Monometallism is an economic system where a single metal, usually gold or silver, serves as the sole standard for currency value and monetary exchange. This system influences inflation, stability, and international trade by anchoring the money supply to the value of one metal. Explore the rest of the article to understand how monometallism impacts your financial decisions and global economic trends.

Table of Comparison

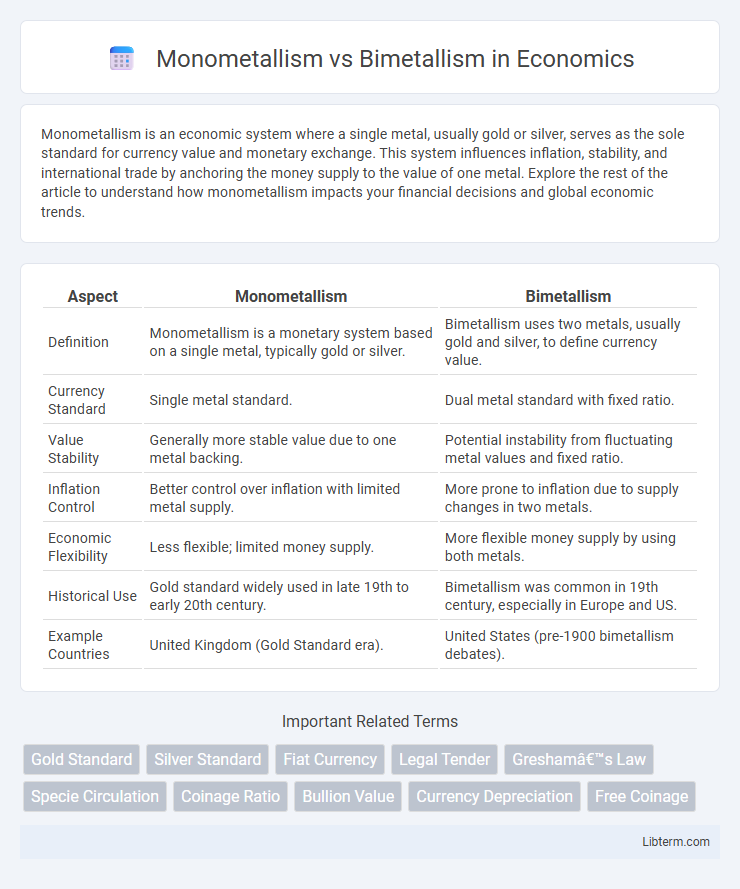

| Aspect | Monometallism | Bimetallism |

|---|---|---|

| Definition | Monometallism is a monetary system based on a single metal, typically gold or silver. | Bimetallism uses two metals, usually gold and silver, to define currency value. |

| Currency Standard | Single metal standard. | Dual metal standard with fixed ratio. |

| Value Stability | Generally more stable value due to one metal backing. | Potential instability from fluctuating metal values and fixed ratio. |

| Inflation Control | Better control over inflation with limited metal supply. | More prone to inflation due to supply changes in two metals. |

| Economic Flexibility | Less flexible; limited money supply. | More flexible money supply by using both metals. |

| Historical Use | Gold standard widely used in late 19th to early 20th century. | Bimetallism was common in 19th century, especially in Europe and US. |

| Example Countries | United Kingdom (Gold Standard era). | United States (pre-1900 bimetallism debates). |

Introduction to Monetary Systems

Monometallism relies on a single metal, typically gold or silver, as the basis for a currency's value, simplifying exchange but limiting flexibility in monetary policy. Bimetallism uses both gold and silver at a fixed ratio to back currency, aiming to stabilize the economy by leveraging the availability of two metals. The debate between these systems shaped 19th and early 20th-century monetary policy, influencing inflation control, trade balances, and coinage standards worldwide.

