Structural adjustment programs are economic policies imposed on developing countries by international financial institutions to stabilize and reform their economies through fiscal austerity, privatization, and deregulation. These measures often aim to reduce government deficits, encourage foreign investment, and promote market efficiency but can lead to social and economic challenges such as increased unemployment and reduced public services. Discover how structural adjustment impacts your country's development and what strategies can help mitigate its effects by reading the full article.

Table of Comparison

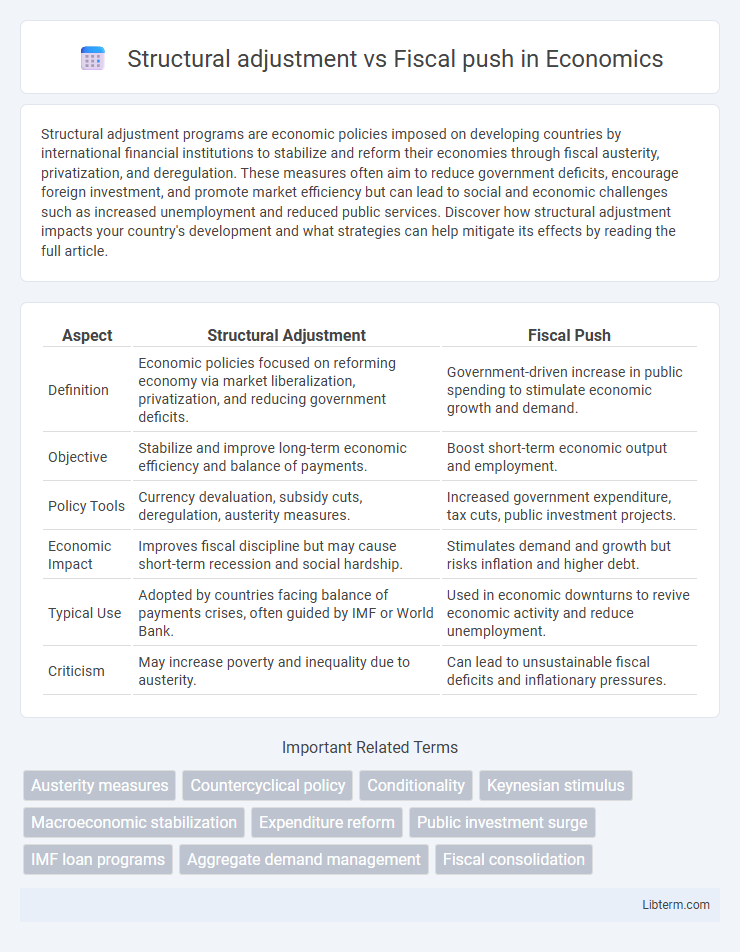

| Aspect | Structural Adjustment | Fiscal Push |

|---|---|---|

| Definition | Economic policies focused on reforming economy via market liberalization, privatization, and reducing government deficits. | Government-driven increase in public spending to stimulate economic growth and demand. |

| Objective | Stabilize and improve long-term economic efficiency and balance of payments. | Boost short-term economic output and employment. |

| Policy Tools | Currency devaluation, subsidy cuts, deregulation, austerity measures. | Increased government expenditure, tax cuts, public investment projects. |

| Economic Impact | Improves fiscal discipline but may cause short-term recession and social hardship. | Stimulates demand and growth but risks inflation and higher debt. |

| Typical Use | Adopted by countries facing balance of payments crises, often guided by IMF or World Bank. | Used in economic downturns to revive economic activity and reduce unemployment. |

| Criticism | May increase poverty and inequality due to austerity. | Can lead to unsustainable fiscal deficits and inflationary pressures. |

Understanding Structural Adjustment

Structural adjustment involves implementing macroeconomic policies aimed at stabilizing and reforming an economy, typically through measures such as reducing fiscal deficits, controlling inflation, and liberalizing trade. It emphasizes long-term economic restructuring by adjusting government budgets, lowering subsidies, and promoting market efficiency to restore economic stability. Understanding structural adjustment requires analyzing its impact on fiscal discipline, resource allocation, and overall economic growth trajectories in contrast to short-term demand stimulation seen in fiscal push strategies.

