Krugman's monopolistic competition model explains how firms differentiate their products to gain market power while facing many competitors, leading to a balance between variety and scale economies. This model highlights the trade-offs firms encounter as they expand product variety and achieve cost efficiency in imperfectly competitive markets. Discover how this framework impacts market structure and consumer choice by reading the full article.

Table of Comparison

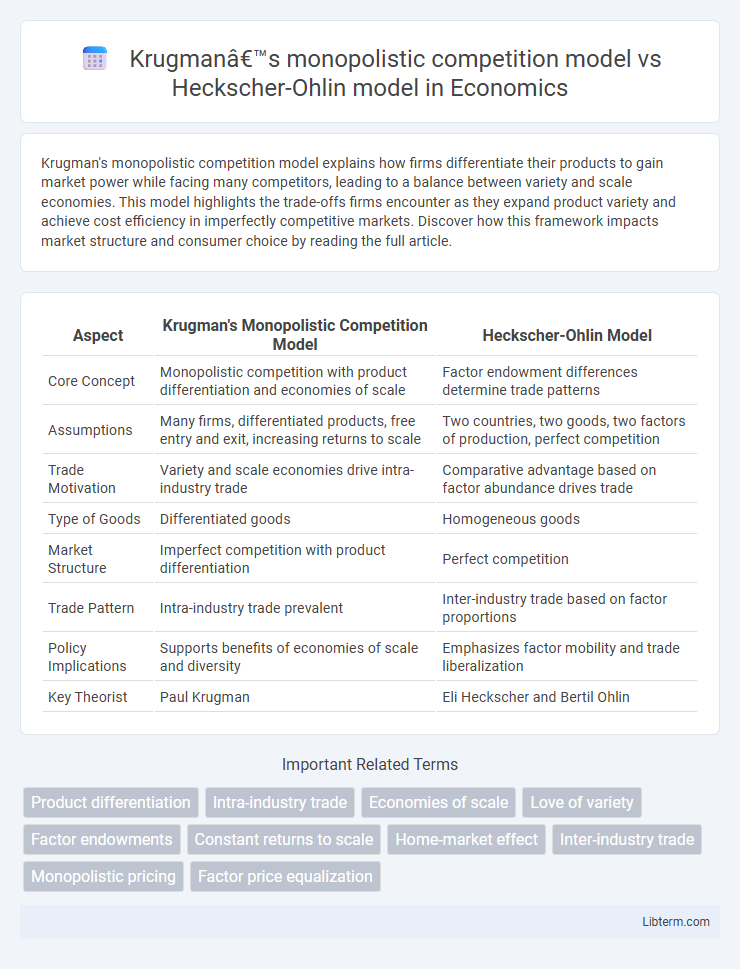

| Aspect | Krugman's Monopolistic Competition Model | Heckscher-Ohlin Model |

|---|---|---|

| Core Concept | Monopolistic competition with product differentiation and economies of scale | Factor endowment differences determine trade patterns |

| Assumptions | Many firms, differentiated products, free entry and exit, increasing returns to scale | Two countries, two goods, two factors of production, perfect competition |

| Trade Motivation | Variety and scale economies drive intra-industry trade | Comparative advantage based on factor abundance drives trade |

| Type of Goods | Differentiated goods | Homogeneous goods |

| Market Structure | Imperfect competition with product differentiation | Perfect competition |

| Trade Pattern | Intra-industry trade prevalent | Inter-industry trade based on factor proportions |

| Policy Implications | Supports benefits of economies of scale and diversity | Emphasizes factor mobility and trade liberalization |

| Key Theorist | Paul Krugman | Eli Heckscher and Bertil Ohlin |

Introduction to International Trade Theories

Krugman's monopolistic competition model emphasizes product differentiation and economies of scale as key drivers of international trade, explaining intra-industry trade between similar countries. The Heckscher-Ohlin model focuses on comparative advantage determined by countries' relative factor endowments, leading to inter-industry trade based on differences in labor, capital, and land. Both models form foundational theories in international economics, with Krugman's model addressing limitations of traditional Heckscher-Ohlin assumptions in explaining real-world trade patterns.

Overview of Krugman’s Monopolistic Competition Model

Krugman's monopolistic competition model emphasizes product differentiation and economies of scale as key drivers of international trade, contrasting with the Heckscher-Ohlin model's focus on factor endowments like labor and capital. It explains intra-industry trade through the presence of many firms producing similar but not identical goods, leading to increased variety and consumer choice. The model integrates imperfect competition and strategic firm behavior, highlighting the role of market structure in shaping trade patterns.

