Money supply refers to the total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances in checking and savings accounts. Central banks regulate the money supply to control inflation, stabilize currency, and influence economic growth. Explore the rest of the article to understand how changes in money supply impact your financial well-being.

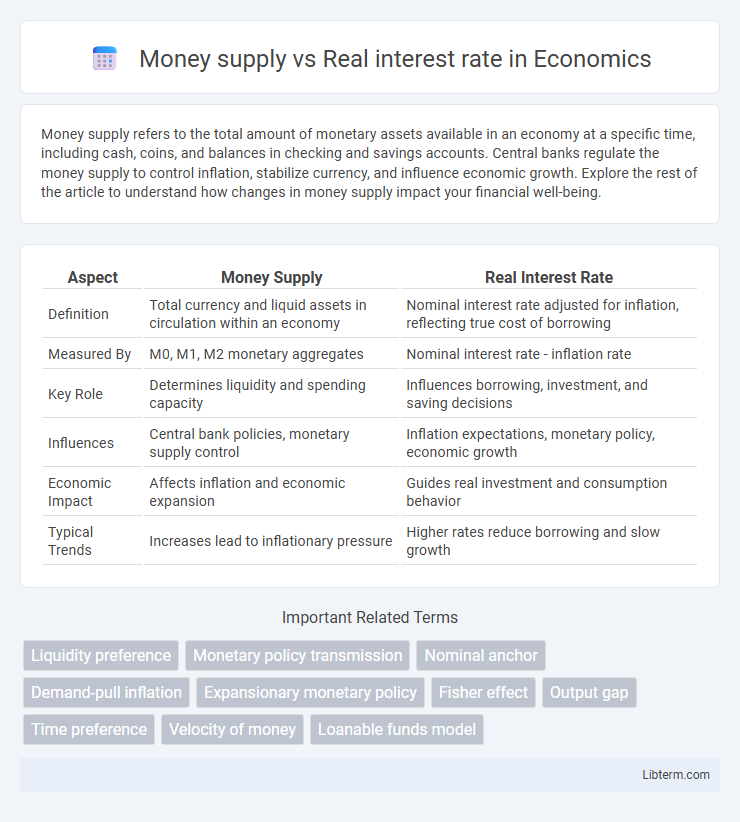

Table of Comparison

| Aspect | Money Supply | Real Interest Rate |

|---|---|---|

| Definition | Total currency and liquid assets in circulation within an economy | Nominal interest rate adjusted for inflation, reflecting true cost of borrowing |

| Measured By | M0, M1, M2 monetary aggregates | Nominal interest rate - inflation rate |

| Key Role | Determines liquidity and spending capacity | Influences borrowing, investment, and saving decisions |

| Influences | Central bank policies, monetary supply control | Inflation expectations, monetary policy, economic growth |

| Economic Impact | Affects inflation and economic expansion | Guides real investment and consumption behavior |

| Typical Trends | Increases lead to inflationary pressure | Higher rates reduce borrowing and slow growth |

Introduction to Money Supply and Real Interest Rate

Money supply refers to the total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances held in checking and savings accounts. The real interest rate is the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield to lenders. Understanding the relationship between money supply and real interest rates is crucial for analyzing monetary policy and its impact on economic growth and inflation.

Defining Money Supply: Concepts and Components

Money supply represents the total stock of liquid assets available in an economy, including currency in circulation, demand deposits, and other liquid financial instruments. Key components of money supply are categorized into M1, M2, and M3, with M1 comprising physical currency and checking deposits, M2 encompassing M1 plus savings accounts and small time deposits, and M3 including M2 alongside large time deposits and institutional money market funds. Understanding these components is essential for analyzing their influence on real interest rates, as variations in money supply affect liquidity, inflation expectations, and borrowing costs within the economy.

Understanding Real Interest Rate: Calculation and Significance

The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate, providing a crucial measure of the true cost of borrowing and the real yield on savings. In macroeconomic analysis, understanding the real interest rate helps to assess monetary policy effectiveness, as it reflects the purchasing power of interest earnings and influences investment and consumption decisions. Money supply changes directly impact nominal rates and inflation expectations, making the real interest rate a vital indicator for predicting economic growth and controlling inflation.

The Relationship Between Money Supply and Real Interest Rate

An increase in money supply typically lowers real interest rates by expanding liquidity, which reduces the cost of borrowing and stimulates investment. Central banks use monetary policy to influence this dynamic, adjusting money supply to control inflation and economic growth. Empirical data show a negative correlation between money supply growth and real interest rates, especially in the short to medium term.

How Central Banks Influence Money Supply

Central banks influence money supply primarily through open market operations, adjusting the quantity of money circulating in the economy to achieve target interest rates. By purchasing government securities, they inject liquidity, increasing the money supply and typically lowering real interest rates; conversely, selling securities withdraws money, reducing supply and raising real interest rates. Reserve requirements and discount rate policies also serve as tools to regulate banking sector liquidity, directly impacting money supply and subsequently influencing real interest rates.

Impact of Money Supply on Real Interest Rates

An increase in money supply typically lowers real interest rates by expanding liquidity and reducing the cost of borrowing, which encourages investment and spending. Central banks influence real interest rates through monetary policy adjustments that alter the money supply, affecting inflation expectations and economic activity. Empirical studies show that an excessive money supply growth often leads to lower real interest rates in the short term but may trigger inflationary pressures that eventually raise nominal rates.

Economic Implications: Inflation, Growth, and Investment

An increase in the money supply typically lowers real interest rates, stimulating investment and economic growth by making borrowing cheaper. Lower real interest rates can also drive inflation upwards as higher demand pressures prices. Conversely, tight money supply leads to higher real interest rates, restraining investment and slowing growth, which may reduce inflationary pressures.

Policy Tools Affecting Money Supply and Interest Rates

Central banks use policy tools such as open market operations, reserve requirements, and discount rates to influence the money supply and real interest rates. Open market operations, involving the buying and selling of government securities, directly affect liquidity in the banking system, thereby altering short-term interest rates. Adjustments in reserve requirements and policy rates change banks' lending abilities and cost of capital, ultimately impacting real interest rates and economic activity.

Historical Examples of Money Supply and Real Interest Rate Dynamics

Historical examples reveal that expansions in money supply often lead to lower real interest rates, as observed during the 1970s in the United States when aggressive monetary easing initially reduced borrowing costs. Conversely, the Volcker disinflation in the early 1980s saw a contraction in money supply coupled with sharply rising real interest rates, illustrating tight monetary control effects. Japan's prolonged quantitative easing since the 1990s highlights a persistent low real interest rate environment despite substantial increases in money supply, demonstrating complex interplay influenced by economic context.

Conclusion: Balancing Money Supply and Real Interest Rates for Economic Stability

Balancing money supply and real interest rates is crucial for maintaining economic stability, as excessive money supply can lead to inflation while high real interest rates may suppress investment and growth. Central banks must carefully calibrate monetary policy to ensure that neither variable undermines economic equilibrium, promoting sustainable development. Effective management of this balance supports steady inflation, stable currency value, and optimal levels of employment.

Money supply Infographic

libterm.com

libterm.com