A crawling peg is an exchange rate system where a currency's value is adjusted periodically in small increments to follow inflation or other economic indicators. This method helps stabilize the currency while allowing gradual changes to accommodate economic shifts. Discover how a crawling peg can influence Your economy and monetary policy throughout this article.

Table of Comparison

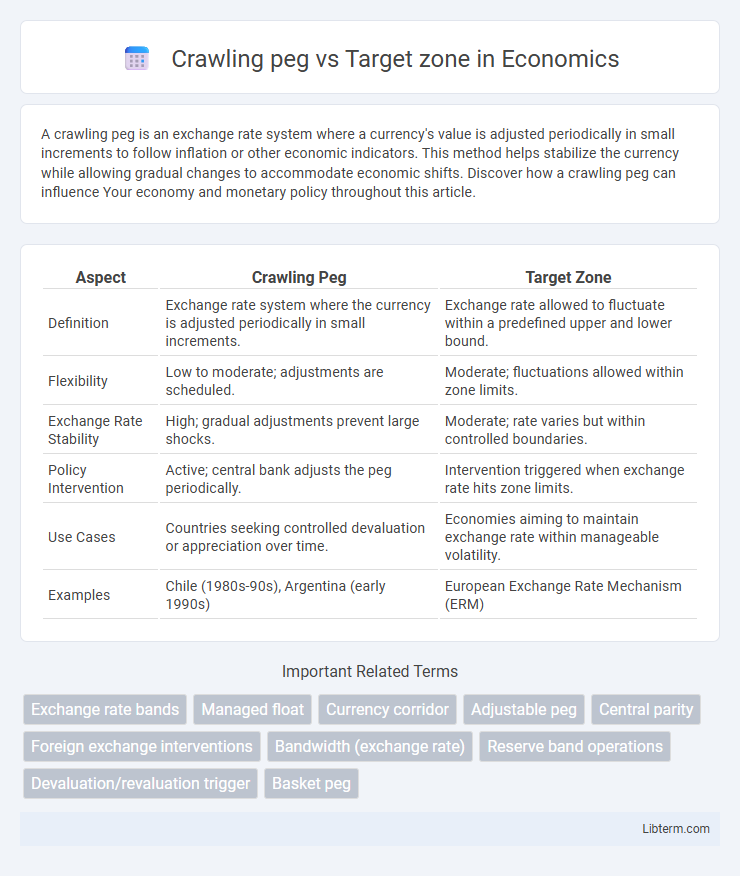

| Aspect | Crawling Peg | Target Zone |

|---|---|---|

| Definition | Exchange rate system where the currency is adjusted periodically in small increments. | Exchange rate allowed to fluctuate within a predefined upper and lower bound. |

| Flexibility | Low to moderate; adjustments are scheduled. | Moderate; fluctuations allowed within zone limits. |

| Exchange Rate Stability | High; gradual adjustments prevent large shocks. | Moderate; rate varies but within controlled boundaries. |

| Policy Intervention | Active; central bank adjusts the peg periodically. | Intervention triggered when exchange rate hits zone limits. |

| Use Cases | Countries seeking controlled devaluation or appreciation over time. | Economies aiming to maintain exchange rate within manageable volatility. |

| Examples | Chile (1980s-90s), Argentina (early 1990s) | European Exchange Rate Mechanism (ERM) |

Introduction to Crawling Peg and Target Zone

A crawling peg is an exchange rate system where a currency's value is adjusted periodically in small increments to reflect market conditions, aiming to avoid large shocks. The target zone is a policy framework where exchange rates fluctuate within a predetermined band or range, providing stability while allowing some flexibility. Both systems serve to manage currency volatility but differ in adjustment mechanisms and the degree of exchange rate control.

Definition of Crawling Peg

A crawling peg is a currency exchange rate regime where a country's currency value is adjusted periodically at a fixed, pre-announced rate or in response to certain indicators to maintain stability. It allows for gradual devaluation or revaluation to reflect economic conditions without abrupt changes. In contrast, a target zone sets a currency value range within which the exchange rate is allowed to fluctuate, providing a broader band of flexibility.

