A declining discount rate reflects decreasing interest rates over time, impacting the present value of future cash flows and investment appraisals. This approach often better captures economic realities in long-term projects, particularly in environmental and infrastructure sectors. Explore the implications of a declining discount rate on your financial decisions and future planning by reading the full article.

Table of Comparison

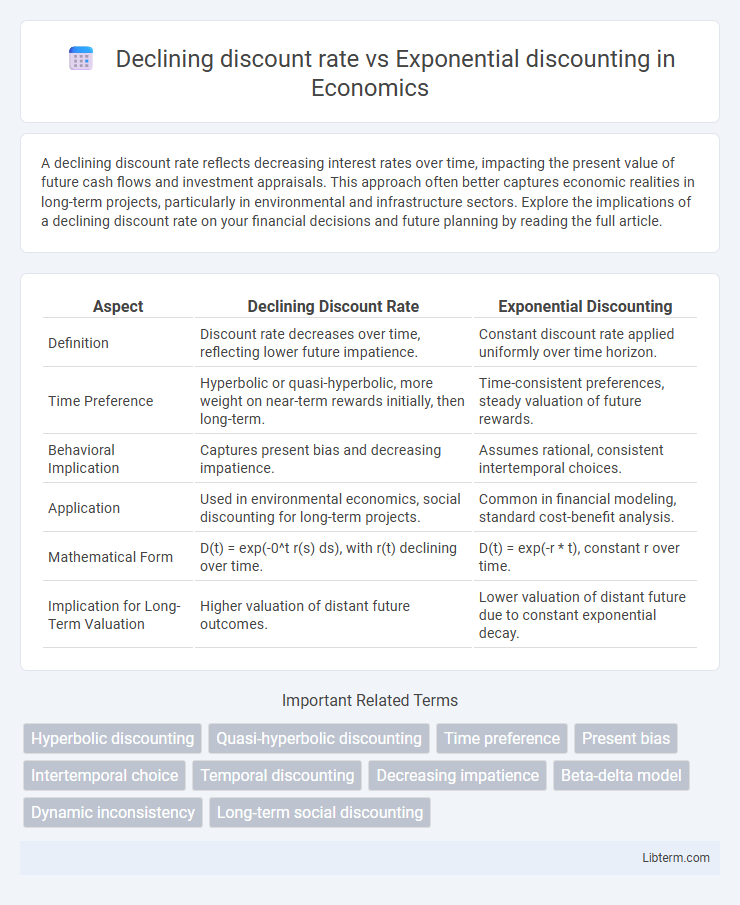

| Aspect | Declining Discount Rate | Exponential Discounting |

|---|---|---|

| Definition | Discount rate decreases over time, reflecting lower future impatience. | Constant discount rate applied uniformly over time horizon. |

| Time Preference | Hyperbolic or quasi-hyperbolic, more weight on near-term rewards initially, then long-term. | Time-consistent preferences, steady valuation of future rewards. |

| Behavioral Implication | Captures present bias and decreasing impatience. | Assumes rational, consistent intertemporal choices. |

| Application | Used in environmental economics, social discounting for long-term projects. | Common in financial modeling, standard cost-benefit analysis. |

| Mathematical Form | D(t) = exp(-0^t r(s) ds), with r(t) declining over time. | D(t) = exp(-r * t), constant r over time. |

| Implication for Long-Term Valuation | Higher valuation of distant future outcomes. | Lower valuation of distant future due to constant exponential decay. |

Introduction to Discounting in Economics

Declining discount rate challenges the traditional exponential discounting model by accounting for decreasing impatience over time, reflecting more realistic human preferences in intertemporal choices. Exponential discounting applies a constant rate to future values, often oversimplifying the diminishing sensitivity to delays observed in real economic behavior. Understanding these models is crucial for accurately evaluating long-term investments, policy-making, and intertemporal consumption decisions in economics.

Understanding the Declining Discount Rate

Understanding the declining discount rate involves recognizing its capacity to better reflect intertemporal decision-making by assigning progressively lower discount rates over longer time horizons, contrasting with exponential discounting which uses a constant rate. This approach aligns with observed human behavior that exhibits decreasing impatience, where future benefits are valued more consistently than exponential models predict. Research in behavioral economics and finance suggests that declining discount rates provide more accurate models for long-term investments, climate change policies, and retirement planning.

