Tariffs are taxes imposed by governments on imported goods, designed to protect domestic industries and generate revenue. These trade barriers can influence prices, supply chains, and international relations, impacting both businesses and consumers worldwide. Discover how tariffs affect your economy and what they mean for global trade in the rest of this article.

Table of Comparison

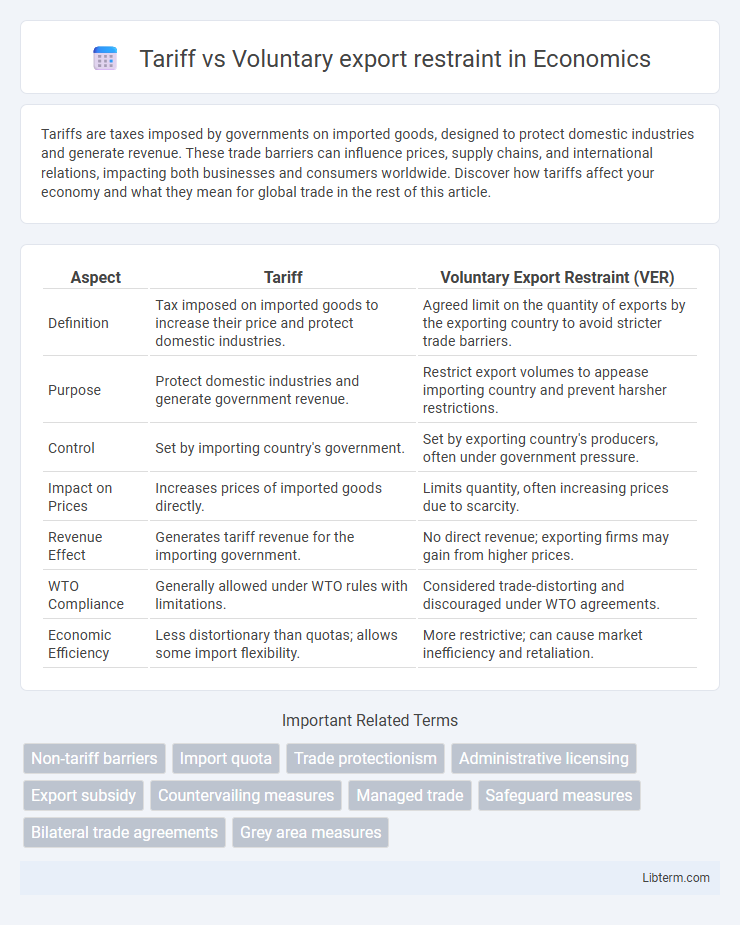

| Aspect | Tariff | Voluntary Export Restraint (VER) |

|---|---|---|

| Definition | Tax imposed on imported goods to increase their price and protect domestic industries. | Agreed limit on the quantity of exports by the exporting country to avoid stricter trade barriers. |

| Purpose | Protect domestic industries and generate government revenue. | Restrict export volumes to appease importing country and prevent harsher restrictions. |

| Control | Set by importing country's government. | Set by exporting country's producers, often under government pressure. |

| Impact on Prices | Increases prices of imported goods directly. | Limits quantity, often increasing prices due to scarcity. |

| Revenue Effect | Generates tariff revenue for the importing government. | No direct revenue; exporting firms may gain from higher prices. |

| WTO Compliance | Generally allowed under WTO rules with limitations. | Considered trade-distorting and discouraged under WTO agreements. |

| Economic Efficiency | Less distortionary than quotas; allows some import flexibility. | More restrictive; can cause market inefficiency and retaliation. |

Understanding Tariffs and Voluntary Export Restraints

Tariffs are government-imposed taxes on imported goods designed to protect domestic industries and generate revenue, often affecting product prices and trade balances. Voluntary Export Restraints (VERs) are self-imposed limits by exporting countries to restrict the quantity of goods exported, aiming to avoid harsher trade barriers and maintain diplomatic trade relations. Both tools influence international trade dynamics, with tariffs directly impacting cost and VERs controlling supply without formal government legislation.