Definition of Target Zone

A target zone is a fixed exchange rate policy where a currency's value is allowed to fluctuate within a specified range or band around a central parity, set by the monetary authorities to maintain exchange rate stability. Unlike a crawling peg, which involves gradual, predetermined adjustments to the central parity, a target zone permits market forces to determine the exchange rate movement within the defined boundaries. Central banks intervene only when the currency approaches the upper or lower limits of the target zone to prevent excessive volatility and ensure the exchange rate remains within the established band.

Key Differences Between Crawling Peg and Target Zone

A crawling peg is an exchange rate regime where a currency's value is adjusted periodically in small increments at a fixed, pre-announced rate, helping to control inflation and maintain competitiveness. A target zone, however, allows the currency to fluctuate within a predetermined band, where central banks intervene only if the currency approaches the upper or lower limits, providing more flexibility. Key differences include the frequency and predictability of adjustments, with crawling pegs involving systematic, scheduled changes, whereas target zones permit market-driven fluctuations within set boundaries.

Mechanisms of Crawling Peg Exchange Rate System

The crawling peg exchange rate system adjusts a currency's value incrementally at pre-announced intervals or in response to inflation differentials, maintaining gradual alignment with economic fundamentals. This mechanism helps prevent sharp currency volatility by allowing the exchange rate to "crawl" within narrowly defined limits, providing stability while enabling flexibility. Central banks intervene periodically to realign the currency within a predetermined band, differentiating it from a target zone where the exchange rate fluctuates within set upper and lower bounds without scheduled adjustments.

Mechanisms of Target Zone Exchange Rate System

The Target Zone Exchange Rate System stabilizes currency values by allowing exchange rates to fluctuate within predefined margins around a fixed central parity, using intervention policies to maintain rates within this band. Mechanisms involve active central bank interventions through foreign exchange market transactions and interest rate adjustments to counteract excessive deviations from the target zone boundaries. This system contrasts with the Crawling Peg, where the exchange rate is periodically adjusted in small increments, while the Target Zone emphasizes maintaining exchange rate stability within a controlled fluctuation range.

Advantages of a Crawling Peg System

A crawling peg system offers the advantage of gradual adjustments to a currency's value, reducing exchange rate volatility and providing greater stability for international trade and investment. This approach helps manage inflation expectations by allowing small, predictable devaluations, which supports export competitiveness over time. Compared to a target zone, the crawling peg minimizes speculative attacks by maintaining a clear and transparent exchange rate path.

Advantages of a Target Zone System

A target zone exchange rate system offers greater flexibility by allowing the currency to fluctuate within a predefined band, reducing the risk of speculative attacks compared to fixed rates. This system promotes more stable trade and investment environments by providing predictable exchange rate ranges while accommodating market adjustments. The controlled volatility under a target zone helps maintain competitiveness without the rigidity of a crawling peg, fostering economic stability.

Drawbacks and Challenges of Each System

Crawling peg systems face challenges such as vulnerability to speculative attacks due to frequent small adjustments and difficulty in maintaining credibility if economic fundamentals shift rapidly. Target zone regimes encounter drawbacks including the need for substantial foreign exchange reserves to defend the zone boundaries and potential policy conflicts when market pressures push the currency toward the edges. Both systems require constant monitoring and intervention, which can strain central bank resources and reduce market confidence if mismanaged.

Real-World Examples and Case Studies

Brazil implemented a crawling peg system in the late 1990s to stabilize its currency by adjusting exchange rates incrementally, which helped control inflation during economic volatility. In contrast, the European Exchange Rate Mechanism (ERM) served as a target zone system in the 1990s, maintaining currency fluctuations within agreed bands to prepare for the euro introduction. These cases illustrate how crawling pegs provide gradual adjustments suited for economies facing inflation, while target zones emphasize stability and convergence among multiple currencies.

Crawling peg Infographic

libterm.com

libterm.com