The classical model emphasizes rational decision-making and efficiency in organizational structures, focusing on hierarchy, specialization, and clear authority lines. It assumes that employees work best when tasks are clearly defined and controlled, leading to optimal productivity. Discover how this approach can impact Your organization's success by exploring the rest of the article.

Table of Comparison

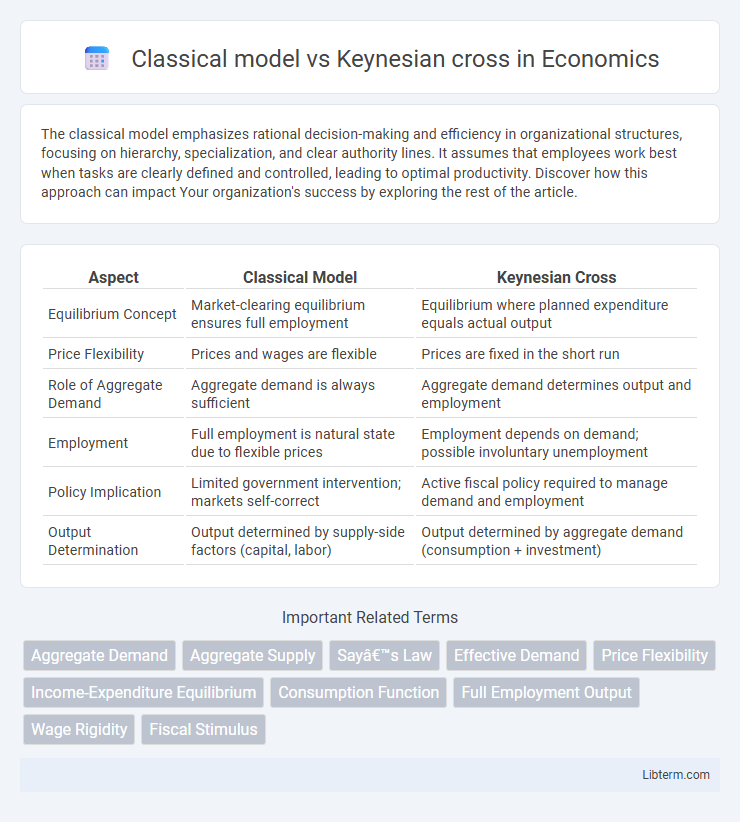

| Aspect | Classical Model | Keynesian Cross |

|---|---|---|

| Equilibrium Concept | Market-clearing equilibrium ensures full employment | Equilibrium where planned expenditure equals actual output |

| Price Flexibility | Prices and wages are flexible | Prices are fixed in the short run |

| Role of Aggregate Demand | Aggregate demand is always sufficient | Aggregate demand determines output and employment |

| Employment | Full employment is natural state due to flexible prices | Employment depends on demand; possible involuntary unemployment |

| Policy Implication | Limited government intervention; markets self-correct | Active fiscal policy required to manage demand and employment |

| Output Determination | Output determined by supply-side factors (capital, labor) | Output determined by aggregate demand (consumption + investment) |

Introduction to Classical and Keynesian Models

The Classical model emphasizes long-term economic equilibrium driven by flexible prices and wages, assuming full employment and self-regulating markets. The Keynesian cross model, however, focuses on short-term economic fluctuations, highlighting aggregate demand as the primary determinant of output and employment levels. Keynesian theory challenges the Classical assumption by introducing government intervention to address demand deficiencies and prevent prolonged recessions.

Historical Context and Development

The Classical model, developed in the 18th and 19th centuries by economists such as Adam Smith and David Ricardo, emphasizes self-regulating markets and Say's Law, which posits that supply creates its own demand. Emerging during the Great Depression in the 1930s, the Keynesian cross by John Maynard Keynes challenged classical assumptions by illustrating how aggregate demand, rather than supply, drives economic output in the short run, advocating for government intervention to address unemployment. This paradigm shift marked a fundamental development in macroeconomic theory, transitioning from market self-correction to active policy responses in economic downturns.

