A line of credit provides flexible access to funds, allowing you to borrow up to a predetermined limit and repay as needed. It helps manage cash flow, handle unexpected expenses, or consolidate debt with lower interest rates than credit cards. Explore the article to understand how a line of credit can support your financial goals and when it's the right choice for you.

Table of Comparison

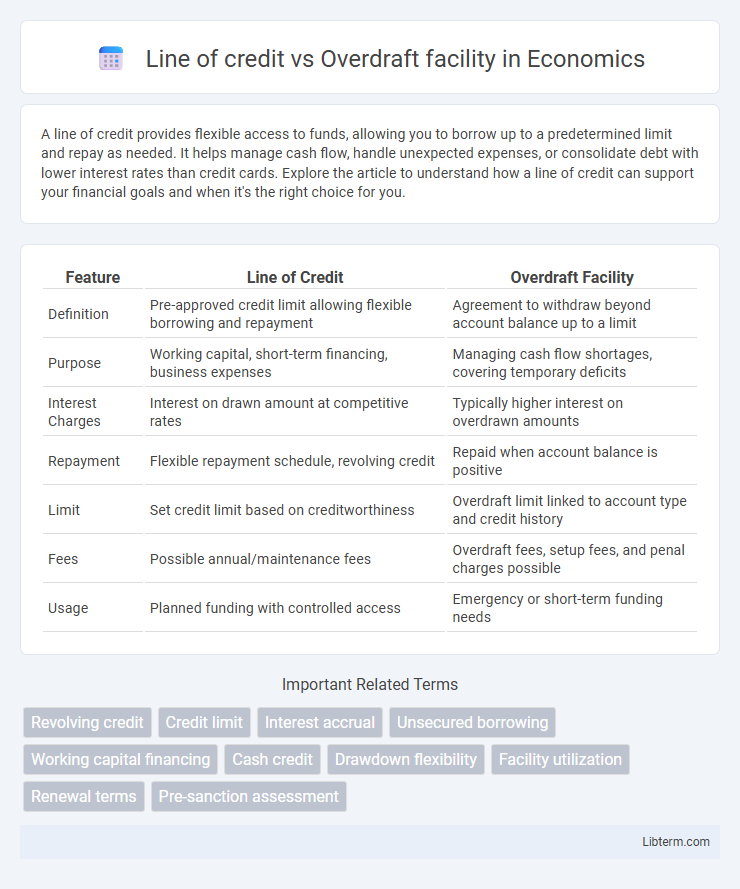

| Feature | Line of Credit | Overdraft Facility |

|---|---|---|

| Definition | Pre-approved credit limit allowing flexible borrowing and repayment | Agreement to withdraw beyond account balance up to a limit |

| Purpose | Working capital, short-term financing, business expenses | Managing cash flow shortages, covering temporary deficits |

| Interest Charges | Interest on drawn amount at competitive rates | Typically higher interest on overdrawn amounts |

| Repayment | Flexible repayment schedule, revolving credit | Repaid when account balance is positive |

| Limit | Set credit limit based on creditworthiness | Overdraft limit linked to account type and credit history |

| Fees | Possible annual/maintenance fees | Overdraft fees, setup fees, and penal charges possible |

| Usage | Planned funding with controlled access | Emergency or short-term funding needs |

Understanding Line of Credit

A line of credit is a flexible loan arrangement allowing borrowers to access funds up to a predetermined limit, repay, and withdraw repeatedly within the agreed period. Interest is charged only on the amount utilized, making it a cost-effective option for managing cash flow and unexpected expenses. Unlike an overdraft facility linked directly to a bank account, a line of credit often involves formal approval processes and can serve for larger, longer-term financing needs.

What is an Overdraft Facility?

An overdraft facility is a credit arrangement linked to a current account that allows account holders to withdraw more money than their available balance up to a pre-approved limit. This short-term borrowing tool helps manage cash flow fluctuations by providing immediate access to funds without the need for a separate loan application. Interest is typically charged only on the overdrawn amount and for the period the overdraft is utilized.

