demand because individuals anticipate future taxes to repay debt and therefore increase savings to offset government borrowing, contrasting with the Permanent Income Hypothesis which emphasizes consumption smoothing based on expected lifetime income. Unlike the Permanent Income Hypothesis, Barro-Ricardian equivalence assumes fully rational agents with perfect foresight about fiscal policy and intergenerational transfers. Empirical evidence challenges the strict validity of Barro-Ricardian equivalence due to factors like liquidity constraints, myopia, and uncertainty altering individual consumption and savings behavior.

Core Principles of Barro-Ricardian Equivalence

Barro-Ricardian equivalence posits that consumers anticipate future taxes resulting from current government borrowing and therefore increase savings to offset government debt, neutralizing fiscal policy effects on aggregate demand. This principle assumes rational agents with perfect foresight, intergenerational altruism, and frictionless capital markets, ensuring that government debt does not affect overall consumption. Unlike the Permanent Income Hypothesis, which centers on lifetime income expectations driving consumption smoothing, Barro-Ricardian equivalence emphasizes the neutrality of fiscal deficits through forward-looking consumer behavior.

Similarities Between the Two Economic Theories

Both the Permanent Income Hypothesis and Barro-Ricardian equivalence emphasize rational expectations and intertemporal consumption choices, suggesting individuals base current spending on anticipated lifetime resources rather than current income alone. Each theory assumes forward-looking agents who smooth consumption over time to optimize utility, minimizing the impact of temporary fiscal changes on consumption patterns. Both frameworks imply limited effectiveness of short-term fiscal policy in stimulating aggregate demand as individuals adjust their savings behavior in response to perceived future income or tax liabilities.

Differences in Predicting Consumer Behavior

The Permanent Income Hypothesis (PIH) predicts that consumers base their spending on expected lifetime income, smoothing consumption despite short-term income fluctuations. In contrast, the Barro-Ricardian Equivalence posits that consumers anticipate future taxes implied by government borrowing and therefore adjust their savings accordingly, neutralizing fiscal policy impacts on consumption. While PIH emphasizes income expectations, Barro-Ricardian equivalence highlights intertemporal budget constraints driven by government debt perceptions.

Implications for Fiscal Policy and Government Spending

The Permanent Income Hypothesis (PIH) suggests fiscal policy's effectiveness depends on how government spending alters consumers' perceived lifetime income, implying temporary fiscal measures may have limited impact on consumption. Barro-Ricardian equivalence posits that government borrowing today leads to future tax liabilities, causing consumers to save rather than spend, which neutralizes fiscal stimulus effects. Policymakers face challenges in using deficit spending for economic stimulus since both theories indicate consumer behavior may offset intended fiscal impacts on aggregate demand.

Empirical Evidence: Testing the PIH and Ricardian Models

Empirical evidence testing the Permanent Income Hypothesis (PIH) and Barro-Ricardian equivalence reveals mixed support for these models across different economies and time periods. Studies examining consumption patterns often find that while the PIH explains long-term consumption smoothing based on expected lifetime income, deviations arise due to liquidity constraints and precautionary saving motives. Barro-Ricardian equivalence faces challenges in empirical validation as households do not always offset government debt increases fully through increased saving, indicating incomplete intergenerational budget balancing or credit market imperfections.

Criticisms and Limitations of Each Theory

The Permanent Income Hypothesis (PIH) faces criticism for assuming rational expectations and perfect capital markets, which overlook liquidity constraints and behavioral factors influencing consumption. Barro-Ricardian Equivalence is limited by its unrealistic assumption that consumers fully internalize government budget constraints, ignoring empirical evidence of myopic behavior and incomplete Ricardian equivalence. Both theories struggle to account for heterogeneity among agents and the short-run deviations observed in real-world fiscal policy effects.

Policy Relevance in Modern Macroeconomics

The Permanent Income Hypothesis emphasizes that consumers base spending on expected long-term income, suggesting fiscal policy has limited short-term effect on consumption. Barro-Ricardian equivalence argues that government debt does not affect aggregate demand because rational agents anticipate future taxes to repay debt, neutralizing fiscal stimulus. Modern macroeconomic policies must consider these theories when designing fiscal interventions, as the effectiveness of government spending and taxation relies heavily on consumers' intertemporal budget constraints and expectations.

Permanent income hypothesis Infographic

libterm.com

libterm.com