The expectations-augmented Phillips curve incorporates inflation expectations into the traditional Phillips curve, highlighting the relationship between unemployment and inflation when anticipated inflation is factored in. This model explains why attempts to reduce unemployment below the natural rate can lead to accelerating inflation, as people adjust their expectations accordingly. Explore the rest of the article to understand how this concept impacts monetary policy and economic stability.

Table of Comparison

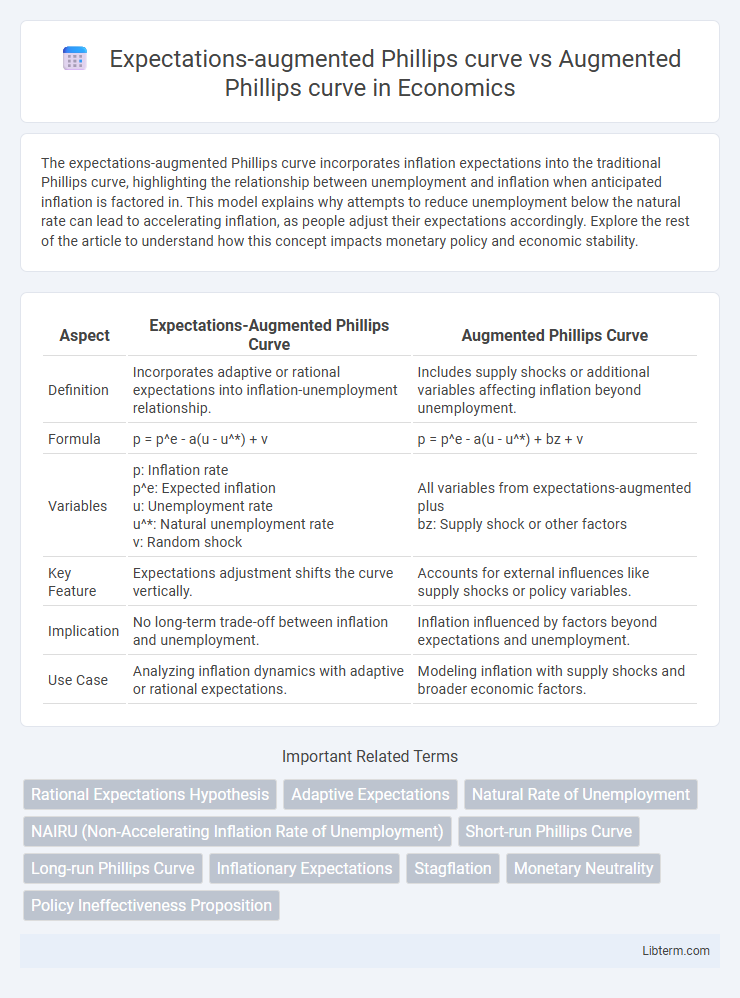

| Aspect | Expectations-Augmented Phillips Curve | Augmented Phillips Curve |

|---|---|---|

| Definition | Incorporates adaptive or rational expectations into inflation-unemployment relationship. | Includes supply shocks or additional variables affecting inflation beyond unemployment. |

| Formula | p = p^e - a(u - u^*) + v | p = p^e - a(u - u^*) + bz + v |

| Variables | p: Inflation rate p^e: Expected inflation u: Unemployment rate u^*: Natural unemployment rate v: Random shock |

All variables from expectations-augmented plus bz: Supply shock or other factors |

| Key Feature | Expectations adjustment shifts the curve vertically. | Accounts for external influences like supply shocks or policy variables. |

| Implication | No long-term trade-off between inflation and unemployment. | Inflation influenced by factors beyond expectations and unemployment. |

| Use Case | Analyzing inflation dynamics with adaptive or rational expectations. | Modeling inflation with supply shocks and broader economic factors. |

Introduction to the Phillips Curve

The Expectations-augmented Phillips curve refines the original Phillips curve by incorporating adaptive or rational inflation expectations, explaining the trade-off between unemployment and inflation in the short run but emphasizing that this trade-off disappears in the long run. The traditional augmented Phillips curve includes variables like expected inflation and supply shocks, extending the initial inverse relationship to account for real economic factors influencing inflation dynamics. Both models build on A.W. Phillips' 1958 observation of wage inflation and unemployment, evolving to highlight how inflation expectations shift unemployment-inflation interactions.

Understanding the Augmented Phillips Curve

The Augmented Phillips Curve incorporates adaptive expectations, suggesting inflation depends on both unemployment and expected inflation, capturing the dynamic adjustment of wage setters over time. It expands on the traditional Phillips Curve by integrating expectations, highlighting the role of anticipated inflation in shaping the short-run trade-off between inflation and unemployment. Understanding this model is essential for analyzing how inflation expectations influence real economic variables and policy effectiveness in stabilizing inflation without increasing unemployment.

