Bail-in is a financial mechanism where a failing bank's creditors and depositors bear part of the losses to stabilize the institution, instead of relying on taxpayer-funded bailouts. This approach reduces systemic risk and promotes responsible banking by ensuring that those who benefit from the bank's services also share the burden during financial distress. Discover how bail-ins impact your finances and the banking sector in the rest of this article.

Table of Comparison

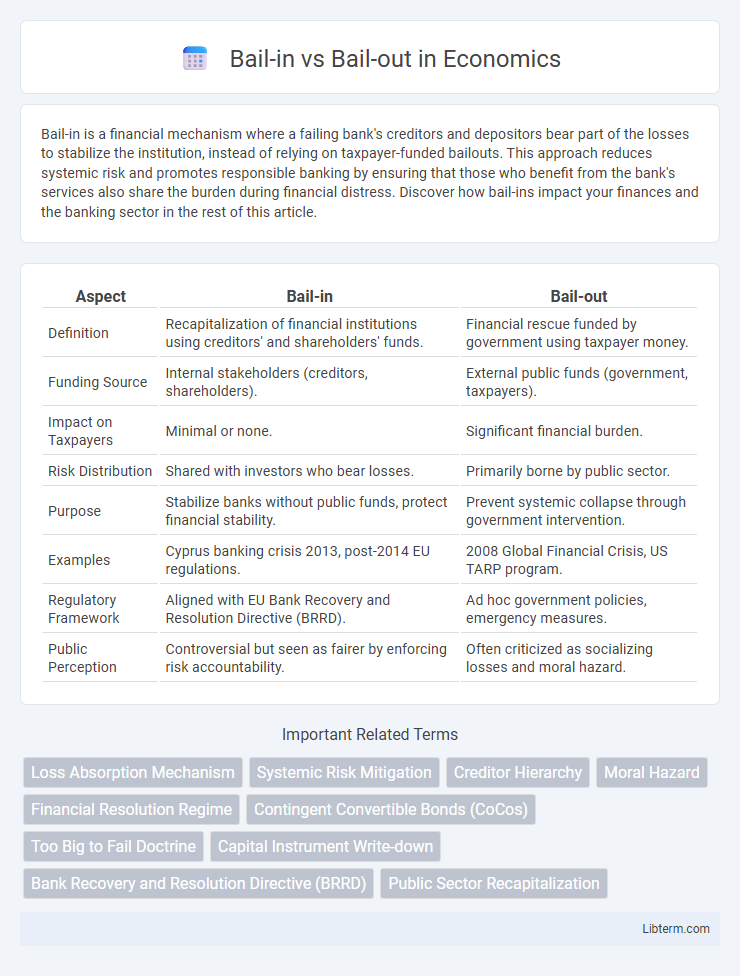

| Aspect | Bail-in | Bail-out |

|---|---|---|

| Definition | Recapitalization of financial institutions using creditors' and shareholders' funds. | Financial rescue funded by government using taxpayer money. |

| Funding Source | Internal stakeholders (creditors, shareholders). | External public funds (government, taxpayers). |

| Impact on Taxpayers | Minimal or none. | Significant financial burden. |

| Risk Distribution | Shared with investors who bear losses. | Primarily borne by public sector. |

| Purpose | Stabilize banks without public funds, protect financial stability. | Prevent systemic collapse through government intervention. |

| Examples | Cyprus banking crisis 2013, post-2014 EU regulations. | 2008 Global Financial Crisis, US TARP program. |

| Regulatory Framework | Aligned with EU Bank Recovery and Resolution Directive (BRRD). | Ad hoc government policies, emergency measures. |

| Public Perception | Controversial but seen as fairer by enforcing risk accountability. | Often criticized as socializing losses and moral hazard. |

Introduction to Bail-in and Bail-out

Bail-in involves a financial institution's creditors and depositors bearing part of the losses by converting debt into equity to stabilize the bank, minimizing taxpayer costs. Bail-out refers to external financial support, typically by the government, to rescue a failing bank or company to prevent systemic collapse. Understanding these mechanisms is crucial for evaluating risk management and financial stability policies.

