Currency exchange tax impacts international transactions by imposing fees on converting one currency to another, influencing global trade and travel expenses. Understanding how these taxes apply to your currency conversions helps in planning more cost-effective financial decisions. Explore the article to learn how currency exchange tax affects you and strategies to minimize its impact.

Table of Comparison

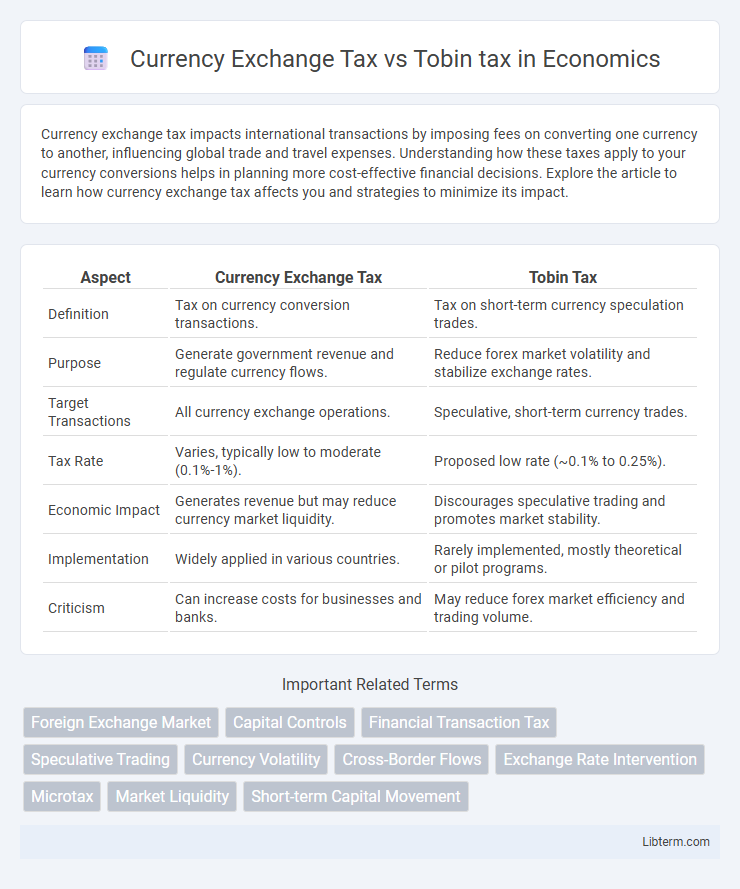

| Aspect | Currency Exchange Tax | Tobin Tax |

|---|---|---|

| Definition | Tax on currency conversion transactions. | Tax on short-term currency speculation trades. |

| Purpose | Generate government revenue and regulate currency flows. | Reduce forex market volatility and stabilize exchange rates. |

| Target Transactions | All currency exchange operations. | Speculative, short-term currency trades. |

| Tax Rate | Varies, typically low to moderate (0.1%-1%). | Proposed low rate (~0.1% to 0.25%). |

| Economic Impact | Generates revenue but may reduce currency market liquidity. | Discourages speculative trading and promotes market stability. |

| Implementation | Widely applied in various countries. | Rarely implemented, mostly theoretical or pilot programs. |

| Criticism | Can increase costs for businesses and banks. | May reduce forex market efficiency and trading volume. |

Introduction to Currency Exchange Tax and Tobin Tax

Currency exchange tax and Tobin tax are financial transaction taxes designed to regulate currency trading. Currency exchange tax is imposed on the conversion of one currency to another, impacting both retail and institutional transactions with goals such as revenue generation and market stability. The Tobin tax, proposed by economist James Tobin, specifically targets short-term currency speculation to reduce market volatility and discourage rapid capital flows.

Historical Background and Evolution

The Currency Exchange Tax traces its origins to early 20th-century proposals aimed at regulating foreign exchange markets, evolving as governments sought mechanisms to stabilize currency volatility and generate fiscal revenue. The Tobin tax, introduced by economist James Tobin in the 1970s, emerged specifically as a financial transaction tax targeting short-term currency speculation to reduce market turbulence. Over time, both taxes have influenced international financial regulation discussions, with the Tobin tax gaining significant attention during global financial crises and ongoing debates around capital flow management.

