Dealer markets facilitate trading where dealers hold inventories and quote prices for buyers and sellers, ensuring liquidity and efficient transactions. These markets contrast with auction markets by allowing continuous buying and selling through dealer intermediaries. Explore the rest of the article to understand how dealer markets impact your trading strategies and investment decisions.

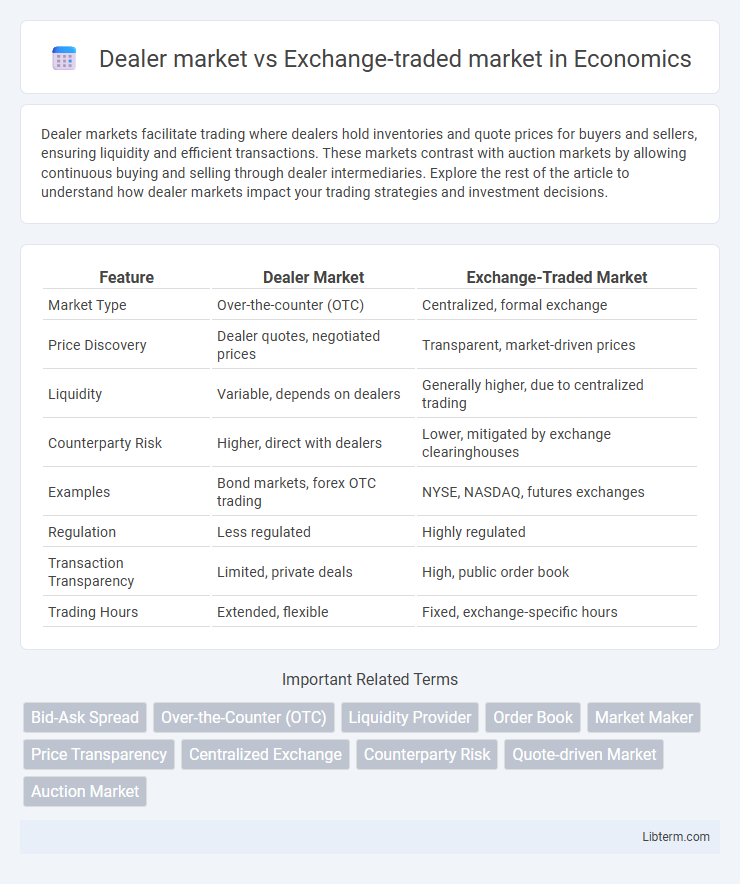

Table of Comparison

| Feature | Dealer Market | Exchange-Traded Market |

|---|---|---|

| Market Type | Over-the-counter (OTC) | Centralized, formal exchange |

| Price Discovery | Dealer quotes, negotiated prices | Transparent, market-driven prices |

| Liquidity | Variable, depends on dealers | Generally higher, due to centralized trading |

| Counterparty Risk | Higher, direct with dealers | Lower, mitigated by exchange clearinghouses |

| Examples | Bond markets, forex OTC trading | NYSE, NASDAQ, futures exchanges |

| Regulation | Less regulated | Highly regulated |

| Transaction Transparency | Limited, private deals | High, public order book |

| Trading Hours | Extended, flexible | Fixed, exchange-specific hours |

Introduction to Dealer and Exchange-Traded Markets

Dealer markets operate through a network of dealers who hold inventories and provide liquidity by buying and selling securities directly to investors, often over-the-counter (OTC). Exchange-traded markets centralize trading activities on formal exchanges like the New York Stock Exchange (NYSE) or NASDAQ, ensuring transparency and regulated price discovery. The primary distinction lies in the trading mechanism: dealer markets rely on intermediaries, whereas exchange-traded markets utilize a centralized order book for matching buyers and sellers.

Defining Dealer Markets

Dealer markets are financial platforms where multiple dealers act as principals, buying and selling securities for their own accounts, facilitating liquidity by quoting bid and ask prices. Unlike exchange-traded markets, trades in dealer markets occur over-the-counter (OTC), without centralized order books, often covering bonds, derivatives, and less liquid stocks. The dealer market structure enhances price discovery and allows for continuous trading, but it generally involves wider spreads and less transparency compared to exchange-traded markets.

