The Aggregate Demand-Aggregate Supply (AD-AS) model illustrates the relationship between total demand and total supply within an economy, helping to explain fluctuations in output and price levels. It highlights how shifts in aggregate demand or aggregate supply can lead to inflation, unemployment, or economic growth. Discover how understanding this model can be crucial for analyzing economic policies and your financial decisions by reading the full article.

Table of Comparison

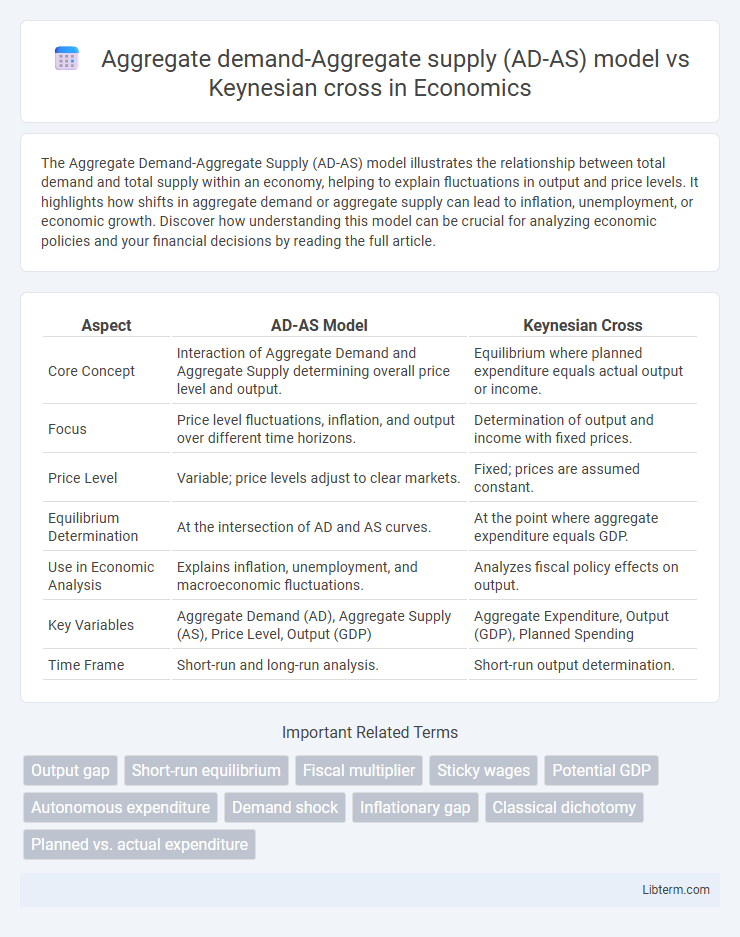

| Aspect | AD-AS Model | Keynesian Cross |

|---|---|---|

| Core Concept | Interaction of Aggregate Demand and Aggregate Supply determining overall price level and output. | Equilibrium where planned expenditure equals actual output or income. |

| Focus | Price level fluctuations, inflation, and output over different time horizons. | Determination of output and income with fixed prices. |

| Price Level | Variable; price levels adjust to clear markets. | Fixed; prices are assumed constant. |

| Equilibrium Determination | At the intersection of AD and AS curves. | At the point where aggregate expenditure equals GDP. |

| Use in Economic Analysis | Explains inflation, unemployment, and macroeconomic fluctuations. | Analyzes fiscal policy effects on output. |

| Key Variables | Aggregate Demand (AD), Aggregate Supply (AS), Price Level, Output (GDP) | Aggregate Expenditure, Output (GDP), Planned Spending |

| Time Frame | Short-run and long-run analysis. | Short-run output determination. |

Introduction to Aggregate Demand-Aggregate Supply (AD-AS) and Keynesian Cross

The Aggregate Demand-Aggregate Supply (AD-AS) model illustrates the interaction between total demand and total supply in an economy, highlighting equilibrium output and price levels under varying economic conditions. The Keynesian Cross framework emphasizes the relationship between aggregate expenditure and national income, focusing on equilibrium where planned spending equals actual output. While AD-AS captures price level adjustments and supply-side factors, the Keynesian Cross primarily addresses demand-driven income determination without explicitly modeling price changes.

Overview of the AD-AS Model

The Aggregate Demand-Aggregate Supply (AD-AS) model illustrates the relationship between total spending (aggregate demand) and total production (aggregate supply) at different price levels, highlighting equilibrium output and price in the economy. It contrasts with the Keynesian cross by incorporating price level changes, thus capturing inflationary and deflationary pressures absent in the fixed-price Keynesian cross framework. The AD-AS model visually explains short-run and long-run economic fluctuations through shifts in aggregate supply and demand curves, providing a comprehensive macroeconomic equilibrium analysis.

