Arbitrage Pricing Theory (APT) is a multifactor financial model used to determine the expected return of an asset based on various macroeconomic factors and their sensitivities. It offers a more flexible approach compared to the Capital Asset Pricing Model (CAPM) by incorporating multiple risk sources rather than relying on a single market portfolio. Explore the rest of the article to understand how APT can enhance your investment decision-making process.

Table of Comparison

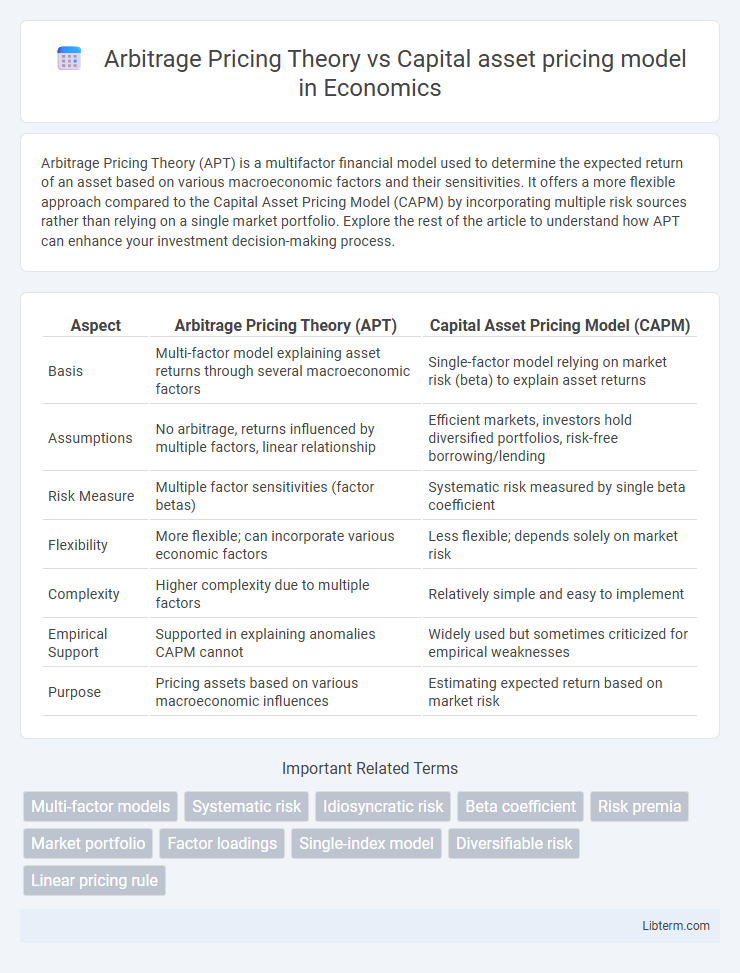

| Aspect | Arbitrage Pricing Theory (APT) | Capital Asset Pricing Model (CAPM) |

|---|---|---|

| Basis | Multi-factor model explaining asset returns through several macroeconomic factors | Single-factor model relying on market risk (beta) to explain asset returns |

| Assumptions | No arbitrage, returns influenced by multiple factors, linear relationship | Efficient markets, investors hold diversified portfolios, risk-free borrowing/lending |

| Risk Measure | Multiple factor sensitivities (factor betas) | Systematic risk measured by single beta coefficient |

| Flexibility | More flexible; can incorporate various economic factors | Less flexible; depends solely on market risk |

| Complexity | Higher complexity due to multiple factors | Relatively simple and easy to implement |

| Empirical Support | Supported in explaining anomalies CAPM cannot | Widely used but sometimes criticized for empirical weaknesses |

| Purpose | Pricing assets based on various macroeconomic influences | Estimating expected return based on market risk |

Introduction to Arbitrage Pricing Theory and Capital Asset Pricing Model

Arbitrage Pricing Theory (APT) is a multi-factor model that explains asset returns through several macroeconomic factors, offering a flexible alternative to the single-factor Capital Asset Pricing Model (CAPM), which relies solely on market risk. APT assumes no arbitrage opportunities and quantifies prices based on multiple systematic risk factors, making it valuable in capturing diverse sources of market risk. CAPM, by contrast, calculates expected returns using the risk-free rate, beta coefficient, and market risk premium, emphasizing the relationship between systematic risk and expected return in equilibrium markets.

