Bond yields reflect the return an investor can expect from holding a bond until maturity, influenced by interest rates, credit risk, and market demand. Understanding how yields fluctuate helps you make informed decisions in fixed-income investments and manage portfolio risk effectively. Explore the rest of this article to learn how bond yields impact your investment strategy and economic outlook.

Table of Comparison

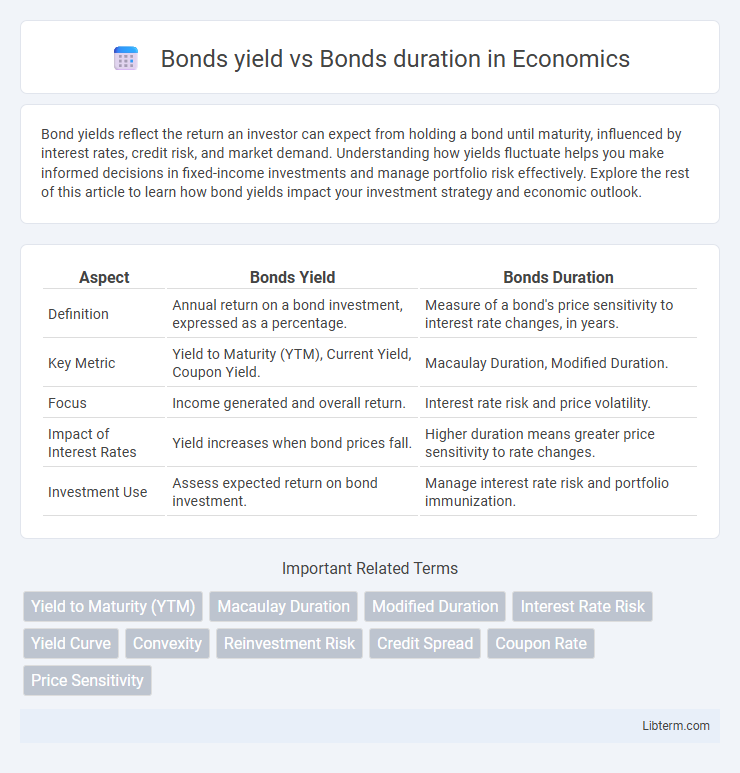

| Aspect | Bonds Yield | Bonds Duration |

|---|---|---|

| Definition | Annual return on a bond investment, expressed as a percentage. | Measure of a bond's price sensitivity to interest rate changes, in years. |

| Key Metric | Yield to Maturity (YTM), Current Yield, Coupon Yield. | Macaulay Duration, Modified Duration. |

| Focus | Income generated and overall return. | Interest rate risk and price volatility. |

| Impact of Interest Rates | Yield increases when bond prices fall. | Higher duration means greater price sensitivity to rate changes. |

| Investment Use | Assess expected return on bond investment. | Manage interest rate risk and portfolio immunization. |

Understanding Bond Yields

Bond yields measure the return an investor can expect from holding a bond until maturity, typically expressed as a percentage of its current price. Understanding bond yields is crucial as they fluctuate inversely with bond prices and reflect market interest rate changes. Duration, on the other hand, quantifies a bond's sensitivity to interest rate movements, indicating the potential price volatility associated with changes in yields.

What is Bond Duration?

Bond duration measures the sensitivity of a bond's price to changes in interest rates, expressed in years, indicating how much the price will fluctuate with a 1% change in yield. Unlike bond yield, which reflects the return an investor earns from the bond's coupon payments and price appreciation, duration estimates interest rate risk and helps investors manage portfolio volatility. Modified duration is commonly used to assess price volatility, guiding investment decisions in bond portfolios by quantifying exposure to interest rate changes.

Key Differences: Yield vs Duration

Bond yield measures the return an investor can expect from a bond, expressed as an annual percentage, while bond duration quantifies the bond's sensitivity to interest rate changes, representing the weighted average time to receive cash flows. Yield reflects the income potential and market valuation of the bond, whereas duration indicates the risk level related to price volatility in response to interest rate fluctuations. Understanding yield helps assess profitability, and duration aids in managing interest rate risk and portfolio immunization strategies.

Factors Affecting Bond Yields

Bond yields are influenced by factors such as interest rate changes, inflation expectations, and credit risk, which directly impact the return investors demand for holding debt securities. Bond duration measures sensitivity to interest rate fluctuations, with longer duration bonds experiencing greater price volatility as yields change. Understanding these factors is crucial for assessing bond performance and managing interest rate risk effectively.

Factors Influencing Bond Duration

Bond duration measures the sensitivity of a bond's price to interest rate changes, with longer durations indicating higher price volatility. Key factors influencing bond duration include maturity, coupon rate, and yield to maturity, where longer maturities and lower coupon rates typically increase duration. Changes in yield directly affect bond prices, making duration a crucial metric for assessing interest rate risk in bond investments.

Yield and Duration in Portfolio Management

Bond yield directly impacts portfolio returns by indicating the income generated relative to bond price, while duration measures interest rate sensitivity and risk exposure. Portfolio management balances yield with duration to optimize return potential against interest rate fluctuations, minimizing volatility. High-yield bonds may offer greater income but often come with longer durations, increasing sensitivity to rate changes and altering portfolio risk profiles.

Interest Rate Risk: Yield vs Duration

Bond yield reflects the return an investor expects, while bond duration measures sensitivity to interest rate changes, directly impacting interest rate risk. Higher duration indicates greater price volatility when yields fluctuate, meaning a bond with longer duration faces increased interest rate risk. Investors use duration to estimate potential losses from rising interest rates and compare it against expected yield for risk-adjusted decisions.

Yield Curve and Duration Analysis

Bond yields represent the return investors expect, influencing the shape of the yield curve which plots bond yields across different maturities to signal economic expectations. Duration measures a bond's sensitivity to interest rate changes, with longer durations indicating greater price volatility and impact from shifts in the yield curve. Understanding duration alongside yield curve analysis helps investors assess interest rate risk and optimize bond portfolio strategies.

Practical Strategies for Investors

Investors should consider bonds yield and duration together to optimize portfolio returns and manage interest rate risk effectively. Bonds with higher yields often come with longer durations, increasing sensitivity to interest rate changes and potential price volatility. Practical strategies include balancing high-yield bonds with shorter durations to protect against rate hikes while capturing income opportunities through diversified maturity profiles.

Common Misconceptions about Yield and Duration

Bond yield measures the return an investor expects from a bond, while duration quantifies the bond's sensitivity to interest rate changes, reflecting its price volatility. A common misconception is that higher yield always means higher risk, but duration plays a crucial role in assessing interest rate risk independently of yield levels. Investors often confuse yield with duration, overlooking that yield impact relates to income, whereas duration affects the bond's price risk under fluctuating interest rates.

Bonds yield Infographic

libterm.com

libterm.com