The Coase theorem explains how parties can resolve conflicts over resource allocation through negotiation, without government intervention, provided transaction costs are low and property rights are well-defined. This economic principle highlights the efficiency of private bargaining in addressing externalities and minimizing social costs. Discover how understanding the Coase theorem can empower your approach to resolving disputes and optimizing resource use by exploring the rest of this article.

Table of Comparison

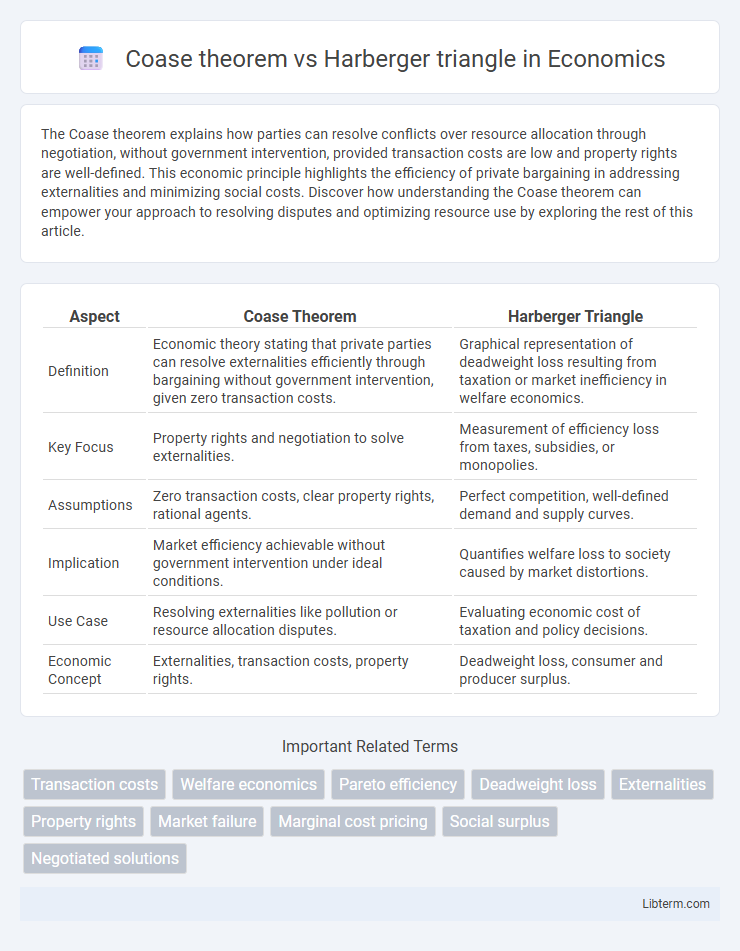

| Aspect | Coase Theorem | Harberger Triangle |

|---|---|---|

| Definition | Economic theory stating that private parties can resolve externalities efficiently through bargaining without government intervention, given zero transaction costs. | Graphical representation of deadweight loss resulting from taxation or market inefficiency in welfare economics. |

| Key Focus | Property rights and negotiation to solve externalities. | Measurement of efficiency loss from taxes, subsidies, or monopolies. |

| Assumptions | Zero transaction costs, clear property rights, rational agents. | Perfect competition, well-defined demand and supply curves. |

| Implication | Market efficiency achievable without government intervention under ideal conditions. | Quantifies welfare loss to society caused by market distortions. |

| Use Case | Resolving externalities like pollution or resource allocation disputes. | Evaluating economic cost of taxation and policy decisions. |

| Economic Concept | Externalities, transaction costs, property rights. | Deadweight loss, consumer and producer surplus. |

Introduction to Coase Theorem and Harberger Triangle

The Coase Theorem explains how private parties can resolve externalities through bargaining without government intervention, assuming low transaction costs and well-defined property rights. The Harberger Triangle represents the deadweight loss or inefficiency caused by market distortions such as taxes or monopolies, visually illustrating the loss of economic welfare. Both concepts are fundamental in economic analysis of market failures, with Coase emphasizing negotiated solutions and Harberger quantifying welfare losses.

