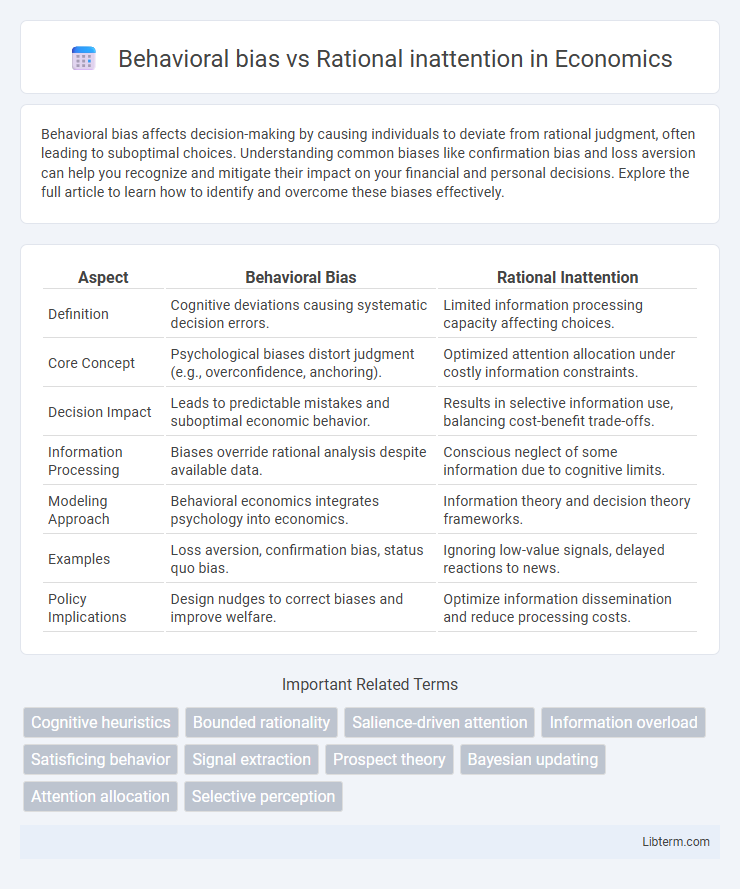

Behavioral bias affects decision-making by causing individuals to deviate from rational judgment, often leading to suboptimal choices. Understanding common biases like confirmation bias and loss aversion can help you recognize and mitigate their impact on your financial and personal decisions. Explore the full article to learn how to identify and overcome these biases effectively.

Table of Comparison

| Aspect | Behavioral Bias | Rational Inattention |

|---|---|---|

| Definition | Cognitive deviations causing systematic decision errors. | Limited information processing capacity affecting choices. |

| Core Concept | Psychological biases distort judgment (e.g., overconfidence, anchoring). | Optimized attention allocation under costly information constraints. |

| Decision Impact | Leads to predictable mistakes and suboptimal economic behavior. | Results in selective information use, balancing cost-benefit trade-offs. |

| Information Processing | Biases override rational analysis despite available data. | Conscious neglect of some information due to cognitive limits. |

| Modeling Approach | Behavioral economics integrates psychology into economics. | Information theory and decision theory frameworks. |

| Examples | Loss aversion, confirmation bias, status quo bias. | Ignoring low-value signals, delayed reactions to news. |

| Policy Implications | Design nudges to correct biases and improve welfare. | Optimize information dissemination and reduce processing costs. |

Understanding Behavioral Bias: Key Concepts

Behavioral bias refers to systematic deviations from rational decision-making caused by cognitive limitations, emotions, and heuristics, leading individuals to make suboptimal choices. Rational inattention describes the deliberate choice to ignore or delay information acquisition due to limited cognitive resources and the cost of processing information. Understanding behavioral bias involves recognizing patterns such as overconfidence, anchoring, and loss aversion, which contrast with the purposeful information neglect seen in rational inattention models.

Defining Rational Inattention in Decision-Making

Rational inattention in decision-making refers to the cognitive constraint where individuals allocate limited attention to process information, leading to suboptimal choices despite rational intentions. Unlike behavioral bias, which stems from systematic deviations due to emotions or heuristics, rational inattention arises from deliberate information avoidance to reduce information-processing costs. This concept explains decision inefficiencies when cognitive resources are insufficient to evaluate all available data thoroughly.

