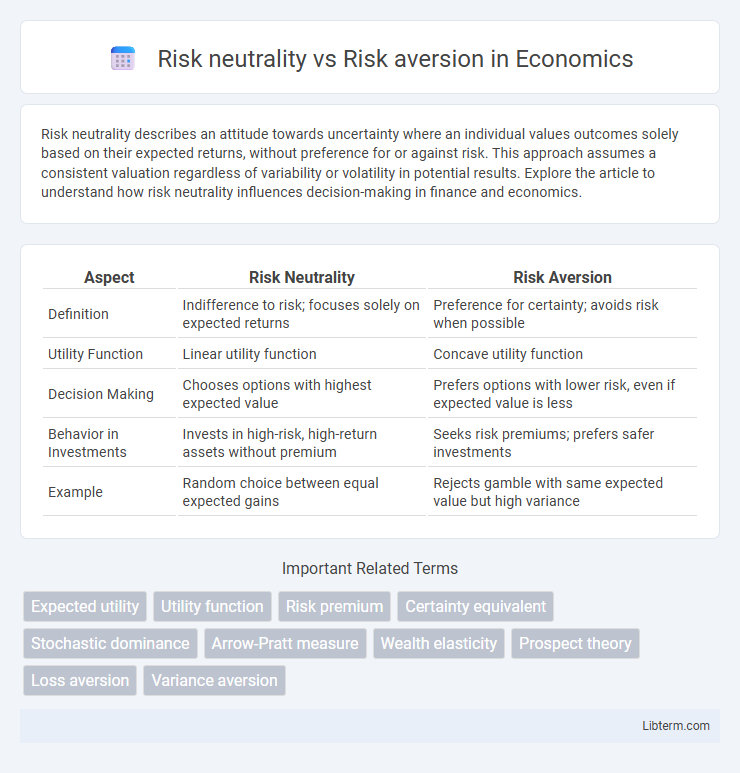

Risk neutrality describes an attitude towards uncertainty where an individual values outcomes solely based on their expected returns, without preference for or against risk. This approach assumes a consistent valuation regardless of variability or volatility in potential results. Explore the article to understand how risk neutrality influences decision-making in finance and economics.

Table of Comparison

| Aspect | Risk Neutrality | Risk Aversion |

|---|---|---|

| Definition | Indifference to risk; focuses solely on expected returns | Preference for certainty; avoids risk when possible |

| Utility Function | Linear utility function | Concave utility function |

| Decision Making | Chooses options with highest expected value | Prefers options with lower risk, even if expected value is less |

| Behavior in Investments | Invests in high-risk, high-return assets without premium | Seeks risk premiums; prefers safer investments |

| Example | Random choice between equal expected gains | Rejects gamble with same expected value but high variance |

Introduction to Risk Preferences

Risk preferences describe how individuals evaluate uncertain outcomes, with risk neutrality reflecting indifference to variability in returns and risk aversion indicating a preference for certainty over potential higher gains. A risk-neutral individual values risky prospects solely based on their expected value, while a risk-averse person prefers a guaranteed outcome to a risky one with the same expected value due to the disutility of uncertainty. Understanding these distinctions is crucial in fields like finance and economics for modeling decision-making under uncertainty and optimizing investment strategies.

Defining Risk Neutrality

Risk neutrality describes an economic or investment behavior where an individual or entity is indifferent to risk when making decisions, valuing uncertain outcomes solely based on their expected returns without preference for variability. Risk-neutral agents evaluate options by calculating the expected value, disregarding the potential for gains or losses beyond the mean outcome. This contrasts with risk aversion, where decision-makers prefer to minimize uncertainty and are willing to accept lower expected returns to avoid risk.

Defining Risk Aversion

Risk aversion defines a preference for certainty over uncertainty, where individuals choose options with lower risk even if they offer lower expected returns. This behavior reflects a utility function that is concave, indicating diminishing marginal utility of wealth. Risk-averse decision-makers prioritize minimizing potential losses and prefer investments with stable outcomes rather than volatile or high-risk opportunities.

Key Differences Between Risk Neutrality and Risk Aversion

Risk neutrality reflects an indifference to risk, where decision-makers value outcomes based solely on expected returns, showing no preference for certainty or uncertainty. In contrast, risk aversion involves a preference for certainty, leading individuals to favor lower but more secure returns over higher, uncertain gains. This fundamental difference shapes investment strategies, with risk-neutral agents treating gambles with equal expected values equally, while risk-averse agents weigh potential losses more heavily than equivalent gains.

Behavioral Foundations of Risk Attitudes

Risk neutrality reflects indifference to risk, where decisions are based solely on expected outcomes without weighting for uncertainty, often modeled through linear utility functions in expected utility theory. Risk aversion involves a preference for certain outcomes over uncertain ones with the same expected value, explained behaviorally by concave utility curves and loss aversion in prospect theory. Behavioral foundations highlight cognitive biases, such as framing effects and probability distortion, that shape individual risk attitudes beyond traditional economic models.

Impact on Investment Decision-Making

Risk neutrality leads investors to evaluate investment opportunities based solely on expected returns, disregarding potential variability or uncertainty, which often results in favoring projects with higher average payoffs regardless of risk. In contrast, risk aversion causes investors to weigh potential losses more heavily, prompting them to prioritize investment options that minimize downside risk and offer greater security, even if the expected returns are lower. This fundamental difference influences portfolio composition, asset allocation, and the overall approach to financial decision-making under uncertainty.

Real-World Examples of Risk Neutral and Risk Averse Actions

Risk-neutral investors, exemplified by gamblers placing equal-value bets irrespective of outcomes, focus solely on expected returns without weighting potential losses more heavily. In contrast, risk-averse individuals, such as conservative retirees preferring government bonds over volatile stocks, prioritize capital preservation and avoid uncertainty to minimize potential losses. Businesses adopting a risk-neutral stance may launch innovative products with uncertain market reception, while risk-averse companies tend to favor incremental improvements and safer market strategies.

Implications in Business Strategy

Risk neutrality in business strategy leads to equal weighting of potential outcomes, encouraging investment in projects with balanced probabilities of success and failure. Risk-averse strategies prioritize minimizing potential losses, often resulting in more conservative decision-making and avoidance of high-variance opportunities. The choice between risk neutrality and risk aversion significantly impacts capital allocation, innovation pursuit, and competitive positioning in dynamic markets.

Risk Preferences in Economic Theory

Risk neutrality reflects a preference for choices with uncertain outcomes where the expected value is the sole criterion, showing indifference to variability in returns. Risk aversion indicates a preference for certain outcomes over risky ones with equivalent expected values, often modeled with concave utility functions representing diminishing marginal utility of wealth. Economic theory uses these risk preferences to explain decision-making under uncertainty, influencing portfolio selection, insurance purchase, and market behavior.

Choosing the Right Risk Approach

Choosing the right risk approach depends on an individual's or organization's tolerance for uncertainty and potential loss. Risk neutrality involves making decisions based solely on expected outcomes without preference for risk level, ideal for maximizing expected value in investments or business strategies. In contrast, risk aversion prioritizes minimizing potential losses, favoring safer options and stability, which is essential in financial planning and insurance contexts to protect against adverse scenarios.

Risk neutrality Infographic

libterm.com

libterm.com