Purchasing power parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods across countries, offering insights into exchange rate equilibrium and economic comparisons. It helps evaluate whether a currency is undervalued or overvalued, influencing international trade and investment decisions. Discover how understanding PPP can enhance your perspective on global markets in the rest of this article.

Table of Comparison

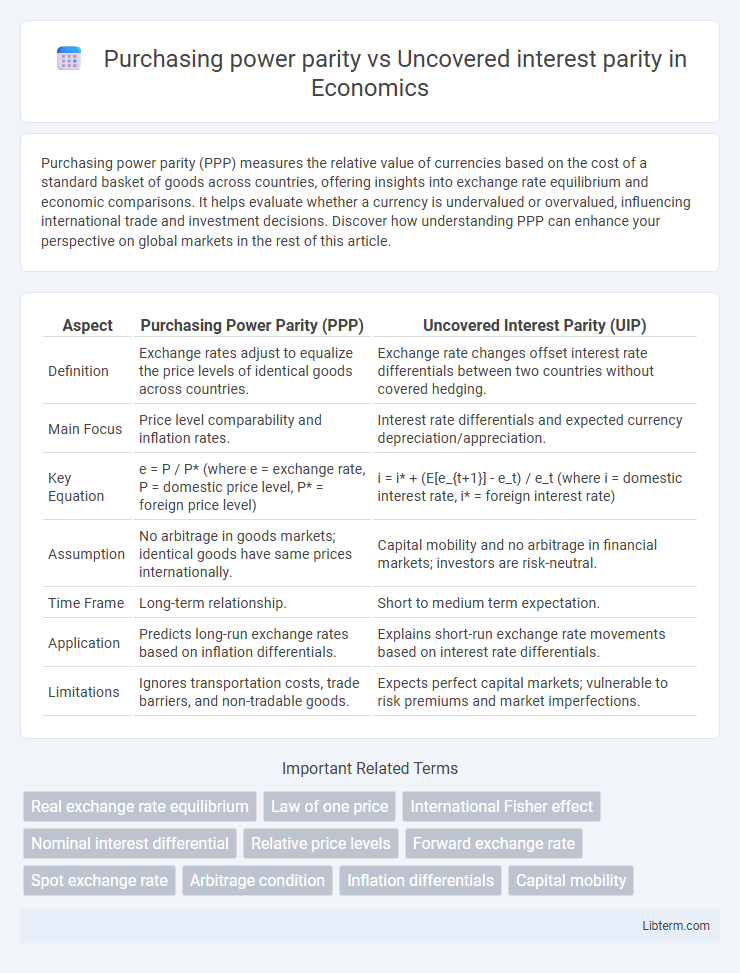

| Aspect | Purchasing Power Parity (PPP) | Uncovered Interest Parity (UIP) |

|---|---|---|

| Definition | Exchange rates adjust to equalize the price levels of identical goods across countries. | Exchange rate changes offset interest rate differentials between two countries without covered hedging. |

| Main Focus | Price level comparability and inflation rates. | Interest rate differentials and expected currency depreciation/appreciation. |

| Key Equation | e = P / P* (where e = exchange rate, P = domestic price level, P* = foreign price level) | i = i* + (E[e_{t+1}] - e_t) / e_t (where i = domestic interest rate, i* = foreign interest rate) |

| Assumption | No arbitrage in goods markets; identical goods have same prices internationally. | Capital mobility and no arbitrage in financial markets; investors are risk-neutral. |

| Time Frame | Long-term relationship. | Short to medium term expectation. |

| Application | Predicts long-run exchange rates based on inflation differentials. | Explains short-run exchange rate movements based on interest rate differentials. |

| Limitations | Ignores transportation costs, trade barriers, and non-tradable goods. | Expects perfect capital markets; vulnerable to risk premiums and market imperfections. |

Introduction to Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory stating that in the long run, exchange rates should adjust so that identical goods cost the same in different countries, reflecting the relative price levels. It is used to compare economic productivity and living standards by converting currencies based on their purchasing power rather than nominal exchange rates. Unlike Uncovered Interest Parity (UIP), which focuses on interest rate differentials affecting expected exchange rates, PPP emphasizes price level convergence and the law of one price in international trade.

Understanding Uncovered Interest Parity (UIP)

Uncovered Interest Parity (UIP) posits that the expected returns on deposits in different currencies are equal once exchange rate changes are accounted for, implying that interest rate differentials predict future exchange rate movements. Unlike Purchasing Power Parity (PPP), which focuses on price levels and inflation rates to explain exchange rate dynamics, UIP centers on capital market equilibrium and interest rates. Empirical tests of UIP often reveal deviations due to risk premiums, market imperfections, and investors' irrational expectations.