Understanding Exchange-Traded Markets

Exchange-traded markets centralize trading through organized exchanges where securities like stocks, bonds, and derivatives are listed and traded according to established rules and transparency standards. These markets provide standardized contracts, real-time pricing, and increased liquidity, enabling investors to buy and sell assets efficiently. Unlike dealer markets where transactions occur directly between buyers and sellers facilitated by dealers, exchange-traded markets reduce counterparty risk through clearinghouses that guarantee trade settlements.

Key Structural Differences

Dealer markets operate through a network of dealers who hold inventory and provide liquidity by directly buying and selling securities, contrasting with exchange-traded markets where transactions occur on centralized platforms with standardized protocols. In dealer markets, prices are determined by dealers and can vary across different market participants, while exchange-traded markets feature transparent price discovery through order books and matching algorithms. The decentralized nature of dealer markets often results in less regulatory oversight compared to the highly regulated and standardized environment of exchange-traded markets.

Liquidity and Price Discovery

Dealer markets provide higher liquidity by maintaining continuous bid-ask quotes and facilitating immediate transactions through dealer inventories, while exchange-traded markets rely on centralized order books that aggregate buy and sell orders, offering transparent price discovery. Price discovery in exchange-traded markets benefits from greater transparency and competition among participants, leading to more efficient price formation compared to dealer markets where prices can be influenced by individual dealers. Liquidity in dealer markets is often more flexible with customized transaction sizes, whereas exchange-traded markets may exhibit standardized contracts but lower immediacy during low-volume periods.

Transparency and Regulation

Dealer markets often lack the transparency found in exchange-traded markets because trades occur over-the-counter without centralized reporting, making price discovery and transaction data less accessible to participants. Exchange-traded markets operate under stringent regulations enforced by bodies like the SEC, ensuring standardized disclosures, transparent price quotations, and real-time trade execution information. The regulatory framework in exchange markets promotes investor protection and market integrity, whereas dealer markets rely more heavily on the reputation and internal controls of individual dealers.

Trading Costs and Accessibility

Dealer markets often incur higher trading costs due to wider bid-ask spreads and dealer commissions, while exchange-traded markets typically feature lower fees and tighter spreads because of increased competition and transparency. Accessibility in dealer markets is generally limited to institutional investors and requires direct relationships with dealers, whereas exchange-traded markets offer broader access to retail investors through standardized platforms and regulatory oversight. The centralized nature of exchange-traded markets enhances price discovery and liquidity, reducing barriers for a wider range of participants compared to decentralized dealer markets.

Market Participants and Roles

Dealer markets feature market participants such as dealers who act as principals, buying and selling securities from their own inventory to provide liquidity. Exchange-traded markets involve brokers and specialists who facilitate transactions between buyers and sellers, ensuring price transparency and order matching. Dealers assume inventory risk, while exchange participants primarily execute client orders without holding inventory.

Advantages and Disadvantages

Dealer markets provide continuous liquidity by allowing dealers to buy and sell securities from their own inventory, facilitating faster transactions and narrower bid-ask spreads. However, they may involve higher counterparty risk and less price transparency compared to exchange-traded markets. Exchange-traded markets offer centralized trading with standardized contracts and greater regulatory oversight, ensuring price discovery and investor protection, but they can have lower liquidity during off-peak hours and may involve higher transaction costs.

Choosing Between Dealer and Exchange-Traded Markets

Choosing between dealer and exchange-traded markets depends on factors such as liquidity, transparency, and price discovery. Dealer markets, characterized by multiple dealers providing bid-ask prices, offer greater flexibility and continuous trading, especially in less standardized securities. Exchange-traded markets provide centralized order books enhancing transparency and price efficiency, making them ideal for standardized securities with high trading volumes.

Dealer market Infographic

libterm.com

libterm.com