A currency board is a monetary authority that issues domestic currency fully backed by foreign reserves, maintaining a fixed exchange rate with an anchor currency. This system ensures monetary stability by limiting discretionary monetary policy and controlling inflation effectively. Discover how a currency board can impact Your economy by reading the rest of the article.

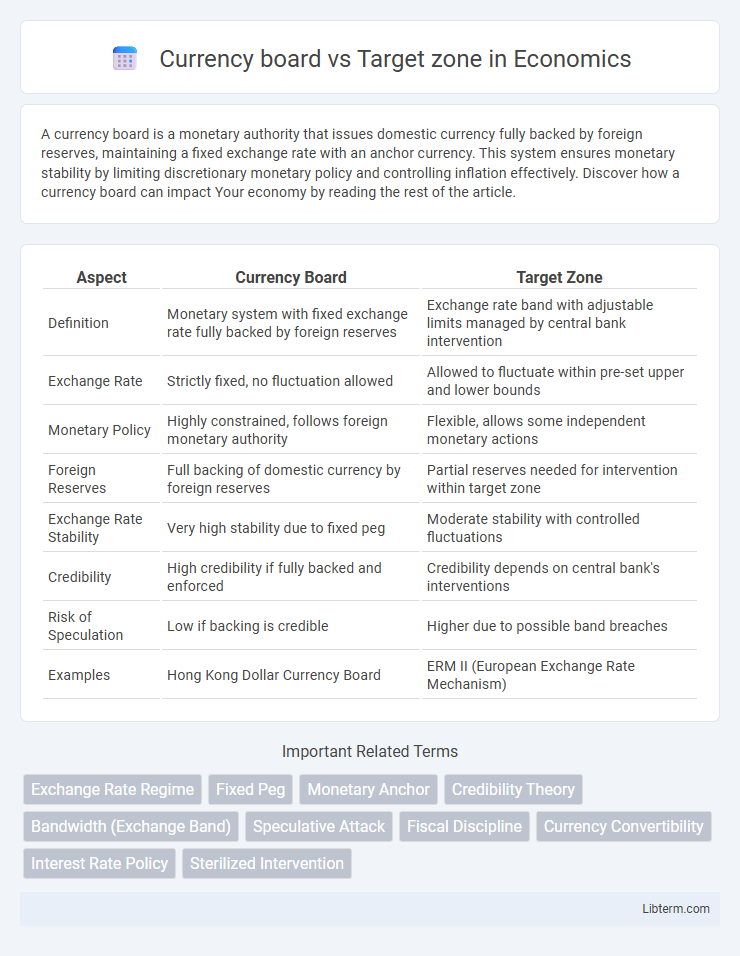

Table of Comparison

| Aspect | Currency Board | Target Zone |

|---|---|---|

| Definition | Monetary system with fixed exchange rate fully backed by foreign reserves | Exchange rate band with adjustable limits managed by central bank intervention |

| Exchange Rate | Strictly fixed, no fluctuation allowed | Allowed to fluctuate within pre-set upper and lower bounds |

| Monetary Policy | Highly constrained, follows foreign monetary authority | Flexible, allows some independent monetary actions |

| Foreign Reserves | Full backing of domestic currency by foreign reserves | Partial reserves needed for intervention within target zone |

| Exchange Rate Stability | Very high stability due to fixed peg | Moderate stability with controlled fluctuations |

| Credibility | High credibility if fully backed and enforced | Credibility depends on central bank's interventions |

| Risk of Speculation | Low if backing is credible | Higher due to possible band breaches |

| Examples | Hong Kong Dollar Currency Board | ERM II (European Exchange Rate Mechanism) |

Introduction to Currency Board and Target Zone

A Currency Board is a monetary authority that pegs the domestic currency to a foreign anchor currency at a fixed exchange rate, maintaining full convertibility and backing its currency issuance with foreign reserves. A Target Zone is an exchange rate regime where a currency is allowed to fluctuate within a predefined band around a central parity, combining elements of fixed and floating exchange rate systems. Currency Boards emphasize strict rules and self-discipline, while Target Zones allow limited flexibility to absorb short-term shocks.

Key Features of Currency Board Systems

Currency board systems maintain a fixed exchange rate by fully backing the domestic currency with foreign reserves, ensuring automatic convertibility and monetary discipline. They operate without discretionary monetary policy, relying on the strict adherence to the currency peg to control inflation and stabilize the economy. Currency boards provide high credibility and reduce currency risk, contrasting with target zones that allow for limited exchange rate fluctuations within a predefined band.

