Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to maintain price stability and foster economic growth. This approach helps anchor inflation expectations and guides interest rate decisions, ensuring your purchasing power remains stable over time. Explore the rest of the article to understand how inflation targeting impacts the economy and your financial well-being.

Table of Comparison

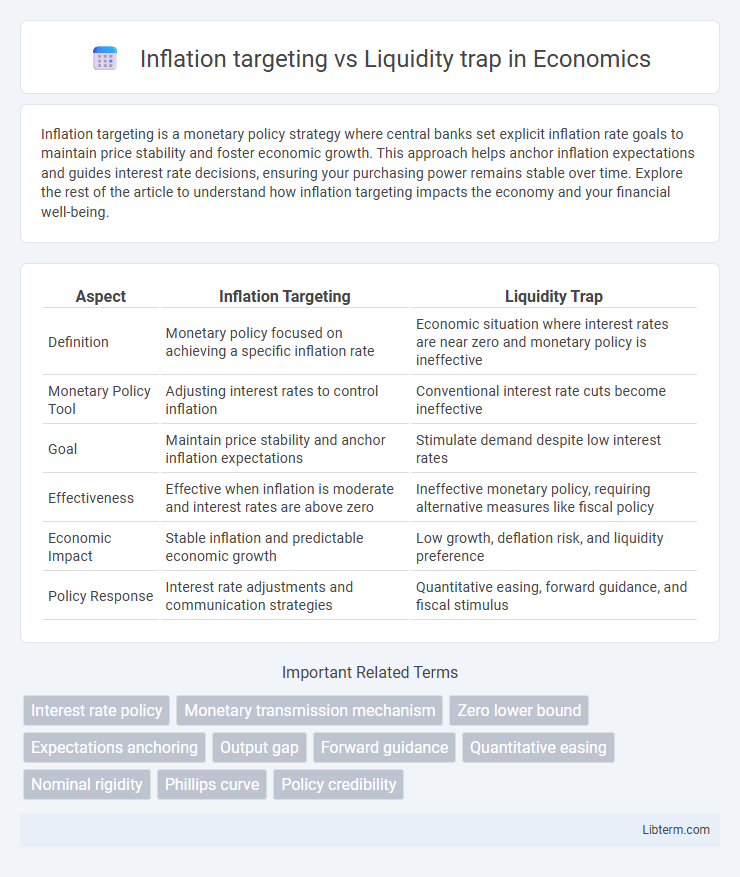

| Aspect | Inflation Targeting | Liquidity Trap |

|---|---|---|

| Definition | Monetary policy focused on achieving a specific inflation rate | Economic situation where interest rates are near zero and monetary policy is ineffective |

| Monetary Policy Tool | Adjusting interest rates to control inflation | Conventional interest rate cuts become ineffective |

| Goal | Maintain price stability and anchor inflation expectations | Stimulate demand despite low interest rates |

| Effectiveness | Effective when inflation is moderate and interest rates are above zero | Ineffective monetary policy, requiring alternative measures like fiscal policy |

| Economic Impact | Stable inflation and predictable economic growth | Low growth, deflation risk, and liquidity preference |

| Policy Response | Interest rate adjustments and communication strategies | Quantitative easing, forward guidance, and fiscal stimulus |

Introduction to Inflation Targeting and Liquidity Trap

Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to stabilize prices and guide economic expectations. A liquidity trap occurs when nominal interest rates approach zero, rendering conventional monetary policy ineffective in stimulating demand despite increased liquidity. Understanding both concepts is crucial for managing economic stability in periods of deflationary pressure and low-interest environments.

Defining Key Concepts: Inflation Targeting

Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to maintain price stability and anchor inflation expectations. This approach involves adjusting interest rates and other monetary tools to steer inflation toward a predetermined target, often around 2%, ensuring economic predictability. In contrast, a liquidity trap occurs when interest rates are near zero, and monetary policy becomes ineffective in stimulating demand, limiting the central bank's ability to control inflation despite efforts to target it.