Theoretical Foundations of PPP

Purchasing Power Parity (PPP) is founded on the Law of One Price, which states that identical goods should sell for the same price across different countries when prices are expressed in a common currency, reflecting relative price levels. PPP theory posits that exchange rates adjust to equalize the purchasing power of different currencies, serving as a long-term equilibrium condition for exchange rates. This contrasts with Uncovered Interest Parity (UIP), which relies on the differential in nominal interest rates between countries without requiring price level adjustments.

Theoretical Basis of UIP

Uncovered Interest Parity (UIP) is grounded in the theory that expected returns on domestic and foreign assets must be equal when adjusted for exchange rate changes, implying no arbitrage opportunities in efficient markets. Unlike Purchasing Power Parity (PPP), which focuses on the relative price levels and inflation rates between countries to determine exchange rates, UIP is based on interest rate differentials predicting future currency movements. UIP assumes investors are risk-neutral and forward-looking, expecting exchange rate changes to offset interest rate differentials without requiring currency interventions.

Key Assumptions and Limitations

Purchasing power parity (PPP) assumes that exchange rates adjust to equalize the price levels of identical goods and services across countries, relying on the law of one price and ignoring transportation costs, tariffs, and non-tradable goods. Uncovered interest parity (UIP) assumes capital mobility and no risk premium, implying that expected changes in exchange rates offset interest rate differentials between countries, yet it often fails due to market imperfections, investor risk aversion, and speculative behavior. Both models face limitations in addressing short-term exchange rate volatility, deviations from perfect market conditions, and the influence of macroeconomic shocks.

Empirical Evidence: PPP vs UIP

Empirical evidence reveals that Purchasing Power Parity (PPP) holds more consistently in the long run across diverse economies, reflecting adjustments in exchange rates relative to price level changes. In contrast, Uncovered Interest Parity (UIP) often fails in the short term due to risk premia and market imperfections, as documented in numerous exchange rate predictability studies. Data from international financial markets typically indicate significant deviations from UIP, while PPP tendencies emerge more clearly in cross-country inflation and exchange rate comparisons over extended periods.

Real-World Applications and Case Studies

Purchasing power parity (PPP) is widely used in long-term exchange rate forecasting and international price comparisons, often applied by multinational corporations to strategize pricing and investment decisions across different markets. Uncovered interest parity (UIP) plays a crucial role in short-term foreign exchange trading and risk management, guiding investors and financial institutions in arbitrage opportunities and interest rate differentials. Case studies from emerging markets highlight PPP's accuracy in predicting equilibrium exchange rates over decades, while UIP often shows deviations due to risk premiums and market imperfections affecting currency returns in real-world financial environments.

Factors Influencing PPP and UIP Deviations

Purchasing Power Parity (PPP) deviations are primarily influenced by factors such as differences in inflation rates, transaction costs, and market barriers that prevent prices from equalizing across countries, while Uncovered Interest Parity (UIP) deviations often arise due to risk premiums, capital controls, and expectations of future exchange rate movements. Exchange rate volatility and monetary policy divergences also play crucial roles in causing discrepancies between PPP and UIP conditions. Empirical evidence shows that short-term UIP deviations are more persistent due to speculative capital flows, whereas PPP tends to hold better in the long run when price adjustments smooth out inflation differentials.

Implications for Exchange Rate Forecasting

Purchasing power parity (PPP) implies that exchange rates adjust to equalize price levels between countries, serving as a fundamental long-term anchor for currency valuation and inflation forecasting. Uncovered interest parity (UIP) suggests that expected changes in exchange rates are driven by interest rate differentials, providing a theoretical framework for short-term exchange rate forecasting based on financial market conditions. Combining PPP's focus on goods market equilibrium with UIP's emphasis on capital market expectations enhances the accuracy of exchange rate predictions by integrating both real and financial factors.

Conclusion: Comparing PPP and UIP

Purchasing Power Parity (PPP) and Uncovered Interest Parity (UIP) offer distinct frameworks for understanding exchange rate dynamics, where PPP emphasizes the role of price level adjustments and inflation differentials, while UIP centers on interest rate differentials and expected currency movements. Empirical evidence often shows PPP providing long-term equilibrium predictions, whereas UIP is more relevant for short-term capital flow expectations but frequently faces deviations due to risk premiums and market imperfections. Combining insights from PPP's inflation-based valuation with UIP's interest rate considerations yields a comprehensive perspective on currency value fluctuations and international financial integration.

Purchasing power parity Infographic

libterm.com

libterm.com