Rational expectations theory assumes individuals use all available information efficiently to forecast future economic variables, shaping their decisions and market outcomes accordingly. This concept plays a crucial role in modern macroeconomics, influencing policies and models by anticipating how people adapt to economic changes. Discover how understanding rational expectations can enhance your insight into economic behavior and policy effectiveness throughout the article.

Table of Comparison

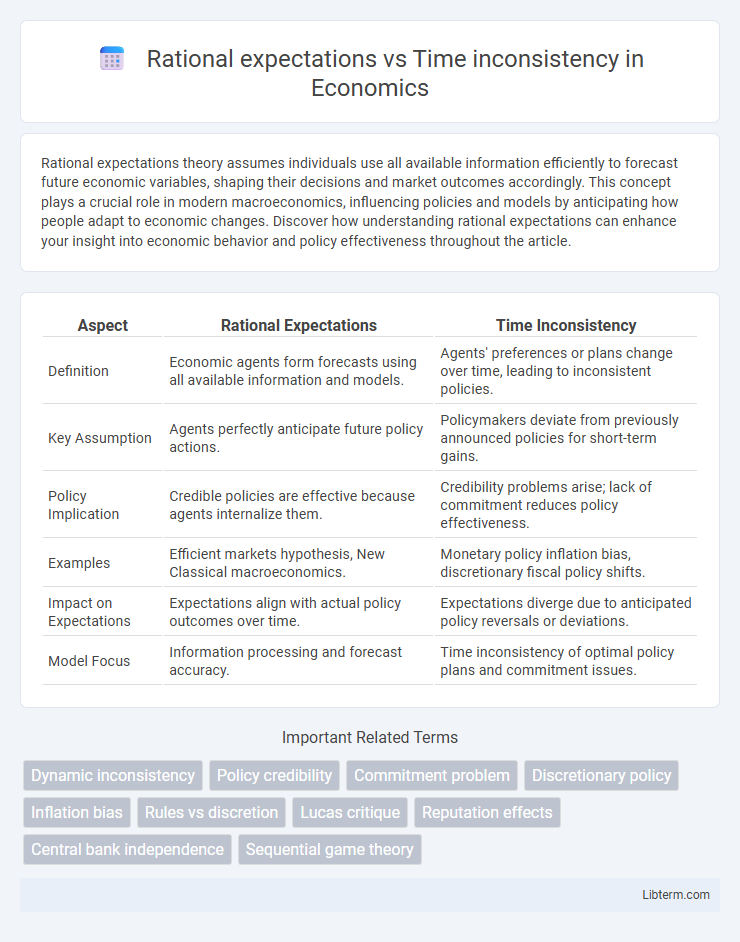

| Aspect | Rational Expectations | Time Inconsistency |

|---|---|---|

| Definition | Economic agents form forecasts using all available information and models. | Agents' preferences or plans change over time, leading to inconsistent policies. |

| Key Assumption | Agents perfectly anticipate future policy actions. | Policymakers deviate from previously announced policies for short-term gains. |

| Policy Implication | Credible policies are effective because agents internalize them. | Credibility problems arise; lack of commitment reduces policy effectiveness. |

| Examples | Efficient markets hypothesis, New Classical macroeconomics. | Monetary policy inflation bias, discretionary fiscal policy shifts. |

| Impact on Expectations | Expectations align with actual policy outcomes over time. | Expectations diverge due to anticipated policy reversals or deviations. |

| Model Focus | Information processing and forecast accuracy. | Time inconsistency of optimal policy plans and commitment issues. |

Introduction to Rational Expectations and Time Inconsistency

Rational expectations theory asserts that individuals form forecasts about future economic variables using all available information and consistent economic models, leading to unbiased and efficient predictions. Time inconsistency refers to the phenomenon where policymakers' optimal plans change over time because future incentives alter original commitments, often undermining policy credibility. Understanding the interplay between rational expectations and time inconsistency is crucial for designing credible and effective economic policies that account for forward-looking behavior.