Origins and Causes of Behavioral Bias

Behavioral bias originates from cognitive limitations, emotions, and social influences that distort decision-making processes, leading individuals to deviate from purely rational behavior. These biases stem from heuristics, mental shortcuts, and psychological factors that affect perception and judgment under uncertainty. In contrast, rational inattention arises when individuals optimally allocate limited cognitive resources, deliberately ignoring some information due to processing costs rather than cognitive errors.

Theoretical Foundations of Rational Inattention

Rational inattention theory builds on the premise that individuals optimally allocate limited attention to process information under cognitive constraints, contrasting with behavioral biases that often stem from systematic cognitive errors or heuristics. Grounded in information theory and economics, rational inattention models use Shannon's channel capacity to formalize how agents maximize expected utility by balancing the cost of acquiring information with its decision-making benefits. This theoretical framework explains deviations from perfect rationality without resorting to psychological biases, highlighting a deliberate, cost-benefit approach to information processing under uncertainty.

Behavioral Bias in Financial Markets

Behavioral bias in financial markets often leads investors to make irrational decisions driven by emotions and cognitive errors such as overconfidence, loss aversion, and herd behavior, resulting in market inefficiencies and mispricing of assets. These biases cause deviations from rational market models by influencing trading volume, volatility, and asset bubbles, which can persist despite available information. Unlike rational inattention, where market participants optimally ignore some information due to cognitive costs, behavioral biases systematically distort decision-making processes, affecting market dynamics and investor outcomes.

Information Processing and Rational Inattention

Behavioral bias arises from systematic deviations in information processing, where individuals rely on heuristics or exhibit cognitive limitations, leading to suboptimal decisions. Rational inattention theory explains decision-making under constraints by positing that individuals optimally allocate limited attention resources, selectively focusing on relevant information while ignoring less critical details. This selective information processing reduces cognitive overload but may result in delayed or biased responses depending on the precision and cost of acquiring information.

Comparing Decision Outcomes: Bias vs Rational Inattention

Behavioral bias often leads to systematic deviations from optimal decision-making, such as overconfidence or loss aversion, resulting in predictable errors and suboptimal outcomes. Rational inattention, by contrast, reflects a deliberate choice to allocate limited cognitive resources, where decision-makers optimize information processing costs against expected benefits, often yielding more adaptive but information-constrained outcomes. Comparing these outcomes reveals that while biases skew decisions away from utility maximization, rational inattention pragmatically balances information acquisition and decision efficiency, influencing market behavior and individual financial choices.

Cognitive Limitations and Economic Choices

Behavioral bias arises from cognitive limitations that lead individuals to deviate from optimal economic choices, such as overconfidence or loss aversion affecting decision-making under uncertainty. Rational inattention theory models how limited cognitive processing capacity causes agents to optimally ignore some information, balancing the costs of acquiring data and the benefits of better decisions. Both concepts highlight how information-processing constraints and cognitive biases influence economic behavior, challenging traditional assumptions of fully rational agents in markets.

Implications for Policy and Market Design

Behavioral bias, such as overconfidence or loss aversion, leads to systematic deviations from optimal decision-making, complicating policy interventions by requiring tailored nudges or corrective regulations that account for cognitive limitations. Rational inattention models assume individuals optimally allocate limited attention, suggesting policies should focus on improving information salience and reducing complexity to enhance decision accuracy without overburdening cognitive resources. Market design benefits from integrating these insights by creating environments that minimize information overload while addressing behavioral pitfalls, improving efficiency and participant welfare through mechanisms like simplified disclosures and automated decision aids.

Integrating Behavioral Bias and Rational Inattention Models

Integrating behavioral bias and rational inattention models enhances the understanding of decision-making by combining cognitive limitations with systematic deviations from rationality. Behavioral bias captures heuristics and emotional influences that lead to suboptimal choices, while rational inattention accounts for the cost of acquiring and processing information under cognitive constraints. This integration allows for more accurate predictions of economic behavior in environments where agents face information processing costs and exhibit bounded rationality.

Behavioral bias Infographic

libterm.com

libterm.com