Key Differences Between Line of Credit and Overdraft

A line of credit provides borrowers with a flexible loan amount that can be drawn upon up to a predetermined limit and repaid over time with interest charged only on the drawn amount. An overdraft facility allows account holders to withdraw more than their available balance up to an approved limit, typically linked to a checking account with interest or fees applied on the overdrawn amount immediately. Key differences include repayment terms, interest calculations, usage flexibility, and purpose, with lines of credit often used for planned expenses or business cash flow, while overdrafts serve as short-term emergency credit for daily transactions.

Eligibility Criteria for Each Option

Eligibility for a line of credit typically requires a strong credit score, stable income, and a demonstrated ability to repay, often necessitating detailed financial documentation and a longer approval process. Overdraft facility eligibility is generally linked to an existing bank account with a history of responsible account management and sufficient average balance, with less stringent credit requirements. Both options prioritize creditworthiness but vary in documentation, with lines of credit demanding more rigorous evaluation compared to overdraft facilities.

Application Process: Line of Credit vs Overdraft

The application process for a line of credit typically involves a detailed credit assessment, including income verification, credit score review, and collateral evaluation if required. Conversely, applying for an overdraft facility is generally quicker, with fewer documentation requirements, as it is often an extension of an existing current account. Both products require bank approval, but lines of credit usually demand more stringent underwriting due to higher credit limits and longer repayment terms.

Interest Rates and Fee Structures

Line of credit interest rates are typically fixed or variable, often lower than overdraft rates due to structured repayment terms, while overdraft facilities usually carry higher, variable interest rates applied only on overdrawn amounts. Fee structures for lines of credit commonly include annual or maintenance fees and possible draw fees, whereas overdraft facilities often entail overdraft fees, daily interest charges, and sometimes minimum usage fees. Comparing these financial products reveals that lines of credit offer more predictable costs with potential savings on interest, whereas overdrafts provide flexible, short-term access at a higher expense.

Repayment Flexibility and Terms

A line of credit offers greater repayment flexibility with preset credit limits and scheduled minimum payments, allowing borrowers to repay and reuse funds multiple times within the agreed term. Overdraft facilities provide short-term borrowing attached to a current account with interest charged only on the overdrawn amount, and repayments occur as deposits cover the negative balance. Both financial products differ in terms, as lines of credit often have fixed periods and structured repayments, while overdrafts are typically more flexible but subject to frequent review and variable fees.

Pros and Cons of Line of Credit

A Line of Credit offers flexible borrowing with predefined credit limits, enabling businesses and individuals to manage cash flow efficiently and access funds as needed, which supports financial agility. Pros include lower interest rates compared to overdrafts, interest charged only on the utilized amount, and the ability to reuse credit without reapplying, but cons involve potential fees for unused credit, strict approval processes, and the risk of overspending leading to debt accumulation. Unlike overdraft facilities that are linked to current accounts with often higher interest and less repayment control, a Line of Credit provides more structured borrowing options suitable for planned expenses.

Advantages and Disadvantages of Overdraft Facility

An overdraft facility offers flexible short-term borrowing directly linked to a current account, allowing users to withdraw more than their available balance up to an approved limit, which provides instant liquidity and convenient cash flow management. Its advantages include quick access to funds without the need for separate loan applications and interest charged only on the utilized amount, but disadvantages consist of higher interest rates compared to standard loans, potential fees for exceeding limits, and the risk of overdraft renewal dependence compromising financial discipline. Businesses and individuals benefit from overdrafts for managing temporary expenses, although careful monitoring is essential to avoid escalating debt and credit rating impact.

Choosing the Right Option for Your Financial Needs

Line of credit offers flexible borrowing with predetermined limits and lower interest rates, ideal for planned expenses and long-term financial management. Overdraft facility provides immediate access to funds during short-term cash flow shortages with higher interest and fees, suitable for temporary financial gaps. Assess your spending patterns, repayment ability, and cost sensitivity to choose a solution aligning with your business or personal financial needs effectively.

Line of credit Infographic

libterm.com

libterm.com