Fundamentals of the Heckscher-Ohlin Model

The Heckscher-Ohlin model explains trade patterns based on countries' relative factor endowments, assuming two factors of production--labor and capital--and identical technologies across nations. It predicts that countries will export goods that intensively use their abundant factors and import goods requiring scarce factors, emphasizing comparative advantage rooted in resource distribution. This contrasts with Krugman's monopolistic competition model, which highlights economies of scale and product differentiation as drivers of trade beyond factor endowment differences.

Key Assumptions: Krugman vs Heckscher-Ohlin

Krugman's monopolistic competition model assumes differentiated products and increasing returns to scale within industries, emphasizing imperfect competition and intra-industry trade driven by consumer preferences for variety. In contrast, the Heckscher-Ohlin model assumes perfect competition, identical products within industries, and constant returns to scale, focusing on factor endowments like labor and capital to explain international trade patterns. These foundational assumptions lead Krugman's model to highlight economies of scale and product differentiation, whereas the Heckscher-Ohlin model centers on comparative advantage arising from relative factor abundance.

Sources of Trade: Product Differentiation vs Factor Endowments

Krugman's monopolistic competition model attributes international trade origins to product differentiation and economies of scale, where firms produce unique varieties that foster intra-industry trade among similar countries. In contrast, the Heckscher-Ohlin model emphasizes differences in factor endowments, such as labor, capital, and land, as the fundamental source of trade, predicting inter-industry trade driven by comparative advantage. While Krugman highlights consumer preference for diverse products within industries, Heckscher-Ohlin centers on how resource abundance shapes specialization and exchange patterns between nations.

Market Structure and Firm Behavior

Krugman's monopolistic competition model emphasizes differentiated products and many firms with some market power, leading to strategic firm behavior such as pricing above marginal cost and product variety expansion. The Heckscher-Ohlin model assumes perfect competition with homogeneous goods, where firms are price takers and focus primarily on factor endowments to determine trade patterns. Consequently, Krugman's framework explains internal economies of scale and trade driven by consumer preferences, while Heckscher-Ohlin centers on external economies of scale influenced by resource abundance.

Predictions on Trade Patterns

Krugman's monopolistic competition model predicts trade patterns driven by economies of scale and consumer preference for product variety, leading to intra-industry trade between similar countries. In contrast, the Heckscher-Ohlin model forecasts trade based on differences in factor endowments, where countries export goods that intensively use their abundant factors and import goods relying on scarce factors. While Krugman emphasizes product differentiation and market structure, Heckscher-Ohlin highlights comparative advantage rooted in resource distribution across nations.

Impacts on Income Distribution and Welfare

Krugman's monopolistic competition model highlights income distribution effects through increased consumer choice and product differentiation, boosting welfare by enhancing utility despite potential wage disparities in imperfect competition. The Heckscher-Ohlin model emphasizes factor endowment differences, predicting that trade benefits factor owners abundant in export goods while potentially disadvantaging owners of scarce factors, which can widen income inequality. Welfare impacts in the Heckscher-Ohlin framework depend on factor mobility and compensation mechanisms, while Krugman's model suggests overall welfare gains due to economies of scale and market variety.

Empirical Evidence and Real-World Applications

Krugman's monopolistic competition model emphasizes product differentiation and economies of scale in explaining intra-industry trade, with empirical studies validating its applicability in industries like automotive and electronics where firms export similar but not identical products. In contrast, the Heckscher-Ohlin model centers on factor endowments, supported by evidence showing countries export goods that intensively use their abundant production factors, such as labor or capital, visible in commodity sectors like textiles or machinery. Real-world applications of Krugman's model are prominent in analyzing trade patterns within developed economies, while the Heckscher-Ohlin model better explains trade flows between developed and developing countries driven by differences in resource allocation.

Conclusion: Comparative Strengths and Limitations

Krugman's monopolistic competition model excels in explaining intra-industry trade through product differentiation and economies of scale, offering insights into trade patterns among similar countries. The Heckscher-Ohlin model emphasizes factor endowments and comparative advantage, effectively predicting inter-industry trade based on resource distribution but struggles with explaining trade between similar economies. Combining both models provides a more comprehensive understanding, as Krugman captures scale economies and consumer preferences while Heckscher-Ohlin grounds trade in resource fundamentals, though each has limitations in addressing the full complexity of global trade dynamics.

Krugman’s monopolistic competition model Infographic

libterm.com

libterm.com