Fundamentals of the Keynesian Cross Model

The Keynesian Cross Model illustrates equilibrium output where planned aggregate expenditure equals total output, emphasizing the role of fiscal policy in influencing demand through government spending and taxation. Unlike the AD-AS model, which incorporates price level changes and long-run aggregate supply, the Keynesian Cross assumes fixed prices and focuses solely on short-run output determination. This model highlights the multiplier effect, showing how initial changes in autonomous spending lead to larger changes in national income, underscoring the importance of aggregate demand management.

Core Assumptions: AD-AS vs. Keynesian Cross

The Aggregate Demand-Aggregate Supply (AD-AS) model assumes prices and wages can be flexible, allowing output and employment to adjust to equilibrium through shifts in aggregate demand and supply curves. In contrast, the Keynesian cross model assumes fixed prices and emphasizes that output is determined by planned expenditure, highlighting demand-driven fluctuations without price level changes. While the AD-AS framework accounts for both price level and real output adjustments, the Keynesian cross focuses primarily on expenditure-output relationships in the short run under rigid price assumptions.

Graphical Representation and Interpretation

The Aggregate Demand-Aggregate Supply (AD-AS) model features intersecting curves representing total demand and total supply in an economy, illustrating equilibrium output and price levels, while the Keynesian cross graph plots planned expenditure against income, highlighting equilibrium income where aggregate expenditure equals output. The AD-AS model captures price level changes and output fluctuations, providing insights into inflation and unemployment dynamics, whereas the Keynesian cross focuses on output determination without explicit price level consideration. Interpreting the AD-AS model involves analyzing shifts in demand or supply curves affecting prices and real GDP, while the Keynesian cross emphasizes fiscal policy impacts on aggregate expenditure and equilibrium income.

Short-Run and Long-Run Dynamics in AD-AS

The Aggregate Demand-Aggregate Supply (AD-AS) model illustrates short-run fluctuations through shifts in aggregate demand and aggregate supply curves, capturing price level changes and output variations. In contrast, the Keynesian cross emphasizes short-run output determination by aggregate expenditure without addressing price level adjustments. Long-run dynamics in the AD-AS model occur as aggregate supply becomes vertical at potential GDP, reflecting classical full-employment output, which the Keynesian cross does not explicitly represent.

Equilibrium Determination: Comparative Analysis

The AD-AS model determines equilibrium where aggregate demand intersects aggregate supply, reflecting price level adjustments and output in the economy. The Keynesian cross, however, identifies equilibrium through planned expenditure equaling actual output, emphasizing income-expenditure relationships without price level changes. Comparing both, the AD-AS model integrates price flexibility and inflation, while the Keynesian cross highlights demand-driven output determination under fixed prices.

Policy Implications: Fiscal and Monetary Responses

The Aggregate Demand-Aggregate Supply (AD-AS) model emphasizes the interaction between overall demand and supply to determine output and price levels, guiding fiscal policies to shift aggregate demand through government spending and taxation, and monetary policies affecting interest rates and money supply. The Keynesian cross focuses on equilibrium output based on planned expenditures, highlighting fiscal policy as the primary tool to close output gaps by boosting aggregate demand when private sector spending is insufficient. Both models inform policy responses, with AD-AS offering a broader framework including price adjustments, while Keynesian cross stresses direct fiscal intervention to address demand shortfalls.

Strengths and Limitations of Each Model

The Aggregate Demand-Aggregate Supply (AD-AS) model excels at illustrating macroeconomic equilibrium, price level adjustments, and the interaction of aggregate demand and aggregate supply in response to economic shocks, but its assumptions of flexible prices and wages can limit real-world applicability during rigid periods. The Keynesian cross model provides a clear framework for understanding output determination through planned expenditure and highlights the impact of fiscal policy in driving demand; however, it assumes fixed prices and does not incorporate supply-side constraints, restricting analysis to short-run demand fluctuations. While the AD-AS model integrates both demand and supply factors for a broader macroeconomic perspective, the Keynesian cross offers a simpler, demand-focused approach ideal for analyzing short-term fiscal interventions.

Real-World Applications and Case Studies

The Aggregate Demand-Aggregate Supply (AD-AS) model offers a comprehensive framework to analyze macroeconomic fluctuations, allowing policymakers to assess the effects of fiscal and monetary interventions on output and price levels, as evidenced by its use during the 2008 global financial crisis to evaluate stimulus measures. The Keynesian Cross model, emphasizing the equilibrium where aggregate expenditure equals total output, provides a foundational tool for understanding short-term output changes in response to shifts in autonomous spending, demonstrated in case studies exploring government spending multipliers in recession recovery phases. Both frameworks guide economic policy decisions by illustrating demand-driven output adjustments, with the AD-AS model incorporating price changes, enhancing its relevance for inflation-targeting policies across various economies.

Aggregate demand-Aggregate supply (AD-AS) model Infographic

libterm.com

libterm.com