What is the Expectations-Augmented Phillips Curve?

The Expectations-Augmented Phillips Curve incorporates inflation expectations into the original Phillips Curve, illustrating the inverse relationship between unemployment and the difference between actual and expected inflation. It emphasizes that only unexpected inflation can reduce unemployment below the natural rate, while expected inflation adjusts wage and price settings. This model refines policymakers' understanding by highlighting the role of adaptive or rational expectations in long-term inflation-unemployment dynamics.

Key Differences Between the Two Models

The Expectations-augmented Phillips curve integrates adaptive expectations, emphasizing how anticipated inflation influences the inflation-unemployment tradeoff, causing the short-run Phillips curve to shift as expectations adjust. The Augmented Phillips curve incorporates both expectations and supply-side factors such as output gaps or unemployment deviations, providing a broader explanation for inflation dynamics by including real economic activity measures. Key differences lie in the expectations framework--adaptive in the Expectations-augmented model versus potentially rational or adaptive in the Augmented model--and the additional inclusion of real output or unemployment gaps in the latter to better capture inflation persistence and labor market conditions.

Role of Inflation Expectations in Both Curves

The Expectations-Augmented Phillips Curve explicitly incorporates adaptive or rational inflation expectations, showing how anticipated inflation shifts the short-run trade-off between unemployment and inflation, causing the curve to move as expectations adjust. The Augmented Phillips Curve extends this framework by factoring in additional variables such as supply shocks and output gaps, but inflation expectations remain a central determinant of the dynamic inflation-unemployment relationship. Both models highlight that unanchored or rising inflation expectations can erode the trade-off, making inflation persist even when unemployment falls to natural rates.

Mathematical Formulations Compared

The Expectations-augmented Phillips curve introduces inflation expectations \(\pi^e\) into the original Phillips curve relationship, expressed mathematically as \(\pi_t = \pi_t^e - \alpha (u_t - u^*)\), where \(\pi_t\) is actual inflation, \(u_t\) is unemployment, and \(u^*\) is the natural rate of unemployment. The Augmented Phillips curve further incorporates supply shocks or other variables, typically in the form \(\pi_t = \pi_t^e - \alpha (u_t - u^*) + \beta z_t\), where \(z_t\) represents supply shocks or other exogenous impacts on inflation. These formulations highlight the evolution from a basic expectations-adjusted trade-off to a more comprehensive model integrating real-world economic shocks and inflation dynamics.

Implications for Monetary Policy

The Expectations-augmented Phillips curve incorporates adaptive expectations, highlighting how anticipated inflation shifts the short-run trade-off between inflation and unemployment, implying monetary policy must manage inflation expectations to maintain credibility. The Augmented Phillips curve includes factors like supply shocks and inflation inertia, emphasizing that monetary policy's effectiveness depends on its ability to influence not only expectations but also real economic variables in the presence of external shocks. Effective monetary policy requires distinguishing between temporary supply-side disturbances and persistent inflation to adjust interest rates appropriately while anchoring inflation expectations for long-term stability.

Short-Run vs. Long-Run Trade-Offs

The Expectations-augmented Phillips curve integrates adaptive or rational expectations, showing a short-run trade-off between inflation and unemployment that vanishes in the long run as expectations adjust, rendering the Phillips curve vertical. In contrast, the Augmented Phillips curve incorporates supply shocks and inflation expectations, emphasizing that short-run trade-offs exist but inflation accelerates if unemployment stays below the natural rate. Both models highlight that while policymakers can exploit short-run inflation-unemployment trade-offs, these compromises disappear in the long run, where the natural rate of unemployment is unaffected by inflation.

Real-World Evidence and Empirical Findings

Empirical findings on the Expectations-Augmented Phillips Curve emphasize the role of adaptive and rational expectations in shaping inflation-unemployment dynamics, showing that inflation expectations adjust based on past inflation, which aligns with real-world data from the 1970s and 1980s. The Augmented Phillips Curve incorporates supply shocks and inflation expectations, with empirical studies highlighting its relevance in explaining volatility during periods of oil price shocks and stagflation, reinforcing its robustness in modern macroeconomic settings. Real-world evidence from various advanced economies supports the augmented specifications over the original Phillips curve by capturing the influence of expectations and external shocks on inflation persistence and unemployment rates.

Conclusion: Choosing the Right Phillips Curve Model

Choosing the right Phillips curve model depends on the economic context and the inflation dynamics being analyzed. The Expectations-augmented Phillips curve integrates adaptive or rational expectations, allowing for a better explanation of inflation persistence and the role of expected inflation in shaping wage and price setting. In contrast, the Augmented Phillips curve incorporates additional variables like supply shocks or unemployment to improve predictive accuracy but may lack the forward-looking perspective critical for policy targeting inflation expectations effectively.

Expectations-augmented Phillips curve Infographic

libterm.com

libterm.com