Understanding the Liquidity Trap Phenomenon

The liquidity trap phenomenon occurs when interest rates are near zero, rendering monetary policy ineffective in stimulating economic growth despite increased money supply. Inflation targeting aims to anchor inflation expectations and maintain price stability, but in a liquidity trap, traditional central bank measures fail to boost demand or inflation rates. Understanding this dynamic highlights the limitations of inflation targeting during periods of economic stagnation and emphasizes the need for alternative fiscal or unconventional policy tools.

Historical Context: Evolution of Monetary Policy Tools

Inflation targeting emerged in the 1990s as central banks sought clear, transparent frameworks to anchor expectations and stabilize prices following periods of volatile inflation in the 1970s and 1980s. The liquidity trap concept gained prominence during the Great Depression and was revitalized after the 2008 financial crisis, highlighting the limitations of conventional monetary policy when nominal interest rates approach zero. This historical evolution reflects a shift from quantity-based tools to inflation expectations management, revealing challenges in stimulating demand when traditional interest rate adjustments become ineffective.

Mechanisms of Inflation Targeting: How It Works

Inflation targeting operates by setting explicit inflation rate goals, typically around 2%, guiding monetary policy decisions to stabilize prices and anchor inflation expectations. Central banks use interest rate adjustments and open market operations to influence demand, ensuring inflation remains within the target range. This mechanism contrasts with a liquidity trap, where conventional monetary tools lose effectiveness as interest rates approach zero and monetary policy fails to stimulate economic activity.

Identifying the Causes and Consequences of Liquidity Traps

Liquidity traps occur when nominal interest rates approach zero, rendering conventional monetary policy ineffective in stimulating demand despite inflation targeting efforts. The primary causes include severe economic downturns, deflationary expectations, and a lack of borrower confidence, which lead to increased liquidity preference and hoarding of cash. Consequences of liquidity traps involve prolonged recessions, stagnant inflation rates below target levels, and challenges in achieving economic recovery through standard interest rate adjustments.

Comparative Analysis: Effectiveness in Economic Stabilization

Inflation targeting effectively stabilizes economies by anchoring inflation expectations and guiding monetary policy, especially when interest rates are above the zero lower bound. In contrast, during a liquidity trap when interest rates approach zero, traditional inflation targeting loses potency as monetary policy cannot lower rates further, limiting economic stimulus. Central banks may then rely on unconventional measures such as quantitative easing to counteract liquidity traps, highlighting the comparative limitation of inflation targeting under these conditions.

Case Studies: Real-World Applications and Outcomes

Japan's prolonged liquidity trap during the 1990s and 2000s challenged traditional inflation targeting, as deflation persisted despite near-zero interest rates and aggressive monetary easing. The U.S. Federal Reserve's response to the 2008 financial crisis combined inflation targeting with unconventional tools like quantitative easing, stabilizing inflation expectations and avoiding a liquidity trap. European Central Bank policies during the Eurozone crisis highlighted mixed outcomes, where strict inflation targeting initially constrained monetary stimulus, prolonging economic stagnation before adopting more flexible approaches.

Policy Challenges and Limitations in Practice

Inflation targeting faces significant policy challenges during a liquidity trap as nominal interest rates approach the zero lower bound, limiting central banks' ability to stimulate demand through conventional rate cuts. The liquidity trap constrains monetary policy effectiveness, rendering inflation targets difficult to achieve amid stagnant economic activity and low consumer confidence. Fiscal policy coordination becomes essential, but practical limitations include timing delays, political constraints, and uncertainty in stimulus impact.

Future Perspectives: Adapting Monetary Policy in Uncertain Times

Future perspectives on inflation targeting emphasize flexible frameworks that incorporate real-time data and forward guidance to navigate uncertain economic conditions. In contrast, addressing liquidity traps requires innovative monetary tools such as negative interest rates and quantitative easing to stimulate demand when traditional policies become ineffective. Central banks must adapt strategies dynamically, balancing inflation control with measures that prevent prolonged stagnation in low-interest environments.

Inflation targeting Infographic

libterm.com

libterm.com