Exponential Discounting Explained

Exponential discounting is a mathematical model used in economics and finance to calculate the present value of future cash flows by applying a constant discount rate over time. This approach assumes time-consistent preferences, where the valuation of future rewards decreases exponentially as the time horizon extends, leading to a steady rate of decline in value. Unlike declining discount rates, exponential discounting does not accommodate changing attitudes toward risk or uncertainty, making it less flexible in modeling real-world decision-making behaviors.

Key Differences Between Declining and Exponential Discounting

Declining discount rates decrease over time, reflecting a higher valuation of long-term benefits and aligning with empirical observations of human decision-making, while exponential discounting applies a constant rate, leading to time-consistent preferences. The key difference lies in time consistency: exponential discounting assumes stable preferences across periods, whereas declining discount rates accommodate preference reversals and decreasing impatience. Behavioral economics favors declining discount rates to better model real-world choices, contrasting with the traditional exponential model rooted in normative theory.

Behavioral Motivations Behind Discount Rate Models

Declining discount rate models capture the behavioral tendency for individuals to value immediate rewards disproportionately higher than future rewards, reflecting time-inconsistent preferences and hyperbolic discounting observed in decision-making experiments. Exponential discounting, by contrast, assumes constant discount rates over time, representing time-consistent preferences that often fail to align with actual human behavior characterized by impulsivity and changing patience. Behavioral motivations behind these models highlight how factors like self-control, future uncertainty, and perceived reward salience drive preference reversals and temporal discounting patterns in economic and psychological contexts.

Mathematical Formulations of Discounting Approaches

Declining discount rate models represent future values using a hyperbolic or quasi-hyperbolic function, typically expressed as \( D(t) = \frac{1}{(1 + k t)^\alpha} \) where \( t \) is time, \( k \) is the discount parameter, and \( \alpha \leq 1 \) captures decreasing impatience, contrasting with exponential discounting's formula \( D(t) = e^{-\rho t} \) where \( \rho \) is the constant discount rate reflecting time-consistent preferences. Exponential discounting assumes a constant rate of time preference, leading to time-consistent intertemporal choices, while declining discount rates account for decreasing rates over time, better modeling observed behavioral phenomena like hyperbolic discounting and preference reversals. Mathematical implications of declining discount rates include non-stationarity and dynamically inconsistent choices, posing challenges for classical economic models that rely on the exponential framework.

Implications for Long-Term Policy Evaluation

Declining discount rates give more weight to future benefits and costs, reflecting increasing societal concern for long-term outcomes, which is crucial for evaluating policies addressing climate change, infrastructure, and sustainability. Exponential discounting, applying a constant discount rate, undervalues distant future impacts, often leading to the underinvestment in projects with significant long-term benefits. The choice between these discounting methods fundamentally shapes cost-benefit analyses, influencing intergenerational equity and the prioritization of policies with prolonged effects.

Discount Rate Models in Environmental Economics

Declining discount rate models in environmental economics adjust the discount rate downward over time to better account for uncertainty and intergenerational equity, contrasting with exponential discounting which applies a constant rate. This approach reflects empirical evidence that societies tend to value long-term environmental benefits more than the steep present bias implied by exponential models. Consequently, declining discount rates support policies favoring sustainable resource management and climate change mitigation by placing greater weight on future outcomes.

Criticisms and Limitations of Each Approach

Declining discount rate models address hyperbolic preferences better than exponential discounting but face challenges in determining an appropriate functional form and can lead to time-inconsistent decisions. Exponential discounting, known for its mathematical simplicity and time consistency, is criticized for failing to capture observed empirical behaviors such as present bias and decreasing impatience over time. Both approaches struggle with accurately representing individual heterogeneity and real-world decision-making scenarios involving uncertainty and delayed rewards.

Choosing the Appropriate Discount Rate Model

Choosing the appropriate discount rate model depends on the context of decision-making and time preferences; declining discount rates reflect decreasing impatience over time, often aligning better with long-term environmental and health economics evaluations. Exponential discounting assumes a constant rate of time preference, simplifying calculations but potentially undervaluing future benefits and costs in intergenerational projects. Selecting between these models requires balancing theoretical consistency with practical policy implications and ethical considerations of future welfare.

Declining discount rate Infographic

libterm.com

libterm.com