Idiosyncratic risk refers to the uncertainty that affects a specific company or industry rather than the entire market. This type of risk can be mitigated through diversification within Your investment portfolio. Explore the rest of the article to understand how managing idiosyncratic risk can improve Your financial strategies.

Table of Comparison

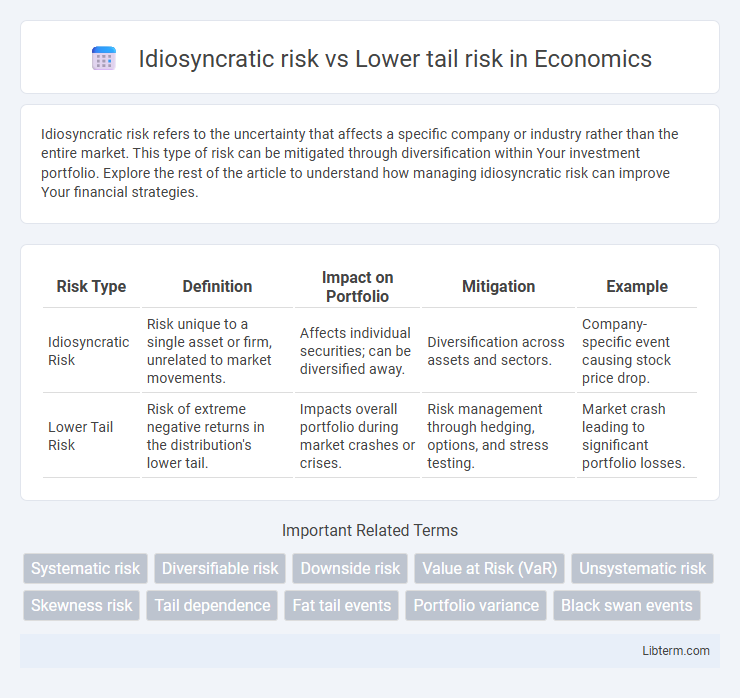

| Risk Type | Definition | Impact on Portfolio | Mitigation | Example |

|---|---|---|---|---|

| Idiosyncratic Risk | Risk unique to a single asset or firm, unrelated to market movements. | Affects individual securities; can be diversified away. | Diversification across assets and sectors. | Company-specific event causing stock price drop. |

| Lower Tail Risk | Risk of extreme negative returns in the distribution's lower tail. | Impacts overall portfolio during market crashes or crises. | Risk management through hedging, options, and stress testing. | Market crash leading to significant portfolio losses. |

Understanding Idiosyncratic Risk

Idiosyncratic risk refers to the uncertainty inherent to a specific asset or company, driven by factors such as management decisions, product recalls, or regulatory changes, which do not affect the broader market. This type of risk can be mitigated through diversification because it is uncorrelated with market-wide movements. Understanding idiosyncratic risk is critical for portfolio management, as it highlights vulnerabilities that are unique to individual investments, unlike lower tail risk which focuses on extreme negative outcomes in the overall distribution of returns.

Defining Lower Tail Risk

Lower tail risk refers to the probability and impact of extreme negative returns occurring in the lower end of a return distribution, representing significant financial losses during adverse market conditions. It captures the likelihood of rare but severe outcomes that disproportionately affect portfolio value compared to average fluctuations. Unlike idiosyncratic risk, which is specific to individual assets, lower tail risk emphasizes systemic or structural events leading to profound downturns across multiple investments.

Key Differences Between Idiosyncratic and Lower Tail Risk

Idiosyncratic risk refers to the risk inherent to a specific asset or company, which can be mitigated through diversification, while lower tail risk involves extreme negative outcomes in the far left tail of a return distribution, affecting overall portfolio performance. Idiosyncratic risk is often isolated and company-specific, whereas lower tail risk captures systemic events and market crashes that cause significant portfolio-wide losses. The key difference lies in idiosyncratic risk being diversifiable and affecting individual securities, versus lower tail risk representing rare but severe losses impacting the entire market or multiple assets simultaneously.

Sources of Idiosyncratic Risk

Idiosyncratic risk arises from company-specific factors such as management decisions, product recalls, or industry disruptions, which do not affect the overall market. It differs from lower tail risk, which involves extreme negative outcomes in a portfolio or market, often driven by systemic events like financial crises or macroeconomic shocks. Understanding sources of idiosyncratic risk enables investors to diversify and mitigate potential losses unique to individual assets.

Trigger Events Leading to Lower Tail Risk

Trigger events leading to lower tail risk often include severe market downturns, economic recessions, and systemic financial crises, which cause widespread asset price declines beyond typical volatility. Unlike idiosyncratic risk, which stems from firm-specific factors such as management failures or product recalls, lower tail risk is driven by macroeconomic shocks and correlated negative events affecting multiple assets simultaneously. Understanding these trigger events aids in portfolio stress testing and implementing hedging strategies to mitigate catastrophic losses in extreme market conditions.

Measurement Techniques for Both Risks

Idiosyncratic risk measurement techniques primarily involve assessing the variability of individual asset returns relative to the overall market, often using metrics like the asset-specific variance or residual variance from factor models such as the CAPM or Fama-French models. Lower tail risk is measured through downside risk metrics including Value at Risk (VaR), Conditional Value at Risk (CVaR), and lower partial moments, which focus on losses occurring in the lower tail of the return distribution. Advanced approaches for both risks incorporate stress testing and scenario analysis to capture extreme events and non-linear effects in financial portfolios.

Impact on Portfolio Performance

Idiosyncratic risk, representing asset-specific uncertainties, can be mitigated through diversification, thus reducing its negative impact on overall portfolio performance. Lower tail risk focuses on extreme negative outcomes in the portfolio's return distribution, highlighting potential large losses that diversification may not sufficiently cushion. Managing lower tail risk often requires techniques beyond traditional diversification, such as downside risk measures and hedging strategies, to protect portfolio value during market downturns.

Risk Mitigation Strategies

Idiosyncratic risk, specific to a company or asset, can be mitigated through diversification across various industries and asset classes, reducing exposure to individual failures. Lower tail risk, reflecting extreme negative market events, requires strategies such as purchasing options, employing stop-loss orders, or allocating assets to safer investments like government bonds to protect against significant downside. Combining diversification with hedging techniques ensures a comprehensive risk management approach addressing both unique and systemic threats.

Role in Asset Allocation and Diversification

Idiosyncratic risk represents asset-specific uncertainty that can be mitigated through diversification, playing a crucial role in multi-asset portfolios by reducing unsystematic fluctuations. Lower tail risk, reflecting extreme negative returns in the distribution's lower tail, influences asset allocation by emphasizing downside protection strategies and risk-aversion measures. Effective portfolio construction balances reducing idiosyncratic risk via diversification while managing lower tail risk through allocation to assets with favorable downside profiles, enhancing resilience to market shocks.

Practical Examples: Case Studies on Both Risk Types

Idiosyncratic risk is exemplified by a tech startup facing sudden CEO departure, causing stock volatility independent of market trends, while lower tail risk is illustrated by the 2008 financial crisis where widespread market collapse led to severe portfolio losses. Case studies of idiosyncratic risk include Tesla's stock fluctuations due to product launch delays, contrasted with lower tail risk scenarios like the COVID-19 market crash impacting diverse asset classes simultaneously. Understanding these risks helps investors implement strategies such as diversification for idiosyncratic risk and tail risk hedging for systemic downturns.

Idiosyncratic risk Infographic

libterm.com

libterm.com