Reserve requirement mandates that banks hold a specific fraction of deposits as reserves, ensuring liquidity and stability in the financial system. Central banks use this tool to control money supply and influence lending practices, impacting overall economic health. Discover how adjusting reserve requirements can affect your financial environment by reading the rest of this article.

Table of Comparison

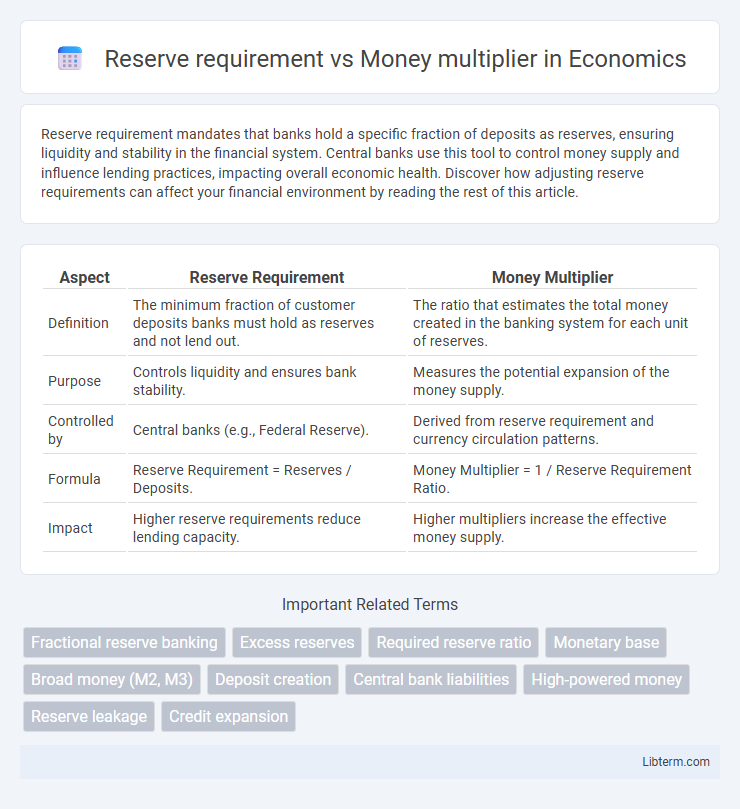

| Aspect | Reserve Requirement | Money Multiplier |

|---|---|---|

| Definition | The minimum fraction of customer deposits banks must hold as reserves and not lend out. | The ratio that estimates the total money created in the banking system for each unit of reserves. |

| Purpose | Controls liquidity and ensures bank stability. | Measures the potential expansion of the money supply. |

| Controlled by | Central banks (e.g., Federal Reserve). | Derived from reserve requirement and currency circulation patterns. |

| Formula | Reserve Requirement = Reserves / Deposits. | Money Multiplier = 1 / Reserve Requirement Ratio. |

| Impact | Higher reserve requirements reduce lending capacity. | Higher multipliers increase the effective money supply. |

Introduction to Reserve Requirement and Money Multiplier

The reserve requirement is a regulatory mandate set by central banks that determines the minimum fraction of customer deposits banks must hold as reserves, either in cash or at the central bank, to ensure liquidity and financial stability. The money multiplier represents the maximum potential increase in the money supply generated from an initial deposit, calculated as the inverse of the reserve requirement ratio. Understanding the interplay between reserve requirements and the money multiplier is essential for grasping how central banks influence credit creation and overall economic activity.

Definition of Reserve Requirement

The reserve requirement is the mandated minimum fraction of customer deposits that banks must hold as reserves, either in their vaults or at the central bank, ensuring liquidity and stability in the banking system. This regulatory ratio directly influences the money multiplier, which measures the potential maximum amount of commercial bank money creation for a given unit of reserves. A higher reserve requirement reduces the money multiplier by limiting the amount of loans banks can issue, thereby impacting the overall money supply in the economy.

Definition of Money Multiplier

The money multiplier refers to the ratio that measures the maximum amount of commercial bank money that can be created, given a certain amount of central bank reserves. It is calculated as the inverse of the reserve requirement ratio, indicating how much the money supply expands through the banking system. A lower reserve requirement leads to a higher money multiplier, thereby increasing the potential money creation in the economy.

How Reserve Requirements Influence Banking

Reserve requirements directly impact the money creation process by determining the fraction of deposits banks must hold as reserves, which limits the amount available for lending. Higher reserve requirements reduce the money multiplier effect, constraining banks' ability to expand credit and decrease the overall money supply. Conversely, lower reserve requirements increase the money multiplier, enabling banks to lend more and amplify money creation within the economy.

Mechanism of the Money Multiplier

The money multiplier mechanism operates by banks holding a fraction of deposits as reserves, known as the reserve requirement, while lending out the remainder to borrowers who redeposit the funds, creating a cycle of deposit and lending that expands the money supply. The formula for the money multiplier is the inverse of the reserve requirement ratio, illustrating how lower reserve requirements result in a higher potential expansion of bank-created money. This process demonstrates the crucial link between regulatory reserve policies and the overall money supply growth in the economy.

Relationship Between Reserve Requirement and Money Multiplier

The reserve requirement directly influences the money multiplier by determining the portion of deposits banks must hold as reserves, limiting the funds available for lending. A higher reserve requirement results in a lower money multiplier since banks can lend less, reducing the expansion of the money supply. Conversely, a lower reserve requirement increases the money multiplier, enabling banks to create more money through loans and amplifying the effect of initial deposits on the total money supply.

Impact on Money Supply and Economic Growth

The reserve requirement directly limits the amount of funds banks can lend, thereby influencing the money multiplier and the overall money supply in the economy. A lower reserve requirement increases the money multiplier, boosting money creation and stimulating economic growth through enhanced lending and investment. Conversely, a higher reserve requirement reduces the money supply, potentially slowing economic expansion by restricting credit availability.

Central Bank Policies and Regulatory Tools

Reserve requirements set by central banks determine the minimum fraction of deposits that commercial banks must hold as reserves, directly influencing the money multiplier effect in the banking system. A higher reserve requirement reduces the money multiplier, limiting banks' capacity to create loans and thus controlling money supply growth. Central bank policies leverage these regulatory tools to manage liquidity, stabilize inflation, and maintain financial system stability.

Real-World Examples and Case Studies

Reserve requirement regulations directly influence the money multiplier effect by determining the fraction of deposits banks must hold as reserves. In the United States, a reserve requirement ratio of 3% allows banks to lend out the remaining 97%, resulting in a theoretical money multiplier of approximately 33.3. Case studies from the 2008 financial crisis reveal how temporary reductions in reserve requirements aimed to increase liquidity but had limited impact due to weakened bank lending confidence.

Conclusion: Implications for Monetary Policy

The reserve requirement directly influences the money multiplier by determining the fraction of deposits banks must hold rather than lend out, thereby controlling the potential expansion of the money supply. A higher reserve requirement reduces the money multiplier and constrains credit creation, which central banks use to manage inflation and stabilize the economy. Effective monetary policy relies on adjusting reserve requirements to modulate liquidity, impacting interest rates and overall economic growth.

Reserve requirement Infographic

libterm.com

libterm.com