Historical Background and Development

Arbitrage Pricing Theory (APT) emerged in the 1970s as a multifactor alternative to the Capital Asset Pricing Model (CAPM), which was introduced by William Sharpe in the 1960s. CAPM is grounded on the single-factor market risk premise, while APT, developed by Stephen Ross, incorporates multiple economic factors to explain asset returns more flexibly. The historical development of APT reflects increasing recognition of market complexities that CAPM's simplistic framework could not fully capture.

Key Assumptions of Arbitrage Pricing Theory

Arbitrage Pricing Theory (APT) assumes multiple macroeconomic factors influence asset returns, unlike the Capital Asset Pricing Model (CAPM), which relies on a single market risk factor. APT presumes no arbitrage opportunities exist, ensuring that asset prices adjust to reflect all available information across these factors. It also assumes linear relationships between asset returns and factor sensitivities, allowing more flexible and realistic risk assessment compared to CAPM's reliance on market portfolio betas.

Key Assumptions of Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) assumes investors are rational and markets are efficient, with all investors having access to the same information and operating under a single-period investment horizon. It presumes a risk-free rate exists, investors can borrow and lend unlimited amounts at this risk-free rate, and that asset returns are normally distributed. CAPM simplifies portfolio risk to a single factor, beta, which measures an asset's sensitivity to market movements, contrasting with the multi-factor approach of Arbitrage Pricing Theory.

Mathematical Framework: APT vs. CAPM

Arbitrage Pricing Theory (APT) employs a multi-factor mathematical framework where asset returns are modeled as a linear function of various macroeconomic factors, allowing for multiple sources of systematic risk. Capital Asset Pricing Model (CAPM) relies on a single-factor framework centered on the market portfolio, with asset returns dependent on beta, which measures sensitivity to market risk. APT's equation expresses expected returns as the sum of risk-free rate plus risk premiums weighted by factor sensitivities, while CAPM formulates expected returns as the risk-free rate plus the product of beta and the market risk premium.

Risk Factors Considered in Each Model

The Arbitrage Pricing Theory (APT) incorporates multiple macroeconomic risk factors such as inflation rates, interest rates, and industrial production, providing a multifactor approach to asset pricing. The Capital Asset Pricing Model (CAPM) relies on a single systematic risk factor, the market portfolio's excess return, to explain expected asset returns. APT captures diverse sources of systematic risk, while CAPM focuses solely on market risk measured by beta.

Portfolio Diversification: APT Compared to CAPM

Arbitrage Pricing Theory (APT) offers greater flexibility in portfolio diversification by incorporating multiple macroeconomic factors that influence asset returns, unlike the Capital Asset Pricing Model (CAPM), which relies solely on market risk represented by beta. APT enables investors to diversify across various risk factors, reducing reliance on the single market factor assumption inherent in CAPM. This multifactor approach allows for a more comprehensive risk assessment and potentially improved portfolio optimization.

Empirical Evidence and Practical Applications

Empirical evidence indicates that the Arbitrage Pricing Theory (APT) often provides better explanatory power for asset returns compared to the Capital Asset Pricing Model (CAPM), as APT incorporates multiple systematic risk factors while CAPM relies solely on market risk. Practical applications of APT include multi-factor risk management and portfolio optimization, enabling investors to capture diverse economic influences like inflation and industrial production. In contrast, CAPM remains prevalent in cost of capital estimation and single-factor market risk assessments due to its simplicity and ease of use despite empirical limitations.

Strengths and Limitations of APT and CAPM

Arbitrage Pricing Theory (APT) offers flexibility by incorporating multiple macroeconomic factors to explain asset returns, allowing for a more comprehensive risk assessment compared to the Capital Asset Pricing Model (CAPM), which relies on a single market beta factor. APT's strength lies in its ability to account for diverse sources of systematic risk, but it requires accurate identification of relevant factors and can be complex to implement. In contrast, CAPM provides a straightforward and widely used framework with easily interpretable results, yet it assumes a simplistic market equilibrium and single-factor risk, which can limit its explanatory power in real-world scenarios.

Choosing Between APT and CAPM: Which Model to Use?

Choosing between Arbitrage Pricing Theory (APT) and the Capital Asset Pricing Model (CAPM) depends on the complexity of the investment environment and required factors. CAPM relies on a single market risk factor and assumes efficient markets, making it suitable for straightforward portfolio analysis. APT incorporates multiple macroeconomic variables, offering a more flexible and realistic approach for diversified portfolios sensitive to various risk sources.

Arbitrage Pricing Theory Infographic

libterm.com

libterm.com