Defining Monometallism

Monometallism refers to a monetary system in which a single metal, usually gold or silver, serves as the standard of value and medium of exchange. This system ensures price stability and simplifies trade by using one consistent measure of money. In contrast, bimetallism employs both gold and silver as legal tender, often leading to complications in valuation and currency exchange.

Understanding Bimetallism

Bimetallism is an economic monetary system where the value of currency is based on fixed quantities of two metals, typically gold and silver, allowing both to be legal tender at a predetermined ratio. This system aims to stabilize the money supply by combining the strengths of gold's scarcity and silver's abundance, reducing the risk of inflation or deflation linked to reliance on a single metal. Critics of bimetallism highlight challenges such as Gresham's Law, where the undervalued metal tends to be hoarded or disappear from circulation, complicating the maintenance of a stable exchange ratio.

Historical Background of Monometallism

Monometallism emerged in the 19th century as nations sought a stable monetary standard, predominantly relying on a single metal such as gold. The Gold Standard Act of 1900 in the United States exemplified the formal adoption of gold monometallism, which facilitated international trade by providing a fixed value for currency. This system contrasted with bimetallism, which attempted to use both gold and silver but faced challenges due to fluctuating metal values and market instability.

Historical Context of Bimetallism

Bimetallism emerged prominently during the 19th century as a monetary system where both gold and silver were used as legal tender at a fixed ratio, aiming to stabilize economies and expand money supply. This system gained traction amidst fluctuating silver prices and gold discoveries, notably influencing debates in the United States and Europe over currency standards. Bimetallism's decline in the late 1800s was driven by market imbalances and the global shift towards the gold standard, shaping modern monetary policies.

Economic Advantages of Monometallism

Monometallism offers increased monetary stability by using a single metal, typically gold, which simplifies currency valuation and reduces fluctuations caused by metal price disparities. This system enhances international trade by providing a uniform standard, minimizing exchange rate volatility and encouraging investor confidence. Economic predictability under monometallism supports long-term financial planning and reduces the risks of inflation caused by varying metal supplies.

Economic Benefits of Bimetallism

Bimetallism promotes economic stability by allowing currency to be backed by both gold and silver, reducing reliance on a single metal and mitigating the risk of deflation or inflation caused by metal supply shocks. This system enhances the money supply flexibility, supporting increased trade and investment by providing a more abundant and stable currency base. The dual-metal standard also stabilizes exchange rates and facilitates international commerce by aligning with the monetary systems of multiple countries that use either metal.

Challenges and Criticisms of Monometallism

Monometallism faces significant challenges, including vulnerability to fluctuations in the value and supply of the single metal used, typically gold, which can lead to economic instability and deflationary pressures. Critics argue that reliance on one metal limits monetary flexibility, restricting governments' ability to respond effectively to economic crises or to expand the money supply. Additionally, monometallism can create trade imbalances and reduce international monetary cooperation, as countries adhering to a single metal standard may experience divergent economic conditions.

Problems and Controversies Surrounding Bimetallism

Bimetallism faced significant problems such as price instability caused by fluctuating market values of gold and silver, leading to uncertainty in currency value. The "Gresham's Law" effect often resulted in one metal driving the other out of circulation, undermining the intended dual-metal currency system. Economic debates intensified as proponents argued bimetallism could boost money supply and inflation, while critics feared it would disrupt trade and financial stability.

Monometallism vs Bimetallism: Modern Implications

Monometallism, relying solely on gold or silver as the monetary standard, provides price stability and simplifies currency valuation, while bimetallism uses both metals to expand money supply and reduce deflation risks. In modern economies, monometallism aligns with the gold standard's emphasis on controlling inflation and maintaining fixed exchange rates, whereas bimetallism's dual-metal system faces challenges due to fluctuating metal values and complexities in maintaining parity. Contemporary discussions highlight monometallism's role in fostering economic stability versus bimetallism's potential to enhance liquidity but complicate monetary policy execution.

Monometallism Infographic

libterm.com

libterm.com