Inflation rate measures the percentage increase in prices of goods and services over a specific period, reflecting the decrease in purchasing power. Tracking inflation helps you understand how rising costs impact your savings, investments, and everyday expenses. Explore the rest of the article to learn how inflation influences the economy and strategies to protect your financial wellbeing.

Table of Comparison

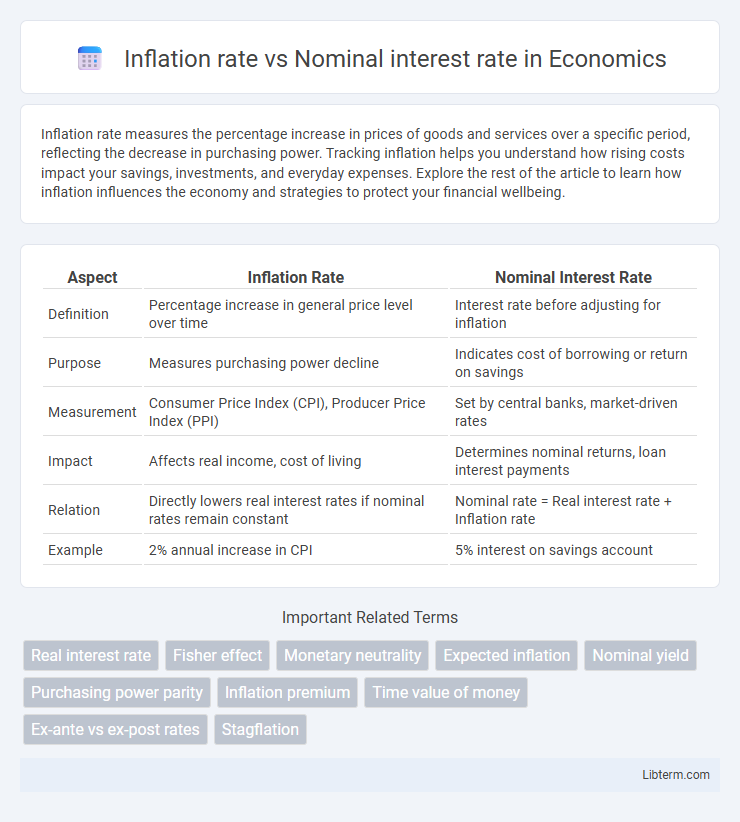

| Aspect | Inflation Rate | Nominal Interest Rate |

|---|---|---|

| Definition | Percentage increase in general price level over time | Interest rate before adjusting for inflation |

| Purpose | Measures purchasing power decline | Indicates cost of borrowing or return on savings |

| Measurement | Consumer Price Index (CPI), Producer Price Index (PPI) | Set by central banks, market-driven rates |

| Impact | Affects real income, cost of living | Determines nominal returns, loan interest payments |

| Relation | Directly lowers real interest rates if nominal rates remain constant | Nominal rate = Real interest rate + Inflation rate |

| Example | 2% annual increase in CPI | 5% interest on savings account |

Understanding Inflation Rate

The inflation rate measures the percentage increase in the general price level of goods and services over a specific period, reflecting the decrease in purchasing power of money. Understanding inflation is crucial for interpreting the nominal interest rate, which is the stated interest rate before adjustment for inflation. Real interest rate, calculated by subtracting the inflation rate from the nominal interest rate, indicates the true cost of borrowing and the real yield on investments.

Defining Nominal Interest Rate

Nominal interest rate represents the percentage increase in money that a borrower pays to a lender without adjusting for inflation. It reflects the stated interest rate on loans or investments, providing the basic cost of borrowing or return on investment before considering changes in purchasing power. Understanding the nominal interest rate is essential when comparing financial options alongside the inflation rate to assess real economic value.

Key Differences Between Inflation Rate and Nominal Interest Rate

The inflation rate measures the percentage increase in the general price level of goods and services over time, reflecting the loss of purchasing power. The nominal interest rate represents the stated return on an investment or loan without adjusting for inflation effects. A key difference lies in their impact on real returns; the real interest rate equals the nominal interest rate minus the inflation rate, indicating the true increase in value after accounting for inflation.

How Inflation Influences Nominal Interest Rates

Inflation directly impacts nominal interest rates by prompting lenders to demand higher returns to compensate for the reduced purchasing power of future interest payments. Central banks often raise nominal interest rates in response to rising inflation to stabilize the economy and control money supply. This relationship is crucial in determining real interest rates, which reflect the true cost of borrowing after accounting for inflation.

The Fisher Effect Explained

The Fisher Effect describes the relationship between nominal interest rates and inflation, stating that nominal interest rates adjust to expected inflation to maintain a constant real interest rate. According to economist Irving Fisher, when inflation expectations rise, lenders demand higher nominal interest rates to compensate for the reduced purchasing power of future interest payments. This principle helps investors and policymakers understand how inflation influences interest rates in financial markets.

Impact on Borrowers and Lenders

The inflation rate erodes the real value of money, affecting both borrowers and lenders by altering the purchasing power of loan repayments. When nominal interest rates fail to keep pace with rising inflation, borrowers benefit as they repay loans with less valuable currency, while lenders incur losses in real terms. Conversely, higher nominal interest rates relative to inflation protect lenders' returns but increase borrowing costs, influencing credit accessibility and economic growth.

Real Interest Rate: The Missing Link

The real interest rate represents the true cost of borrowing, calculated by subtracting the inflation rate from the nominal interest rate. This metric reveals the actual purchasing power of money over time, guiding investors and policymakers in decision-making. Understanding the real interest rate bridges the gap between nominal figures and economic reality, impacting savings, investments, and monetary policy effectiveness.

Historical Trends and Economic Implications

Historical trends reveal that nominal interest rates typically rise in response to increasing inflation rates to preserve real returns for lenders. During periods of high inflation, such as the 1970s, nominal interest rates surged globally, reflecting central banks' attempts to curb inflationary pressures. This dynamic influences borrowing costs, investment decisions, and overall economic growth, with prolonged mismatches potentially leading to stagflation or recession.

Strategies to Hedge Against Inflation Risks

Investors can hedge against inflation risks by prioritizing assets with nominal interest rates that exceed the inflation rate, preserving purchasing power. Strategies include investing in Treasury Inflation-Protected Securities (TIPS), real estate, and commodities known to appreciate during inflationary periods. Diversifying portfolios with inflation-resistant assets effectively mitigates the erosion of returns caused by rising inflation rates.

Conclusion: Navigating Inflation and Interest Rates

Understanding the relationship between inflation rate and nominal interest rate is crucial for effective financial decision-making. When nominal interest rates rise above inflation rates, real returns on investments improve, safeguarding purchasing power. Careful monitoring of these rates enables individuals and businesses to optimize borrowing, lending, and investment strategies in fluctuating economic conditions.

Inflation rate Infographic

libterm.com

libterm.com