Defining Bail-in: Mechanisms and Purpose

Bail-in mechanisms involve the internal recapitalization of a failing financial institution by converting its debt into equity, thereby minimizing reliance on public funds and protecting taxpayers. This process imposes losses on shareholders and certain creditors, stabilizing the bank while maintaining critical financial operations. The primary purpose of a bail-in is to ensure financial stability through private sector involvement, reducing systemic risks and moral hazard associated with traditional bailouts.

Understanding Bail-out: Methods and Rationale

Bail-out refers to the financial support provided by governments or external parties to rescue failing institutions, primarily banks, to prevent systemic collapse and protect the broader economy. Methods include direct capital injections, government-backed loans, and asset purchases, aiming to stabilize the institution's balance sheet and restore market confidence. The rationale behind bail-outs centers on mitigating systemic risk, safeguarding depositor funds, and maintaining financial stability during economic crises.

Key Differences Between Bail-in and Bail-out

Bail-in involves restructuring a failing bank's liabilities by converting debt into equity to absorb losses internally, whereas bail-out consists of external financial assistance, typically government funds, to stabilize the institution. Bail-ins prioritize protecting taxpayers by imposing losses on creditors and shareholders, while bail-outs often rely on public funds, raising concerns about moral hazard. The key distinction lies in the source of recovery, with bail-ins emphasizing internal recapitalization and bail-outs using external support to restore solvency.

Historical Examples of Bail-ins

Historical examples of bail-ins include the 2013 Cyprus banking crisis, where depositors' funds were used to stabilize failing banks, marking a significant shift from traditional bail-outs. In this case, uninsured depositors faced losses as part of the rescue plan, setting a precedent for future financial restructurings. The Italian bank Monte dei Paschi di Siena also underwent a bail-in process in 2017, highlighting the growing reliance on internal recapitalization mechanisms in European banking regulation.

Notable Bail-out Cases Worldwide

Notable bail-out cases worldwide include the 2008 U.S. government rescue of Lehman Brothers' competitors like AIG and Citigroup to prevent financial collapse. The European debt crisis saw Greece, Ireland, and Portugal receiving multi-billion-euro bailouts from the IMF and EU to stabilize their economies. These bail-outs prioritized government intervention and taxpayer funds to restore market confidence and avoid systemic failure.

Advantages and Drawbacks of Bail-in

Bail-in restructures a failing financial institution by converting creditors' and depositors' claims into equity, preserving taxpayer funds and promoting market discipline through increased accountability. It mitigates moral hazard by ensuring that investors bear losses, encouraging more prudent risk management, but may trigger short-term financial instability and erode depositor confidence. The complexity of bail-in mechanisms can create legal uncertainties and potential contagion risks, posing challenges for maintaining overall financial system stability.

Pros and Cons of Bail-out Strategies

Bail-out strategies provide immediate financial relief to struggling institutions by injecting capital, preventing collapse and stabilizing markets during crises. However, they can create moral hazard by encouraging risky behavior, as firms may expect government rescue, and lead to significant taxpayer burden. This approach also risks distorting market competition by favoring certain institutions over others.

Economic and Social Impacts of Both Approaches

Bail-ins restructure financial institutions by converting creditor claims into equity, minimizing taxpayer burden and reducing moral hazard but often triggering short-term market volatility and potential loss of confidence among retail investors. Bail-outs inject public funds into struggling banks, stabilizing the financial system swiftly but increasing public debt and potentially perpetuating risky behavior due to moral hazard, which may lead to long-term economic inequality and societal resentment. Both approaches influence economic growth trajectories and social trust, with bail-ins promoting greater financial discipline and bail-outs offering immediate relief at the cost of fiscal sustainability and social equity.

Future Trends in Financial Crisis Management

Future trends in financial crisis management emphasize bail-in mechanisms to enhance bank resilience by forcing creditors and shareholders to absorb losses, reducing taxpayer burdens. Regulatory frameworks like the EU's Bank Recovery and Resolution Directive (BRRD) are expected to expand globally, promoting internal recapitalization over public bailouts. Technological advancements in real-time risk assessment support faster implementation of bail-ins, improving financial stability in crises.

Bail-in Infographic

libterm.com

libterm.com