Time inconsistency occurs when individuals or policymakers change their preferences over time, leading to decisions that may contradict earlier plans or commitments. This phenomenon often results in challenges for long-term planning and economic policy, as actions optimal today might be reversed in the future for immediate benefits. Discover how understanding time inconsistency can improve your decision-making by exploring the detailed insights in the rest of this article.

Table of Comparison

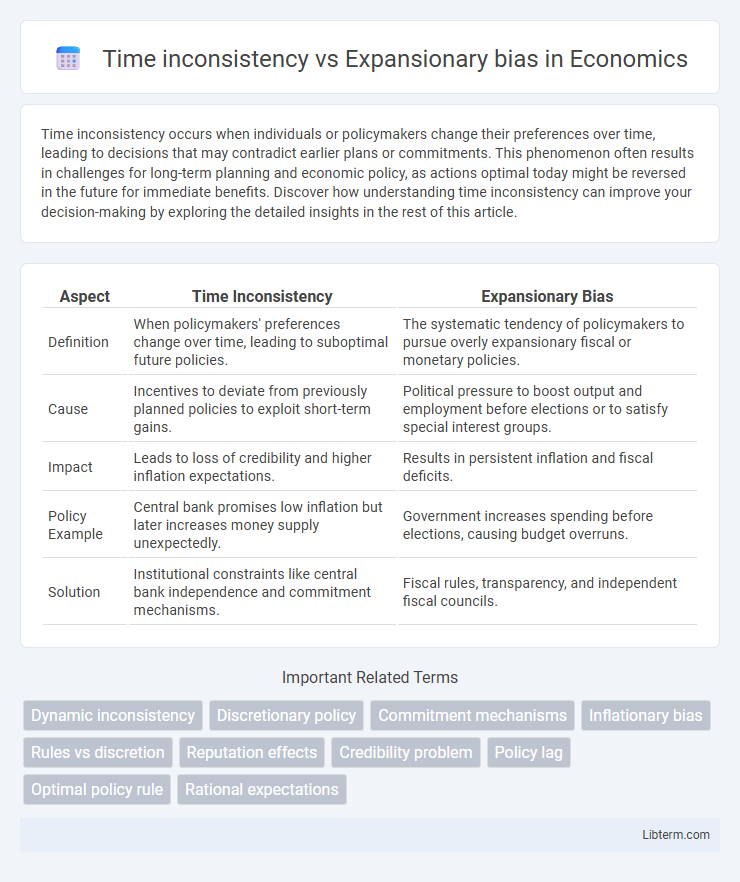

| Aspect | Time Inconsistency | Expansionary Bias |

|---|---|---|

| Definition | When policymakers' preferences change over time, leading to suboptimal future policies. | The systematic tendency of policymakers to pursue overly expansionary fiscal or monetary policies. |

| Cause | Incentives to deviate from previously planned policies to exploit short-term gains. | Political pressure to boost output and employment before elections or to satisfy special interest groups. |

| Impact | Leads to loss of credibility and higher inflation expectations. | Results in persistent inflation and fiscal deficits. |

| Policy Example | Central bank promises low inflation but later increases money supply unexpectedly. | Government increases spending before elections, causing budget overruns. |

| Solution | Institutional constraints like central bank independence and commitment mechanisms. | Fiscal rules, transparency, and independent fiscal councils. |

Understanding Time Inconsistency in Economic Policy

Time inconsistency in economic policy occurs when policymakers' preferences change over time, leading to decisions that are optimal in the short term but suboptimal in the long run, undermining credibility and effectiveness. Expansionary bias arises when policymakers systematically prefer stimulative policies to boost output and employment, despite potential inflationary consequences, often due to political incentives or electoral pressures. Understanding these concepts is crucial for designing institutions and rules that commit policymakers to consistent, credible policies, improving long-term economic stability and reducing inflationary risks.

Defining the Expansionary Bias Phenomenon

Expansionary bias occurs when policymakers consistently implement more accommodative fiscal or monetary policies than optimal, driven by political incentives to boost short-term economic output despite long-term costs. This phenomenon arises from the divergence between private agents' expectations and policymakers' actions, leading to systematically higher inflation or fiscal deficits. Time inconsistency, closely related to expansionary bias, refers to the inability of policymakers to commit to future plans, resulting in policy reversals that undermine credibility and economic stability.