The Concept of Fiscal Push

Fiscal push refers to government efforts to stimulate economic growth through increased public spending and tax reductions, aiming to boost aggregate demand and investment. Unlike structural adjustment, which focuses on long-term economic reforms such as deregulation and privatization, fiscal push emphasizes short-term fiscal policies to counteract economic downturns. This approach often involves budget deficits to finance infrastructure projects, social programs, and subsidies, driving consumption and employment.

Key Differences Between Structural Adjustment and Fiscal Push

Structural adjustment involves long-term economic reforms aimed at restructuring an economy through policies like liberalization, privatization, and austerity to improve macroeconomic stability, while fiscal push focuses on short-term government spending increases to stimulate demand and economic growth. Structural adjustment policies typically require reducing budget deficits and controlling inflation, contrasting with fiscal push strategies that often involve expanding deficits to boost consumption and investment. The key difference lies in structural adjustment's supply-side, market-oriented reforms versus fiscal push's demand-side, stimulus-driven approach.

Historical Contexts: When Are These Approaches Used?

Structural adjustment programs emerged primarily in the 1980s during debt crises in developing countries, aiming to restore macroeconomic stability through market liberalization, privatization, and fiscal austerity mandated by institutions like the IMF and World Bank. Fiscal push strategies are historically applied during economic recessions or demand shocks, where governments increase public spending and cut taxes to stimulate growth and employment, often seen during the Great Depression and post-2008 financial crisis. The choice between these approaches depends heavily on the economic context, with structural adjustment favored in balance of payments crises and fiscal push preferred for demand-driven downturns.

Macroeconomic Outcomes of Structural Adjustment

Structural adjustment programs (SAPs) prioritize fiscal discipline, monetary restraint, and market liberalization to restore macroeconomic stability by reducing budget deficits and controlling inflation. These policies often lead to short-term economic contraction but aim for long-term growth through improved fiscal balance and enhanced competitiveness. Empirical evidence indicates varying success across countries, with some achieving stabilized inflation rates and increased foreign investment, while others faced persistent unemployment and slowed social development.

Fiscal Push and Its Impact on Economic Growth

Fiscal push involves government expenditure and tax policies aimed at stimulating economic growth by increasing aggregate demand. Increased public spending on infrastructure, social programs, and investment incentives boosts employment and encourages private sector investment. Empirical studies show fiscal push significantly enhances GDP growth, especially during economic downturns, by correcting demand deficiencies and fostering long-term development.

Case Studies: Successes and Failures

Structural adjustment programs (SAPs) implemented in countries like Ghana and Argentina often resulted in mixed outcomes, with initial fiscal stabilization but long-term social challenges due to austerity measures and reduced public spending. Fiscal push strategies in South Korea and China demonstrated success by boosting government expenditure on infrastructure and industry, fostering rapid economic growth and poverty reduction. However, excessive fiscal expansion in some Latin American countries led to inflation and debt crises, highlighting the delicate balance required for sustainable economic policy.

Social Consequences: Poverty, Employment, and Inequality

Structural adjustment programs often lead to reduced public spending, which exacerbates poverty by limiting access to essential services and social safety nets. Fiscal push strategies, by increasing government expenditures, can stimulate employment and reduce inequality through targeted social programs and infrastructure investments. However, without effective implementation, fiscal push may also result in inflationary pressures that disproportionately affect low-income populations.

Policy Recommendations for Emerging Economies

Emerging economies should adopt a balanced policy approach integrating structural adjustment reforms with strategic fiscal push measures to stimulate sustainable growth. Structural adjustments targeting market liberalization, regulatory transparency, and institutional reforms improve economic efficiency, while fiscal push policies focusing on infrastructure investment and social programs drive demand and long-term development. Combining these strategies enhances macroeconomic stability and resilience, supporting inclusive growth and poverty reduction in emerging markets.

Choosing the Right Path: Structural Reform or Fiscal Expansion?

Choosing between structural adjustment and fiscal push hinges on a country's economic context and long-term goals. Structural reform emphasizes improving institutional efficiency, reducing regulatory burdens, and enhancing market flexibility to promote sustainable growth, while fiscal expansion focuses on increasing government spending or cutting taxes to stimulate demand and boost short-term economic activity. Effective policy design often requires balancing structural reforms that address supply-side constraints with targeted fiscal measures that support aggregate demand during economic downturns.

Structural adjustment Infographic

libterm.com

libterm.com