Competitive appreciation highlights the rising value of assets within a competitive marketplace, driven by demand and scarcity. Understanding this concept can help you make informed investment decisions and recognize market trends. Explore the rest of the article to learn how competitive appreciation impacts your financial growth.

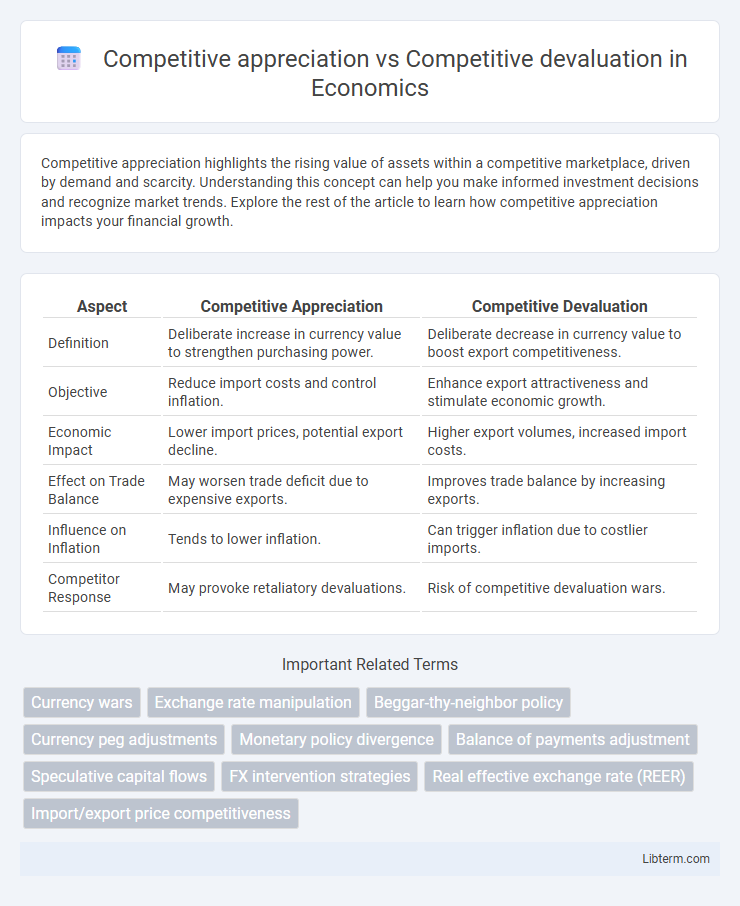

Table of Comparison

| Aspect | Competitive Appreciation | Competitive Devaluation |

|---|---|---|

| Definition | Deliberate increase in currency value to strengthen purchasing power. | Deliberate decrease in currency value to boost export competitiveness. |

| Objective | Reduce import costs and control inflation. | Enhance export attractiveness and stimulate economic growth. |

| Economic Impact | Lower import prices, potential export decline. | Higher export volumes, increased import costs. |

| Effect on Trade Balance | May worsen trade deficit due to expensive exports. | Improves trade balance by increasing exports. |

| Influence on Inflation | Tends to lower inflation. | Can trigger inflation due to costlier imports. |

| Competitor Response | May provoke retaliatory devaluations. | Risk of competitive devaluation wars. |

Understanding Competitive Appreciation and Competitive Devaluation

Competitive appreciation occurs when a country's currency strengthens relative to others, boosting its purchasing power and reducing import costs, which can enhance economic stability and attract foreign investment. Competitive devaluation involves deliberately lowering a currency's value to make exports more competitive, potentially stimulating economic growth but also risking inflation and retaliatory trade measures. Understanding these dynamics is crucial for policymakers to balance trade advantages with broader economic impacts such as inflation rates, capital flows, and international relations.

Key Differences Between Competitive Appreciation and Devaluation

Competitive appreciation refers to a nation's currency increasing in value relative to others, enhancing its purchasing power and making imports cheaper. Competitive devaluation involves deliberately lowering the currency's value to boost exports by making them more affordable internationally. The key difference lies in their economic goals: appreciation aims at reducing inflation and increasing consumer purchasing power, while devaluation targets improving trade balance and export competitiveness.

Economic Drivers Behind Currency Appreciation

Competitive appreciation occurs when a country's currency strengthens due to robust economic drivers such as high interest rates, strong trade surpluses, and increased foreign investment inflows. These factors boost demand for the currency, raising its value relative to others. Conversely, competitive devaluation involves deliberately lowering the currency's value to enhance export competitiveness, often triggered by economic stagnation or trade deficits.

Factors Leading to Currency Devaluation

Factors leading to currency devaluation include persistent trade deficits, causing increased supply of the domestic currency in foreign exchange markets. High inflation rates diminish purchasing power, prompting investors to shift away from the currency. Political instability and weakening economic fundamentals reduce investor confidence, accelerating capital outflows and further pressuring the currency's value downward.

Impacts on International Trade and Exports

Competitive appreciation increases a country's currency value relative to others, making exports more expensive and less competitive in the global market, which can reduce export volumes and widen trade deficits. Competitive devaluation, by lowering the currency value, makes exports cheaper and more attractive internationally, potentially boosting export volumes and improving the trade balance. Both strategies significantly influence trade flows, impacting international competitiveness, foreign exchange earnings, and global market share.

Policy Tools Used for Currency Management

Competitive appreciation involves a country's efforts to increase its currency value through policy tools such as tightening monetary policy, raising interest rates, and restricting money supply to attract foreign capital. In contrast, competitive devaluation employs measures like lowering interest rates, increasing money supply, and direct intervention in forex markets to reduce currency value and boost export competitiveness. Central banks often use foreign exchange reserves and capital controls as supplementary tools in managing currency value during these competitive strategies.

Case Studies: Countries Engaging in Competitive Currency Strategies

Case studies of competitive appreciation include Switzerland during the 2011 eurozone crisis, where the Swiss franc sharply increased in value to attract safe-haven capital, disrupting exports. Conversely, competitive devaluation is exemplified by China's currency policy in the early 2000s, deliberately weakening the yuan to boost export competitiveness and stimulate economic growth. These contrasting strategies highlight how countries manipulate exchange rates to influence trade balances and economic stability amid global financial pressures.

Risks and Benefits for Domestic Economies

Competitive appreciation can enhance domestic purchasing power and reduce inflation by strengthening the currency, benefiting importers and consumers. However, it risks harming export competitiveness, potentially leading to trade deficits and job losses in export-oriented industries. Competitive devaluation boosts exports by making goods cheaper abroad and can stimulate economic growth, but it may trigger inflation, increase the cost of imports, and provoke retaliatory currency devaluations from trade partners.

Global Market Reactions and Currency Wars

Competitive appreciation occurs when countries intentionally strengthen their currency to gain purchasing power, often leading to reduced export competitiveness and global market tensions. Competitive devaluation involves deliberate currency weakening to boost exports by making goods cheaper internationally, triggering retaliatory measures and currency wars among trading partners. These dynamics increase volatility in foreign exchange markets, disrupt global trade balances, and escalate protectionist policies.

Future Trends in Currency Competition

Future trends in currency competition highlight increased instances of competitive devaluation as countries seek export advantages through lower currency values, driving inflationary pressures globally. Conversely, competitive appreciation may emerge in economies with strong technology sectors and capital inflows, reinforcing currency strength to attract investment and stabilize financial markets. Central banks and policymakers will balance these opposing forces, influencing exchange rate regimes, monetary policies, and digital currency adoption in the evolving global financial landscape.

Competitive appreciation Infographic

libterm.com

libterm.com