Key Differences Between Tariffs and VERs

Tariffs impose a fixed tax on imported goods that raise their price to protect domestic industries, while Voluntary Export Restraints (VERs) are agreements where exporting countries limit the quantity of goods sent to a foreign market. Tariffs generate government revenue whereas VERs directly restrict supply without generating fiscal income for the importing country. Tariffs allow market-driven adjustments in import volumes, but VERs enforce predetermined limits, often leading to higher prices and supply constraints.

Economic Impact of Tariffs

Tariffs impose direct tax on imported goods, increasing their price and protecting domestic industries by reducing foreign competition, which can lead to higher consumer prices and potential inefficiencies in the market. They generate government revenue and may improve trade balances but risk retaliatory measures from trading partners, possibly escalating trade conflicts. In contrast, voluntary export restraints limit export quantities through agreements without direct tax, often causing supply shortages and higher prices without government revenue benefits.

How Voluntary Export Restraints Work

Voluntary Export Restraints (VERs) work by allowing exporting countries to agree to limit the quantity of goods shipped to an importing country, typically in response to pressure from the importing nation's government or industries seeking protection from foreign competition. Unlike tariffs that impose taxes on imports, VERs restrict supply directly, thereby controlling market access and potentially maintaining higher domestic prices. These agreements are negotiated between governments and are used as a tool to manage trade flows while avoiding formal trade barriers like tariffs or quotas.

Historical Examples of Tariffs

The Smoot-Hawley Tariff Act of 1930 significantly raised U.S. tariffs on over 20,000 imported goods, exacerbating the Great Depression by triggering retaliatory tariffs from trading partners. Another historical example is the Corn Laws in 19th-century Britain, which imposed high tariffs on imported grain to protect domestic farmers and caused widespread food price inflation and social unrest. These examples demonstrate how tariffs have historically been used to shield domestic industries but often lead to international trade tensions and economic consequences.

Case Studies: Voluntary Export Restraints in Practice

Voluntary Export Restraints (VERs) have been prominently applied in the automotive industry, notably with Japanese car exports to the United States during the 1980s, limiting export volumes to protect domestic manufacturers while avoiding harsher tariffs. Another case study involves steel exports from various countries to the European Union, where VERs were employed to prevent market oversaturation and retaliatory trade barriers. These examples demonstrate how VERs serve as negotiated trade restrictions that differ from tariffs by limiting quantities rather than imposing tax-based trade costs.

Effects on Domestic Industries

Tariffs increase the cost of imported goods, thereby protecting domestic industries by reducing foreign competition and encouraging local production. Voluntary export restraints (VERs) limit the quantity of goods exported to a country, effectively capping imports and directly restraining competition, which can stabilize prices and protect domestic manufacturers. Both measures aim to shield domestic industries, but tariffs generate government revenue while VERs often lead to higher prices for consumers due to restricted supply.

Consumer Consequences: Price and Choice

Tariffs increase import costs, leading to higher prices for consumers and reduced product variety due to limited foreign competition. Voluntary export restraints (VERs) restrict supply directly, often causing sharper price hikes and more significant reductions in available options. Both policies limit consumer choice, but VERs tend to have more immediate and pronounced effects on price inflation and market diversity.

Global Trade Relations: Tariffs vs VERs

Tariffs impose a tax on imported goods, directly affecting prices and government revenue, thereby influencing trade balances and protecting domestic industries. Voluntary Export Restraints (VERs) are negotiated limits set by exporting countries to restrict export quantities, often to avoid more severe trade barriers and maintain diplomatic relations. Both mechanisms impact global trade relations by shaping market access, altering competitive dynamics, and serving as tools for negotiation in international trade agreements.

Choosing Between Tariffs and VERs: Policy Considerations

Choosing between tariffs and voluntary export restraints (VERs) depends on the balance of economic and political objectives, as tariffs generate government revenue while VERs typically do not. Tariffs provide transparent price adjustments and market-driven import limitations, whereas VERs involve negotiated export limits that can create bilateral trade tensions and lack transparency. Policymakers must consider economic efficiency, potential retaliatory responses, administrative costs, and international trade obligations when selecting between these trade restriction tools.

Tariff Infographic

libterm.com

libterm.com