Oligopoly is a market structure characterized by a small number of firms dominating the industry, leading to limited competition and potential collusion. These companies often influence prices and output, affecting overall market dynamics and consumer choices. Explore the rest of the article to understand how oligopolies impact your buying decisions and market efficiency.

Table of Comparison

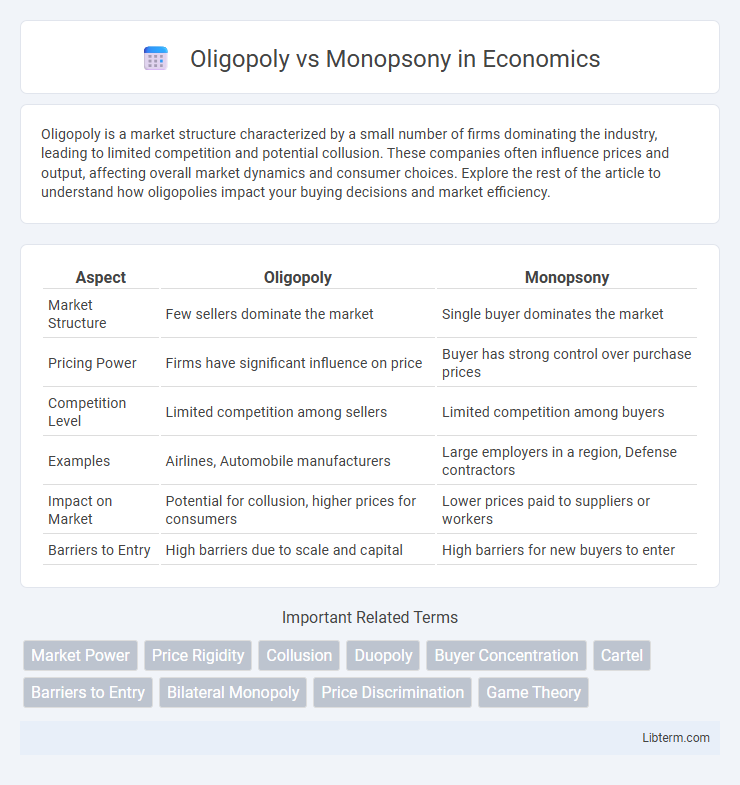

| Aspect | Oligopoly | Monopsony |

|---|---|---|

| Market Structure | Few sellers dominate the market | Single buyer dominates the market |

| Pricing Power | Firms have significant influence on price | Buyer has strong control over purchase prices |

| Competition Level | Limited competition among sellers | Limited competition among buyers |

| Examples | Airlines, Automobile manufacturers | Large employers in a region, Defense contractors |

| Impact on Market | Potential for collusion, higher prices for consumers | Lower prices paid to suppliers or workers |

| Barriers to Entry | High barriers due to scale and capital | High barriers for new buyers to enter |

Introduction to Oligopoly and Monopsony

Oligopoly is a market structure characterized by a few firms dominating the supply side, resulting in limited competition and potential price-setting power. Monopsony, in contrast, occurs when a single buyer controls the market, influencing the demand side by setting prices or wages below competitive levels. Both market forms significantly impact market equilibrium, pricing strategies, and resource allocation in their respective sectors.

Defining Oligopoly: Key Features

An oligopoly is a market structure characterized by a small number of firms dominating the industry, resulting in limited competition and significant market power for each firm. Key features include interdependent decision-making, where firms' pricing and output choices affect one another, and high barriers to entry that prevent new competitors from entering the market easily. Product differentiation can be either homogeneous or heterogeneous, and firms often engage in strategic behaviors such as collusion or price leadership to maintain market stability.

Understanding Monopsony: Core Characteristics

Monopsony is a market structure characterized by a single dominant buyer exerting significant control over suppliers, often leading to lower prices and reduced supplier bargaining power. Unlike oligopoly markets dominated by a few sellers competing for buyers, monopsonies concentrate purchasing power, which can influence wage levels and input costs. Key features include limited buyer competition, buyer-determined pricing, and supplier dependence on the monopsonist for market access.

Market Structures: Oligopoly vs Monopsony

Oligopoly is a market structure characterized by a few firms dominating the supply side, leading to limited competition and potential price-setting behavior. Monopsony occurs when a single buyer controls the demand side, exerting significant power over suppliers and influencing purchase prices. Both structures impact market efficiency and pricing but differ fundamentally in whether market power resides with sellers (oligopoly) or buyers (monopsony).

Major Players: Firms in Oligopoly, Buyers in Monopsony

In oligopoly markets, a few dominant firms control the majority of market share, enabling them to influence prices and output levels collectively or through strategic competition. In contrast, a monopsony is characterized by a single powerful buyer that dictates terms and prices to numerous sellers, often leading to lower input costs and restricted supplier power. Major players in an oligopoly leverage market concentration to maintain high barriers to entry, while the monopsonist buyer exploits its exclusive purchasing power to shape market conditions.

Pricing Power and Market Influence

Oligopoly markets feature a few dominant firms with significant pricing power, enabling them to influence market prices through strategic interactions and collusion risks. In contrast, a monopsony consists of a single powerful buyer who controls purchase prices and can dictate terms to numerous sellers, often pushing prices lower. The key difference lies in oligopolies exerting market influence as sellers while monopsonies wield buying power to shape supplier behavior and market outcomes.

Examples of Oligopoly and Monopsony in the Real World

The automobile industry exemplifies an oligopoly with a few major players like Toyota, Ford, and Volkswagen dominating global markets. In contrast, the labor market for nurses in some regions represents a monopsony, where a single large hospital system acts as the primary buyer of nursing labor. Another example is the commercial aircraft industry, where Boeing and Airbus form an oligopoly, while defense contractors often face monopsony conditions due to sole government procurement agencies.

Economic Consequences and Consumer Impact

Oligopoly markets, dominated by a few sellers, often lead to higher prices and reduced output, limiting consumer choice due to reduced competition. In contrast, a monopsony, characterized by a single buyer, can suppress prices paid to suppliers, potentially lowering production quality and innovation downstream. Both market structures distort normal supply and demand dynamics, resulting in inefficient resource allocation and welfare losses for consumers.

Regulatory Challenges and Policies

Oligopoly markets, dominated by a few firms, often face regulatory challenges related to collusion, price-fixing, and barriers to entry, requiring antitrust policies to promote competition and protect consumers. Monopsony conditions, where a single buyer dominates the market, pose difficulties in ensuring fair wages and prices, leading regulators to implement labor laws and buyer-side competition rules to prevent exploitation. Both market structures demand tailored policies balancing market power control while fostering economic efficiency and innovation.

Conclusion: Comparing Oligopoly and Monopsony

Oligopoly markets are characterized by a few dominant sellers exerting significant control over prices, while monopsony markets consist of a single buyer influencing supplier conditions. Both structures lead to market power imbalances that can affect pricing, supply, and consumer welfare but from opposite sides of the transaction. Understanding these differences is crucial for designing regulatory policies that address market inefficiencies and promote competitive equilibrium.

Oligopoly Infographic

libterm.com

libterm.com