Charge cards offer a unique payment solution by requiring full balance payment each billing cycle, preventing interest charges and encouraging disciplined spending. They often come with exclusive perks such as rewards, travel benefits, and enhanced security features tailored for frequent users. Discover how charge cards can optimize your financial management and enhance your purchasing power throughout the article.

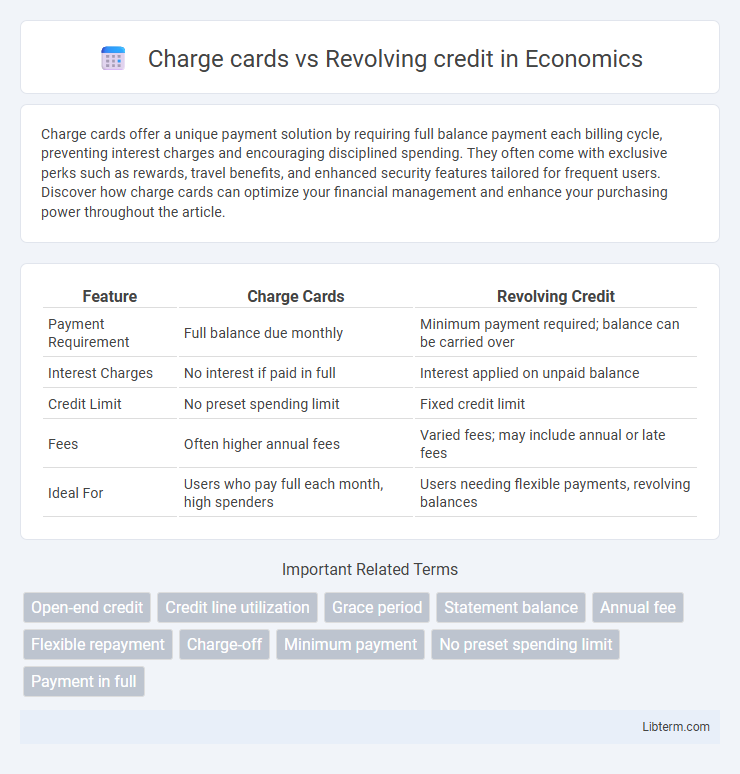

Table of Comparison

| Feature | Charge Cards | Revolving Credit |

|---|---|---|

| Payment Requirement | Full balance due monthly | Minimum payment required; balance can be carried over |

| Interest Charges | No interest if paid in full | Interest applied on unpaid balance |

| Credit Limit | No preset spending limit | Fixed credit limit |

| Fees | Often higher annual fees | Varied fees; may include annual or late fees |

| Ideal For | Users who pay full each month, high spenders | Users needing flexible payments, revolving balances |

Introduction to Charge Cards and Revolving Credit

Charge cards require full repayment of the balance each month, without carrying over any debt, often offering no preset spending limit. Revolving credit, on the other hand, allows users to carry a balance from month to month with minimum payments and applicable interest charges. Both financial tools provide flexible purchasing options but differ significantly in repayment structure and credit management.

Core Definitions: Charge Cards vs Revolving Credit

Charge cards require full payment of the balance each billing cycle, eliminating interest charges but demanding disciplined cash flow management. Revolving credit allows users to carry a balance month-to-month with minimum payments, accruing interest on unpaid amounts and providing flexible borrowing options. Understanding the core distinction is essential: charge cards enforce complete monthly repayment, while revolving credit supports ongoing credit utilization with interest-based financing.

Key Differences in Payment Structures

Charge cards require full payment of the statement balance each month, eliminating interest charges but necessitating disciplined budgeting. Revolving credit allows users to carry a balance by making minimum payments, with interest accruing on the unpaid amount and flexible repayment options. The key difference lies in charge cards' mandatory full payment versus revolving credit's adaptable payment structure with potential interest costs.

Credit Limits: Set Amounts vs Flexible Spending

Charge cards require users to adhere to a fixed credit limit, often tied to their spending and payment history, promoting disciplined financial management. Revolving credit offers flexible spending, allowing consumers to borrow up to a maximum credit limit and carry balances over time with interest. This flexibility provides users with ongoing access to credit, but it may lead to higher debt levels if not managed responsibly.

Interest Rates and Fees Compared

Charge cards typically require full payment each month, avoiding interest charges but often carrying annual fees ranging from $95 to over $600 depending on the issuer and card benefits. Revolving credit accounts, such as credit cards, allow carrying a balance with interest rates usually between 15% and 25% APR, alongside potential late fees, annual fees, and finance charges. Consumers should carefully assess spending habits and fee structures to choose between charge cards' no-interest but higher fees and revolving credit's flexible payment with interest costs.

Impact on Credit Score and Financial Health

Charge cards require full monthly payment, promoting disciplined spending and timely payments, which positively impact credit scores by minimizing credit utilization and preventing interest accrual. Revolving credit allows carrying balances with minimum payments, risking higher credit utilization and potential debt accumulation, potentially lowering credit scores and harming financial health. Consistently managing charge card payments enhances credit reliability, whereas revolving credit demands careful balance control to avoid negative credit implications.

Rewards and Perks: What Each Option Offers

Charge cards often provide exclusive rewards and premium perks such as travel upgrades, concierge services, and access to elite events, catering to users who pay balances in full each month. Revolving credit cards typically offer flexible cashback, points, or miles programs with varied redemption options but may include interest charges if balances are carried over. The choice between the two depends on spending habits, with charge cards favoring reward maximization through upfront payments and revolving credit catering to ongoing credit utility with rewards.

Ideal Use Cases for Charge Cards

Charge cards are ideal for users who can pay their balance in full each billing cycle, offering benefits such as no preset spending limits and robust rewards on business or travel expenses. They suit individuals or businesses seeking to manage cash flow with disciplined financial practice, avoiding interest charges that typically accompany revolving credit. Using charge cards for large, predictable expenses enhances credit profile and maximizes rewards without accumulating debt.

Best Situations to Use Revolving Credit

Revolving credit is best suited for managing ongoing or unexpected expenses where flexibility in repayment amounts and timing is essential, such as home renovations or emergency medical bills. Its ability to carry a balance and make minimum payments allows users to maintain cash flow while gradually paying off debt. This credit type is ideal for individuals seeking to build credit history and prefer a consistent borrowing limit without the need for full monthly repayment.

Choosing the Right Option for Your Financial Goals

Charge cards require full payment each month, helping users avoid interest charges and maintain disciplined spending habits. Revolving credit offers flexible repayments and carries interest on unpaid balances, suitable for managing cash flow and building credit over time. Selecting the right option depends on your financial goals, such as avoiding debt accumulation with charge cards or leveraging revolving credit for ongoing purchasing power and credit score growth.

Charge cards Infographic

libterm.com

libterm.com