Core Assumptions of the Classical Model

The Classical Model assumes flexible prices and wages that ensure full employment and market equilibrium through self-correcting mechanisms in the economy. It posits that aggregate supply always equals aggregate demand in the long run due to price adjustments, relying on Say's Law which states that supply creates its own demand. In contrast, the Keynesian Cross highlights demand-driven fluctuations, emphasizing sticky prices and wages that can cause prolonged periods of unemployment and output gaps.

Foundational Concepts of the Keynesian Cross

The Keynesian Cross model centers on aggregate expenditure and its role in determining equilibrium output, emphasizing the significance of planned spending in driving economic activity. It rejects the Classical model's assumption of self-correcting markets by illustrating that output adjusts to demand rather than prices adjusting to clear markets. This foundational concept highlights the multiplier effect, where changes in autonomous spending lead to amplified shifts in equilibrium income, underscoring Keynesian economics' focus on demand-side stimuli.

Aggregate Demand and Supply: A Comparative Perspective

The Classical model assumes aggregate supply is perfectly inelastic and always equals aggregate demand at full employment, emphasizing price and wage flexibility to clear markets. In contrast, the Keynesian cross highlights aggregate demand's decisive role in determining output and employment, with aggregate supply exhibiting short-run rigidity due to sticky prices and wages. This fundamental divergence underlines the Classical model's focus on long-run equilibrium versus the Keynesian emphasis on short-run demand-driven fluctuations.

Price and Wage Flexibility: Classical vs Keynesian View

The classical model assumes complete price and wage flexibility, allowing markets to clear quickly and ensuring full employment through adjustments in wages and prices. In contrast, the Keynesian cross model highlights price and wage rigidity, which can lead to prolonged periods of unemployment and output gaps because prices and wages do not adjust swiftly to restore equilibrium. This fundamental difference underpins the classical belief in self-correcting markets versus the Keynesian emphasis on active policy intervention to stabilize the economy.

Role of Government Intervention

The Classical model emphasizes limited government intervention, advocating for self-regulating markets where supply creates its own demand, relying on flexible prices and wages to achieve equilibrium. In contrast, the Keynesian cross model highlights the government's critical role in stabilizing the economy through fiscal policy, using government spending and taxation to manage aggregate demand and counteract economic fluctuations. Keynesian theory supports active fiscal intervention to address demand shortfalls, especially during recessions, while the Classical approach favors minimal interference to allow natural market adjustments.

Implications for Unemployment and Output

The Classical model posits that markets, including labor markets, clear efficiently, implying no cyclical unemployment and that output always returns to its natural level determined by factors like technology and resources. The Keynesian cross, in contrast, emphasizes aggregate demand's role, showing that insufficient demand can lead to sustained unemployment and output below potential, highlighting the need for government intervention. Keynesian analysis suggests that fiscal stimulus can close the output gap and reduce unemployment when the economy is in a demand-deficient recession.

Policy Responses to Economic Fluctuations

Classical model emphasizes self-correcting markets where fiscal policy is largely ineffective due to flexible prices and wages restoring equilibrium without government intervention. Keynesian cross advocates for active fiscal policies, such as increased government spending and tax cuts, to stimulate aggregate demand and counteract economic downturns. Empirical evidence supports Keynesian interventions, especially during recessions when nominal rigidities prevent automatic adjustments in output and employment.

Conclusion: Evaluating Classical and Keynesian Approaches

The Classical model emphasizes market self-regulation and long-term equilibrium through flexible prices and wages, while the Keynesian cross highlights aggregate demand's role in determining output and employment in the short run. Keynesian approaches advocate for active fiscal policy to address demand deficiencies, contrasting with the Classical reliance on supply-side adjustments. Evaluating both models reveals the Keynesian framework's relevance during economic downturns, whereas the Classical model aligns with growth and inflation dynamics in stable economies.

Classical model Infographic

libterm.com

libterm.com