Key Definitions and Concepts

Currency Exchange Tax imposes a levy on foreign currency transactions to stabilize exchange rates and reduce speculation, typically calculated as a small percentage of the transaction value. Tobin Tax, proposed by economist James Tobin, is a specific type of currency exchange tax designed to discourage short-term currency speculation by applying a modest fee on all spot currency conversions. Both taxes aim to minimize market volatility but differ in scope and intent, with the Tobin Tax targeting speculative trading across global financial markets.

Objectives and Rationale of Each Tax

Currency exchange tax aims to generate government revenue and regulate currency market volatility by imposing a small fee on foreign exchange transactions. Tobin tax specifically targets speculative short-term currency trades to reduce market destabilization and curb harmful financial speculation. Both taxes seek to promote financial stability but differ as currency exchange tax has broader fiscal goals, while Tobin tax focuses on minimizing speculative capital flows.

Mechanisms of Implementation

The Currency Exchange Tax typically applies to all foreign exchange transactions, imposed as a small percentage fee collected directly by governments or financial institutions during currency conversion. In contrast, the Tobin tax targets short-term currency speculation by levying a modest fee on spot currency trades, often implemented through automated systems integrated into trading platforms to discourage rapid, speculative exchanges. Both mechanisms rely on precise transaction tracking and transparent reporting to ensure effective collection and minimize market disruption.

Economic Impacts: Pros and Cons

Currency Exchange Tax reduces short-term speculative trading by imposing a small fee on currency transactions, potentially stabilizing exchange rates but possibly increasing transaction costs for businesses and investors. Tobin tax specifically targets currency speculation to curb excessive volatility and generates government revenue, though it risks reducing market liquidity and may encourage trading in untaxed venues. Both taxes aim to enhance economic stability but face criticism for potentially hindering financial market efficiency and international capital flows.

Effect on Global Financial Stability

The Currency Exchange Tax aims to reduce excessive currency fluctuations by imposing a small levy on foreign exchange transactions, promoting market stability and lowering speculative volatility. The Tobin Tax, a broader financial transaction tax proposed by economist James Tobin, targets all short-term capital movements to deter speculative trading and decrease market turbulence. Both taxes can enhance global financial stability by curbing volatile capital flows and fostering more predictable currency and asset prices in international markets.

Case Studies and Real-World Applications

The Currency Exchange Tax is implemented in Brazil and Switzerland to curb speculative trading by taxing currency conversions, with Brazil observing reduced short-term volatility but concerns about market liquidity. The Tobin Tax, proposed by economist James Tobin and trialed in the European Union on financial transactions, aims to stabilize markets by imposing a small levy on currency trades, demonstrated during the 2009 Swedish trial where transactional volume dropped significantly. Both taxes reflect efforts to reduce harmful speculation in forex markets, yet case studies reveal challenges in enforcement, cross-border capital flight, and balancing economic growth with financial stability.

Criticisms and Controversies

Currency exchange tax and Tobin tax face criticism for potentially reducing market liquidity and increasing transaction costs, which may deter legitimate trade and investment. Critics argue the Tobin tax's broad application on all currency transactions could lead to economic distortions and challenge regulatory enforcement. Both taxes spark controversy over their effectiveness in curbing volatile speculation versus unintended financial market disruptions and revenue implications.

Future Prospects and Policy Recommendations

Currency exchange tax targets cross-border currency transactions to reduce speculative trading, while Tobin tax specifically aims at stabilizing global financial markets by imposing a small levy on all spot currency conversions. Future prospects suggest enhanced international coordination and digital technology integration will improve enforcement and efficacy of both tax types. Policy recommendations include establishing clear definitions, setting appropriate tax rates to balance revenue generation with market liquidity, and promoting transparency to reduce evasion risks.

Currency Exchange Tax Infographic

libterm.com

libterm.com