Historical Origins of Time Inconsistency

The historical origins of time inconsistency trace back to the seminal work of Finn Kydland and Edward Prescott in the 1970s, who identified the challenge of policymakers' inability to commit to future policies, leading to suboptimal economic outcomes. This concept contrasts with expansionary bias, where policymakers systematically prefer short-term stimulus at the expense of long-term stability. Understanding these origins clarifies why rules-based policy frameworks were developed to mitigate the temptation of discretion that underlies time inconsistency.

Causes and Consequences of Expansionary Bias

Expansionary bias occurs when policymakers prioritize short-term output gains over long-term economic stability, often due to political pressures and the temptation to exploit the short-run Phillips curve. This bias results in persistent inflationary expectations, undermining monetary credibility and causing higher inflation without corresponding decreases in unemployment. The main consequence is a time inconsistency problem where initial promises of low inflation are not credible, leading to suboptimal economic outcomes and increased policy volatility.

Interconnections Between Time Inconsistency and Expansionary Bias

Time inconsistency arises when policymakers have incentives to deviate from previously announced policies, often to exploit short-term gains, which directly contributes to expansionary bias by encouraging overly loose fiscal or monetary policies. Expansionary bias reflects a persistent preference for stimulus despite long-term inflationary costs, rooted in the inability to commit credibly to restrained policy paths, illustrating the fundamental interconnection with time inconsistency. Empirical studies demonstrate that institutions lacking credible commitment mechanisms exhibit higher occurrences of expansionary bias, highlighting the critical role of credible policy frameworks in mitigating the effects of time inconsistency.

Policy Implications of Time-Inconsistent Behavior

Time-inconsistent behavior in economic policy leads to challenges in maintaining credible commitments, often resulting in suboptimal outcomes such as higher inflation or fiscal deficits. Expansionary bias occurs when policymakers systematically favor short-term stimulus at the expense of long-term stability, exacerbating time inconsistency problems. Implementing rules-based policies and independent institutions can mitigate these effects by enhancing commitment credibility and reducing the temptation for opportunistic expansionary actions.

Case Studies Demonstrating Expansionary Bias

Case studies demonstrating expansionary bias frequently analyze fiscal policies in emerging economies where governments prioritize short-term political gains over long-term stability, leading to persistent budget deficits and rising public debt. Examples include Argentina's recurrent fiscal expansions despite inflationary pressures and Greece's pre-2009 fiscal practices that masked true debt levels, ultimately causing severe economic crises. These cases underscore how expansionary bias results from policymakers' incentives misaligned with sustainable fiscal discipline, contrasting with time inconsistency problems that focus more on monetary policy credibility.

Institutional Solutions to Time Inconsistency in Policy-Making

Institutional solutions to time inconsistency in policy-making include the establishment of independent central banks, which distance monetary policy decisions from political pressures that often drive expansionary bias. Rules-based frameworks, such as inflation targeting or fiscal rules, constrain policymakers to commit to long-term objectives, reducing the temptation to exploit short-term gains at the expense of future stability. Transparent accountability mechanisms and legislative oversight enhance commitment credibility, preventing policymakers from deviating towards overly expansionary policies that lead to suboptimal economic outcomes.

The Role of Central Banks in Mitigating Expansionary Bias

Central banks mitigate expansionary bias by committing to credible, rule-based monetary policies that anchor inflation expectations and reduce discretionary interventions prone to political pressures. Independent central banks with transparent communication frameworks enhance policy credibility, decreasing the temptation to exploit short-term demand expansions that lead to suboptimal long-term inflation outcomes. Empirical evidence shows that higher central bank independence correlates with lower inflation and improved macroeconomic stability, effectively addressing time inconsistency problems linked to expansionary bias.

Comparing Long-Term Outcomes: Time Inconsistency vs. Expansionary Bias

Time inconsistency occurs when policymakers alter their plans after committing to a policy, leading to suboptimal long-term outcomes like higher inflation and reduced credibility. Expansionary bias refers to a systematic tendency for policymakers to pursue overly stimulative policies, often resulting in persistent fiscal deficits and inflationary pressures. Comparing these phenomena reveals that while time inconsistency stems from a lack of commitment over time, expansionary bias is linked to structural incentives, both causing inflationary distortions and undermining economic stability in the long run.

Time inconsistency Infographic

libterm.com

libterm.com