Monopoly is a classic board game that challenges players to strategically buy, trade, and develop properties to dominate the market and bankrupt opponents. Mastering the game requires understanding its rules, tactics for property acquisition, and effective money management to outsmart competitors. Explore the full article to learn expert tips and strategies that will elevate your Monopoly gameplay.

Table of Comparison

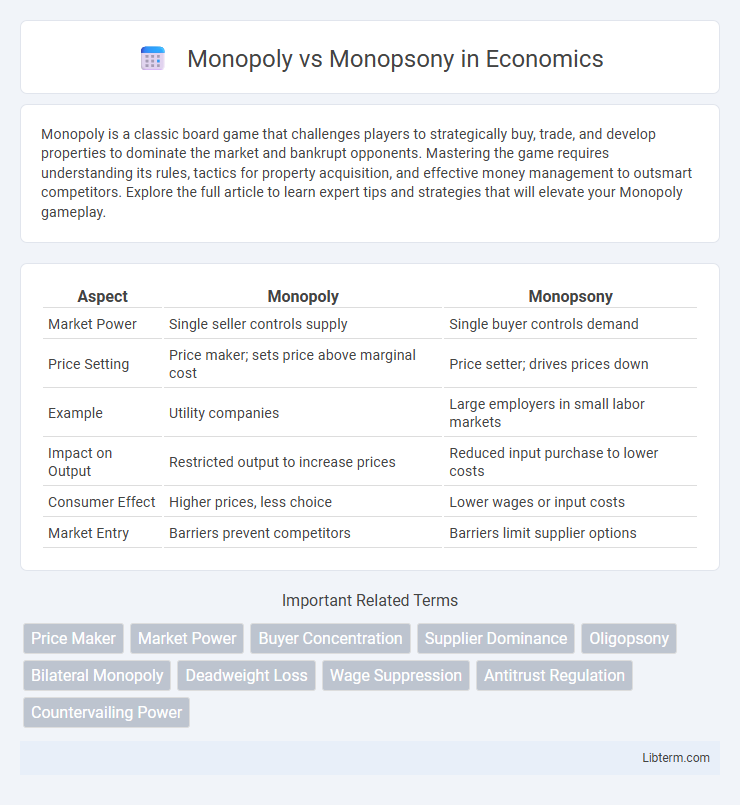

| Aspect | Monopoly | Monopsony |

|---|---|---|

| Market Power | Single seller controls supply | Single buyer controls demand |

| Price Setting | Price maker; sets price above marginal cost | Price setter; drives prices down |

| Example | Utility companies | Large employers in small labor markets |

| Impact on Output | Restricted output to increase prices | Reduced input purchase to lower costs |

| Consumer Effect | Higher prices, less choice | Lower wages or input costs |

| Market Entry | Barriers prevent competitors | Barriers limit supplier options |

Understanding Monopoly and Monopsony: Key Definitions

Monopoly refers to a market structure where a single seller dominates the supply of a product or service, controlling prices and limiting competition. Monopsony occurs when a single buyer controls the market, influencing wages or prices paid to suppliers. Both concepts highlight imbalances in market power, affecting economic efficiency and market outcomes.

Core Differences Between Monopoly and Monopsony

A monopoly occurs when a single seller dominates the market, controlling the supply of a product or service, while a monopsony features a single buyer controlling demand. In a monopoly, the seller sets prices to maximize profits, often leading to higher prices and reduced consumer choice. Conversely, a monopsony buyer wields power to drive prices down, potentially lowering input costs but also reducing supplier competition.

Market Dynamics: How Monopoly and Monopsony Influence Prices

A monopoly controls the supply of a product or service, enabling it to set higher prices due to lack of competition, which often leads to reduced consumer surplus and market inefficiencies. In contrast, a monopsony dominates the buying side of the market, exerting downward pressure on prices paid to suppliers by limiting demand options, which can lower input costs but may reduce supplier incentives and market variety. Both market structures disrupt competitive pricing mechanisms, resulting in price distortions that affect overall market welfare and resource allocation.

Monopoly Power: Impact on Consumers and Competitors

Monopoly power enables a single firm to dominate a market, restricting output and raising prices, which diminishes consumer welfare through higher costs and limited choices. This market control stifles competition, deterring new entrants and innovation due to barriers like economies of scale and control over essential resources. The result is reduced market efficiency and potential welfare losses as monopolists prioritize profit maximization over consumer interests.

Monopsony Power: Effects on Suppliers and Employees

Monopsony power occurs when a single buyer dominates a market, enabling control over suppliers and wages offered to employees. This market imbalance often forces suppliers to accept lower prices and workers to face reduced wages or limited job opportunities, diminishing overall market efficiency. The concentrated buying power can lead to decreased innovation and quality as suppliers have less incentive to improve goods or services under constrained demand conditions.

Real-World Examples of Monopoly vs Monopsony

Monopoly examples include tech giants like Microsoft in the 1990s software market and utility companies such as Pacific Gas and Electric, which control regional power supply. Monopsony cases appear in labor markets where companies like Amazon or Walmart dominate as primary employers, exerting significant influence over wage levels. These real-world scenarios highlight monopolies' pricing power over consumers and monopsonies' wage-setting power over suppliers or workers.

Regulatory Challenges: Addressing Market Imbalances

Monopoly and monopsony present distinct regulatory challenges due to their respective market imbalances: monopolies concentrate market power on the supply side, enabling price control and potential consumer harm, while monopsonies dominate demand, suppressing input prices and disadvantaging suppliers or labor. Effective regulation requires tailored antitrust laws and monitoring mechanisms to prevent abuse, promote competition, and ensure fair pricing in monopolized markets or monopsonistic labor pools. Regulatory agencies must balance intervention to correct market failures without stifling innovation or efficiency inherent in large-scale operations.

Economic Consequences of Market Power

Monopoly leads to higher prices and reduced output as a single seller controls the supply, resulting in allocative inefficiency and deadweight loss in the market. Monopsony, where a single buyer dominates demand, suppresses prices paid to suppliers and can lead to lower wages or reduced production incentives. Both market structures distort competitive equilibrium, reducing overall social welfare through market power exploitation.

Policy Solutions for Monopoly and Monopsony Issues

Policy solutions for monopoly issues include enforcing antitrust laws to break up or regulate dominant firms, promoting market competition through deregulation and encouraging new entrants, and implementing price controls to prevent abuse of market power. For monopsony problems, policy measures focus on empowering suppliers or workers by strengthening collective bargaining rights, imposing wage floors or procurement regulations to prevent exploitative pricing, and increasing market transparency to reduce information asymmetry. Both approaches aim to restore competitive balance, improve market efficiency, and protect consumer and producer welfare.

The Future of Market Power: Trends and Predictions

Monopoly and monopsony both represent significant concentrations of market power, with monopolies dominating supply and monopsonies controlling demand. Emerging trends indicate that technological advancements, such as AI-driven analytics, could intensify these market structures by enabling firms to optimize pricing and supplier negotiations. Predictive models suggest increased regulatory scrutiny and market interventions aimed at preserving competitive dynamics and preventing abuse of power in digital and traditional markets.

Monopoly Infographic

libterm.com

libterm.com