Defining the Coase Theorem

The Coase Theorem asserts that when property rights are clearly defined and transaction costs are negligible, private parties can negotiate efficient allocations of resources regardless of initial entitlements, resolving externalities without government intervention. In contrast, the Harberger triangle quantifies the deadweight loss from market distortions like taxes or monopolies, measuring the economic inefficiency caused by such interventions. Understanding the Coase Theorem highlights the significance of well-defined legal frameworks and low negotiation costs in achieving optimal resource allocation, while the Harberger triangle emphasizes the cost of market imperfections.

Understanding the Harberger Triangle

The Harberger triangle represents the deadweight loss from market inefficiencies, illustrating the loss in total surplus due to taxes, subsidies, or distortions. Unlike the Coase theorem, which suggests that private negotiations can lead to efficient outcomes despite externalities, the Harberger triangle quantifies welfare loss by showing the area of lost consumer and producer surplus. Understanding this triangle is essential for evaluating the social cost of policies and interventions in imperfect markets.

Key Assumptions of the Coase Theorem

The Coase Theorem rests on the key assumptions of zero transaction costs, clearly defined property rights, and rational agents able to negotiate without barriers, leading to efficient resource allocation regardless of initial ownership. In contrast, the Harberger triangle highlights deadweight loss due to taxation or market distortions, assuming imperfect market conditions and transaction costs. Understanding these contrasting assumptions illuminates how Coase's framework prioritizes negotiation and legal clarity, while Harberger's model emphasizes inefficiency from external market interventions.

Measuring Deadweight Loss with the Harberger Triangle

Measuring deadweight loss using the Harberger triangle involves quantifying the loss of economic efficiency when market equilibrium is distorted by taxes, subsidies, or price controls. The area of the Harberger triangle represents the total surplus lost, capturing the cost of reduced mutually beneficial trades between buyers and sellers. Unlike the Coase theorem, which emphasizes the role of property rights and bargaining in resolving externalities, the Harberger triangle strictly measures the static welfare loss from market interventions.

Coase Theorem in Real-World Applications

Coase Theorem emphasizes that well-defined property rights and low transaction costs enable efficient resource allocation through private negotiations, minimizing externalities without government intervention. In real-world applications, this theorem guides policies in areas such as environmental regulation, where negotiable pollution permits allow firms to internalize external costs effectively. Unlike the Harberger triangle, which quantifies deadweight loss due to taxes or distortions, Coase Theorem focuses on the potential for negotiated solutions to eliminate such inefficiencies.

Visualizing Market Inefficiency: Harberger Triangle Explained

The Harberger triangle visually represents market inefficiency caused by taxes or distortions, illustrating deadweight loss as the area between supply and demand curves where mutually beneficial trades no longer occur. In contrast, the Coase theorem suggests that under zero transaction costs and well-defined property rights, private negotiations can resolve externalities without causing efficiency loss, implying no deadweight loss. The Harberger triangle thus quantifies welfare loss from market interventions, while the Coase theorem provides a theoretical framework for achieving efficient outcomes despite externalities.

Comparing Solutions to Market Failures

The Coase theorem addresses market failures by suggesting that private negotiations between parties can lead to efficient resource allocation without government intervention, provided property rights are well-defined and transaction costs are low. In contrast, the Harberger triangle represents the deadweight loss or inefficiency created by taxation or distortionary policies that deviate from optimal market equilibrium. While Coase emphasizes negotiation and property rights to resolve externalities, the Harberger triangle quantifies welfare losses resulting from government-imposed market distortions.

Policy Implications: Coase vs. Harberger Perspectives

Coase theorem emphasizes efficient resource allocation through private bargaining without government intervention, assuming zero transaction costs and clear property rights, suggesting policies should focus on establishing legal frameworks rather than regulatory controls. In contrast, the Harberger triangle quantifies deadweight loss from taxation or market distortions, supporting government intervention to correct inefficiencies caused by externalities or imperfect competition. Policymakers must balance Coase's reliance on market solutions with Harberger's demonstration of net welfare losses to design interventions that minimize economic distortions while promoting social welfare.

Conclusion: Complementary Roles in Economic Analysis

The Coase theorem highlights the importance of well-defined property rights and low transaction costs in achieving efficient resource allocation without government intervention. The Harberger triangle quantifies the welfare loss from taxation or market distortions, emphasizing the cost of inefficiencies in resource allocation. Together, these concepts play complementary roles in economic analysis by explaining both the conditions for efficient negotiation and the measurable impact of market failures on social welfare.

Coase theorem Infographic

libterm.com

libterm.com