Fiscal neutrality ensures tax policies do not distort economic decisions, allowing markets to function efficiently without favoring one activity over another. Maintaining this balance supports fair competition and promotes sustainable economic growth. Discover how fiscal neutrality impacts your financial decisions in the rest of this article.

Table of Comparison

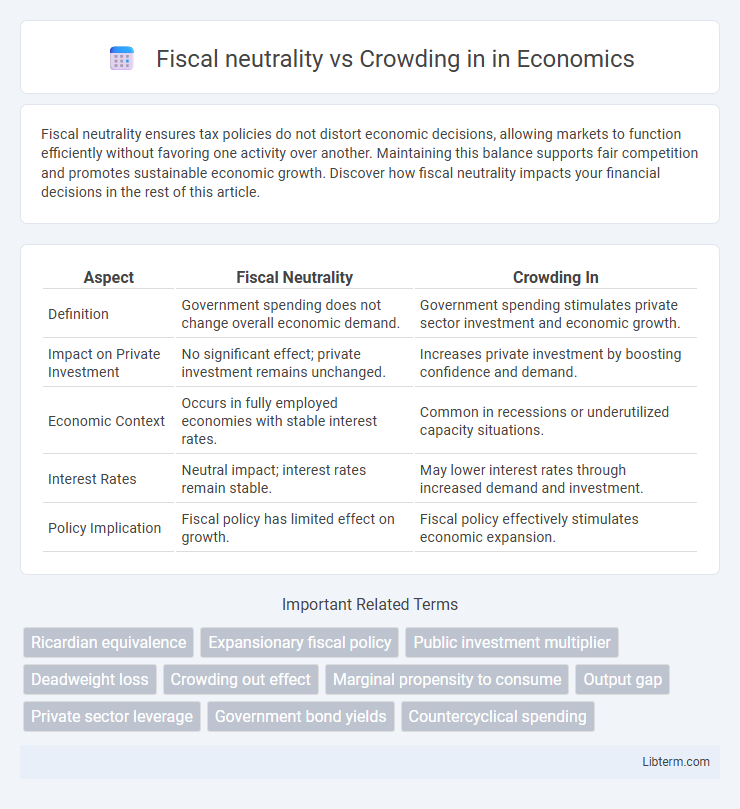

| Aspect | Fiscal Neutrality | Crowding In |

|---|---|---|

| Definition | Government spending does not change overall economic demand. | Government spending stimulates private sector investment and economic growth. |

| Impact on Private Investment | No significant effect; private investment remains unchanged. | Increases private investment by boosting confidence and demand. |

| Economic Context | Occurs in fully employed economies with stable interest rates. | Common in recessions or underutilized capacity situations. |

| Interest Rates | Neutral impact; interest rates remain stable. | May lower interest rates through increased demand and investment. |

| Policy Implication | Fiscal policy has limited effect on growth. | Fiscal policy effectively stimulates economic expansion. |

Introduction to Fiscal Neutrality and Crowding In

Fiscal neutrality occurs when government spending does not alter overall economic demand, maintaining a balanced fiscal impact. Crowding in refers to increased private investment triggered by government expenditure improving economic conditions or infrastructure. Understanding these concepts is essential for evaluating the effectiveness of fiscal policy and its influence on private sector activities.

Defining Fiscal Neutrality: Core Principles

Fiscal neutrality emphasizes maintaining a balanced government budget where public spending and revenues do not distort market outcomes or influence private sector activities. Core principles include non-interference in resource allocation, ensuring that fiscal policies neither stimulate nor suppress investment independently of economic fundamentals. This approach contrasts with crowding in, which involves fiscal measures aimed at encouraging private sector investment by increasing demand through public expenditure or tax incentives.

Understanding Crowding In: Economic Implications

Crowding in refers to a phenomenon where increased government spending stimulates private sector investment, enhancing overall economic growth rather than displacing it. This effect often occurs when public investments address market failures, improve infrastructure, or boost confidence in economic prospects. Understanding crowding in highlights the potential for fiscal policy to catalyze private capital flow, supporting sustained economic expansion beyond initial government expenditure.

Key Differences Between Fiscal Neutrality and Crowding In

Fiscal neutrality occurs when government borrowing does not affect private sector investment, maintaining steady interest rates and unchanged capital allocation. Crowding in happens when increased public spending stimulates private investment by boosting demand or improving economic confidence, leading to a rise in overall investment levels. The key difference lies in fiscal neutrality preserving the status quo in private investment, while crowding in actively enhances private sector participation through government fiscal actions.

Fiscal Policy Tools: Impact on Neutrality and Crowding In

Fiscal policy tools, such as government spending and taxation, play critical roles in maintaining fiscal neutrality or promoting crowding in economic activity. Fiscal neutrality occurs when government interventions neither stimulate nor suppress private investment, preserving market equilibrium, while crowding in happens when public spending encourages additional private sector investment by improving economic confidence or infrastructure. Understanding the impact of instruments like targeted tax incentives or public capital projects helps policymakers balance fiscal neutrality with the potential benefits of crowding in to foster sustainable economic growth.

Empirical Evidence: Case Studies and Global Trends

Empirical evidence from case studies in emerging markets demonstrates that fiscal neutrality, where government spending neither stimulates nor suppresses private investment, contrasts with crowding in effects seen in advanced economies experiencing strategic public investments. Data from World Bank reports and IMF analyses highlight how infrastructure projects in countries like Brazil and India have generated crowding in by catalyzing private sector growth, while regions with rigid fiscal policies, such as parts of the Eurozone, exhibit fiscal neutrality outcomes. Global trends indicate that targeted government expenditure aligned with economic complementarities tends to induce crowding in, suggesting nuanced policy designs are critical for optimizing investment dynamics.

Economic Growth: Effects of Fiscal Neutrality vs Crowding In

Fiscal neutrality maintains government spending levels without significantly altering private sector investment, preserving steady economic growth by avoiding market distortions. Crowding in occurs when increased public investment stimulates additional private sector spending, amplifying overall economic growth through enhanced infrastructure, innovation, or demand. Empirical studies demonstrate that crowding in is more likely in environments with underutilized resources and effective policy coordination, leading to stronger and more sustained economic expansion.

Monetary Policy Interactions and Fiscal Outcomes

Fiscal neutrality occurs when government fiscal actions, such as changes in taxes or public spending, do not alter overall economic demand because monetary policy offsets these effects. Crowding in happens when fiscal stimulus boosts private investment by improving economic conditions, often supported by accommodative monetary policy that keeps interest rates low. The interplay between monetary policy and fiscal outcomes determines whether fiscal measures lead to neutral, contractionary, or expansionary effects on growth and investment.

Policy Implications for Government Decision-Making

Fiscal neutrality ensures government interventions do not distort market allocations, maintaining efficient resource distribution and stable economic environments. Crowding in occurs when government spending stimulates private sector investment, amplifying economic growth through enhanced demand and improved infrastructure. Policy decisions must balance these effects by designing fiscal measures that encourage private investment without undermining market efficiency or causing excessive public debt.

Conclusion: Balancing Fiscal Neutrality and Crowding In

Achieving a balance between fiscal neutrality and crowding in is essential for sustainable economic growth, as excessive government spending can displace private investment, while well-targeted public expenditure can stimulate private sector activity and innovation. Fiscal policies must be designed to minimize distortion in capital markets while maximizing multiplier effects that encourage private investment and productivity. Effective coordination between fiscal and monetary policy, along with transparent budget management, helps maintain this equilibrium and fosters long-term economic resilience.

Fiscal neutrality Infographic

libterm.com

libterm.com