Drift occurs when an object or vehicle moves unintentionally from its intended path due to external forces like wind, current, or mechanical factors. Understanding the causes and effects of drift is essential for maintaining control and safety in navigation, whether on water, in the air, or on land. Explore this article to discover how drift impacts your journey and effective strategies to manage it.

Table of Comparison

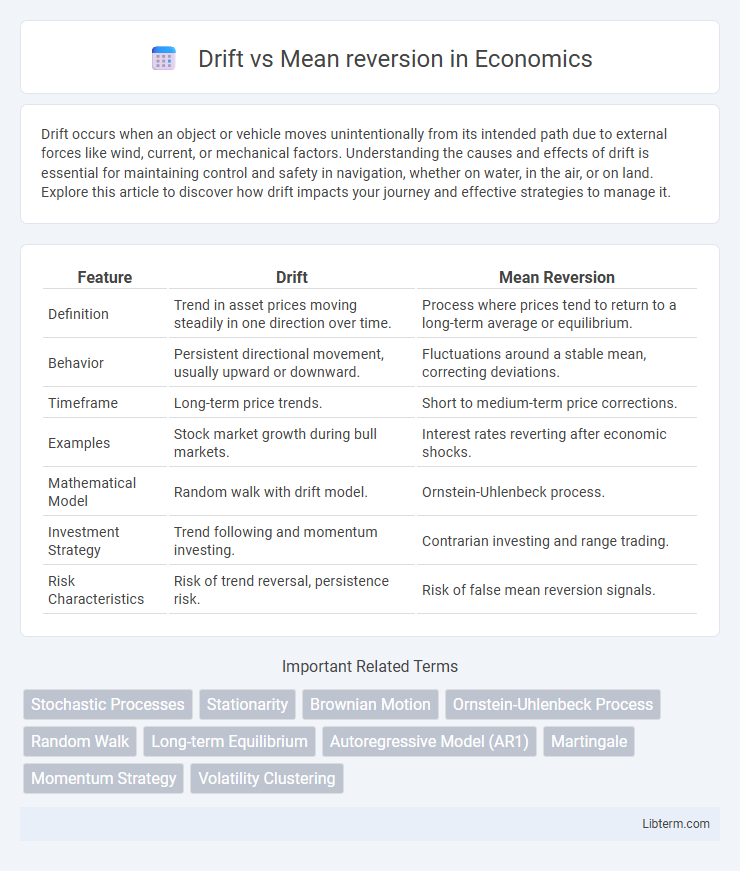

| Feature | Drift | Mean Reversion |

|---|---|---|

| Definition | Trend in asset prices moving steadily in one direction over time. | Process where prices tend to return to a long-term average or equilibrium. |

| Behavior | Persistent directional movement, usually upward or downward. | Fluctuations around a stable mean, correcting deviations. |

| Timeframe | Long-term price trends. | Short to medium-term price corrections. |

| Examples | Stock market growth during bull markets. | Interest rates reverting after economic shocks. |

| Mathematical Model | Random walk with drift model. | Ornstein-Uhlenbeck process. |

| Investment Strategy | Trend following and momentum investing. | Contrarian investing and range trading. |

| Risk Characteristics | Risk of trend reversal, persistence risk. | Risk of false mean reversion signals. |

Introduction to Drift and Mean Reversion

Drift refers to the persistent, directional movement of a time series, such as stock prices or interest rates, influenced by underlying factors like market trends or economic growth. Mean reversion describes the tendency of a variable to fluctuate around a long-term average, returning to a central value after deviations caused by temporary shocks or volatility. Understanding drift and mean reversion dynamics is essential for modeling financial markets, risk management, and developing quantitative trading strategies.

Defining Drift in Financial Markets

Drift in financial markets refers to the expected directional movement of an asset's price over time, often influenced by factors such as economic growth, inflation, and company performance. Unlike mean reversion, which assumes prices will return to a historical average, drift indicates a persistent trend that can lead prices to gradually increase or decrease. Understanding drift helps traders and investors model price dynamics and develop strategies that anticipate long-term directional trends in asset valuation.

Understanding Mean Reversion Concepts

Mean reversion is a financial theory suggesting that asset prices and returns eventually move back toward their long-term average or mean level. Unlike drift, which implies a consistent directional trend, mean reversion assumes that deviations from the mean are temporary and prices will revert to equilibrium over time. Understanding mean reversion is essential for developing trading strategies that capitalize on price corrections and identifying overbought or oversold market conditions.

Key Differences Between Drift and Mean Reversion

Drift refers to the long-term directional movement in asset prices driven by consistent factors such as economic growth or inflation, while mean reversion implies prices tend to return to an average level after deviations. Drift is characterized by a persistent trend, making it suitable for momentum-based strategies, whereas mean reversion signals indicate potential entry or exit points as prices oscillate around a stable mean. Understanding these distinctions helps investors decide between trend-following approaches rooted in drift and contrarian tactics based on mean reversion dynamics.

Mathematical Models: Drift vs Mean Reversion

Drift models describe asset prices following a stochastic process with a constant or time-varying expected return, often modeled by geometric Brownian motion where the drift term represents the trend component. Mean reversion models, such as the Ornstein-Uhlenbeck process, introduce a restoring force that pulls prices back toward a long-term equilibrium level, characterized by parameters including mean reversion speed and volatility. In quantitative finance, drift captures persistent directional trends while mean reversion captures tendencies to revert around a mean, making them fundamental components in pricing derivatives and risk management strategies.

Real-World Examples of Drift

Stock market indices like the S&P 500 often exhibit drift, reflecting long-term upward trends driven by economic growth and inflation. Real estate prices in major cities tend to show drift as property values generally increase over decades due to population growth and urban development. In commodity markets, oil prices can display drift influenced by geopolitical tensions and supply-demand imbalances, leading to sustained price movements rather than mean reversion.

Real-World Examples of Mean Reversion

Mean reversion is frequently observed in financial markets, such as stock prices returning to their historical average after periods of volatility, exemplified by the cyclical recovery of the S&P 500 following economic downturns. Commodity prices, like crude oil, also demonstrate mean reversion as supply shocks dissipate and prices stabilize near long-term equilibrium levels. Currency exchange rates often revert to fundamental values, with the EUR/USD pair showing mean reversion tendencies after significant central bank interventions or geopolitical disruptions.

Practical Applications in Trading Strategies

Drift-based trading strategies rely on the assumption that asset prices follow a random walk with a persistent directional trend, making them effective for momentum and trend-following approaches. Mean reversion strategies capitalize on the tendency of prices to return to an average level, proving particularly useful in range-bound or oscillating markets for identifying entry and exit points. Combining drift and mean reversion techniques can enhance risk management and improve portfolio diversification by adapting to varying market conditions.

Risks and Limitations of Each Approach

Drift models risk misestimating long-term trends, leading to potential overexposure during market shifts, while mean reversion assumes prices revert to a historical average, potentially missing sustained trends and causing premature exits. Both approaches suffer from sensitivity to parameter selection, impacting predictive accuracy and increasing model risk. Market volatility and structural changes further limit their effectiveness, requiring robust risk management and adaptive strategies to mitigate losses.

Conclusion: Choosing Between Drift and Mean Reversion

Selecting between drift and mean reversion models depends primarily on the asset's historical price behavior and market context. Drift models suit trending markets where prices show sustained directional moves, while mean reversion models perform better in range-bound markets where prices revert to an average level. Accurate identification of these dynamics enhances forecasting precision and risk management strategies.

Drift Infographic

libterm.com

libterm.com