Defining Rational Expectations in Economics

Rational expectations in economics refer to the hypothesis that individuals and firms make decisions based on all available information and consistent economic models, anticipating future events accurately on average. This concept assumes agents use current data and past experiences to form unbiased forecasts, minimizing systematic errors in predictions of variables like inflation or policy outcomes. Contrastingly, time inconsistency occurs when policymakers' optimal plans change over time, leading to potential credibility problems despite agents' rational foresight.

Understanding the Concept of Time Inconsistency

Time inconsistency occurs when policymakers' optimal plans change over time due to shifts in incentives, causing a deviation from previously announced policies. Rational expectations assume that agents anticipate these future policy changes, leading to adjustments in behavior that undermine the credibility of current commitments. Understanding time inconsistency is crucial for designing credible policies that align incentives and maintain commitment over time.

Historical Context and Evolution of Both Theories

Rational expectations theory emerged in the 1960s through the work of economists like John Muth and Robert Lucas, challenging traditional adaptive expectations by positing that agents use all available information to forecast future economic variables, which transformed macroeconomic modeling and policy analysis. Time inconsistency, formalized by Finn Kydland and Edward Prescott in the 1970s, highlighted the problem where policymakers' optimal plans change over time, leading to suboptimal outcomes due to changes in incentives. Both theories evolved as foundational concepts in modern macroeconomics, influencing the development of rules-based policy frameworks and shedding light on the limitations of discretionary monetary and fiscal policies.

Key Differences: Rational Expectations vs Time Inconsistency

Rational expectations assume that economic agents use all available information efficiently to forecast future variables, leading to decisions that align with equilibrium outcomes. Time inconsistency refers to situations where a policy plan considered optimal in the present becomes suboptimal in the future, causing policymakers to deviate from their initial strategy. The key difference lies in rational expectations emphasizing forward-looking behavior and information processing, while time inconsistency highlights the conflict between current and future incentives affecting policy credibility.

Impact of Rational Expectations on Economic Policy

Rational expectations significantly influence economic policy by shaping how agents anticipate and respond to policy actions, often neutralizing intended effects such as inflation reduction through monetary tightening. Policymakers face challenges in credible commitments, as rational agents predict future policy changes, leading to time inconsistency problems where short-term incentives disrupt long-term plans. Incorporating rational expectations requires designing policies with transparency and credibility to ensure effective outcomes and maintain economic stability.

Time Inconsistency in Policy Design and Implementation

Time inconsistency in policy design and implementation occurs when policymakers' plans change over time, undermining their credibility and effectiveness, as economic agents anticipate future deviations and adjust their behavior accordingly. This phenomenon poses significant challenges in monetary and fiscal policies, particularly when short-term incentives conflict with long-term goals, leading to suboptimal outcomes such as inflation bias or fiscal indiscipline. Addressing time inconsistency requires commitment mechanisms like rules-based policies or independent institutions that enhance policy credibility and align expectations with intended objectives.

Case Studies Illustrating Both Concepts

Case studies like Robert Lucas' evaluation of monetary policy highlight rational expectations, showing how individuals anticipate and counteract policy interventions, diminishing their effectiveness. The time inconsistency problem is exemplified by the United States' experience with discretionary inflation targeting, where policymakers' incentives to stimulate the economy lead to higher inflation expectations and subsequent credibility loss. These empirical examples underscore the challenges in designing economic policies that align with forward-looking agents and maintain consistent commitment over time.

Criticisms and Limitations of Each Approach

Rational expectations face criticism for assuming agents have perfect foresight and access to all relevant information, often overlooking real-world limitations like cognitive biases and information asymmetry. Time inconsistency highlights the challenge policymakers face when their future incentives change, but critics argue it may overemphasize the inability to commit and neglects the potential for credible long-term policies. Both approaches struggle with empirical validation due to their reliance on idealized assumptions, limiting their applicability in complex, dynamic economic environments.

Conclusion: Lessons for Modern Economic Policy

Rational expectations emphasize the importance of credible and consistent policy commitments to influence economic agents' behavior effectively. Time inconsistency highlights the challenge policymakers face when short-term incentives lead to policy reversals that undermine long-term goals. Modern economic policy must integrate mechanisms that enhance commitment credibility to avoid the pitfalls of time-inconsistent policies and maintain market confidence.

Rational expectations Infographic

libterm.com

libterm.com