Main Characteristics of Target Zone Regimes

Target zone regimes establish a fixed exchange rate band within which a currency is allowed to fluctuate, providing more flexibility than currency boards while maintaining exchange rate stability. These regimes often involve central bank interventions to keep the currency within predefined upper and lower limits, supporting gradual adjustments and smoothing market volatility. Target zones balance exchange rate commitments with monetary policy autonomy, allowing economies to respond to external shocks without abandoning exchange rate anchors.

Historical Context and Development

Currency boards emerged in the 19th century as a strict monetary arrangement to maintain fixed exchange rates by issuing domestic currency fully backed by foreign reserves, providing stability during colonial and post-colonial economic transitions. Target zones were introduced in the late 20th century, particularly during the European Monetary System in the 1970s and 1980s, aiming to reduce exchange rate volatility while allowing limited flexibility within predefined bounds. The development of currency boards was driven by the need for monetary discipline in developing economies, whereas target zones were designed to facilitate economic convergence among developed countries preparing for monetary union.

Exchange Rate Stability Comparison

Currency boards enforce strict exchange rate stability by pegging the domestic currency to a foreign anchor with full backing of foreign reserves, ensuring minimal exchange rate fluctuations. Target zones allow for limited exchange rate variability within defined bands, providing moderate flexibility to absorb external shocks while maintaining stability. Currency boards offer stronger exchange rate predictability compared to target zones, which balance stability with adaptive monetary policy interventions.

Monetary Policy Flexibility

A currency board imposes strict monetary policy constraints by fixing the domestic currency to a foreign anchor at a fixed rate, limiting central bank intervention and reducing monetary policy flexibility. In contrast, a target zone allows for some exchange rate fluctuation within predetermined bands, offering moderate flexibility in adjusting monetary policy to address economic shocks. The target zone's semi-fixed exchange rate system balances exchange rate stability with discretionary monetary policy measures.

Risk of Speculative Attacks

Currency boards significantly reduce the risk of speculative attacks by maintaining a fixed exchange rate backed by full foreign reserves, ensuring high credibility and limiting discretionary monetary policy. Target zones rely on adjustable exchange rate bands that can be defended through central bank interventions and interest rate adjustments, but they remain vulnerable to speculative pressures if market participants doubt the sustainability of the intervention. Empirical evidence from the European Exchange Rate Mechanism (ERM) crisis highlights that target zones may collapse under intense speculative attacks, whereas currency boards tend to maintain stability due to their rigid commitment.

Economic Performance and Outcomes

Currency boards provide strict monetary discipline by pegging local currency to a hard currency, ensuring price stability and low inflation but limiting monetary policy flexibility during economic shocks. Target zones allow exchange rates to fluctuate within predefined bands, offering some monetary autonomy to respond to economic changes while maintaining investor confidence and reducing exchange rate volatility. Studies show currency boards tend to achieve lower inflation rates and greater fiscal discipline, whereas target zones can better accommodate growth fluctuations but may face risks of speculative attacks if bands are perceived as unsustainable.

Case Studies: Notable Examples Worldwide

Hong Kong operates a successful currency board system, maintaining a fixed exchange rate between the Hong Kong dollar and the US dollar, ensuring monetary stability and investor confidence. Argentina's use of a target zone in the 1990s, pegging the peso within a controlled band against the US dollar, initially curbed hyperinflation but eventually collapsed due to external shocks and fiscal mismanagement. Estonia's adoption of a currency board in the 1990s facilitated its transition to the euro by maintaining a stable kroon pegged to the German mark, exemplifying currency board effectiveness in small open economies.

Choosing Between Currency Board and Target Zone

Choosing between a currency board and a target zone hinges on the desired monetary stability and policy flexibility; a currency board offers strict fixed exchange rates backed by foreign reserves, minimizing inflation and currency risk, while a target zone allows controlled fluctuations within set bands, providing greater flexibility to respond to economic shocks. Countries prioritizing credibility and low inflation often prefer currency boards, whereas those valuing some monetary discretion to manage macroeconomic stability lean towards target zones. Evaluating factors such as economic openness, reserve adequacy, and political commitment is crucial in deciding the optimal exchange rate regime.

Currency board Infographic

libterm.com

libterm.com