Idiosyncratic risk refers to the potential for loss due to factors unique to a specific company or asset, such as management decisions or product recalls. This type of risk can be minimized through diversification, as it does not affect the entire market. Discover how understanding idiosyncratic risk can enhance your investment strategy by reading the full article.

Table of Comparison

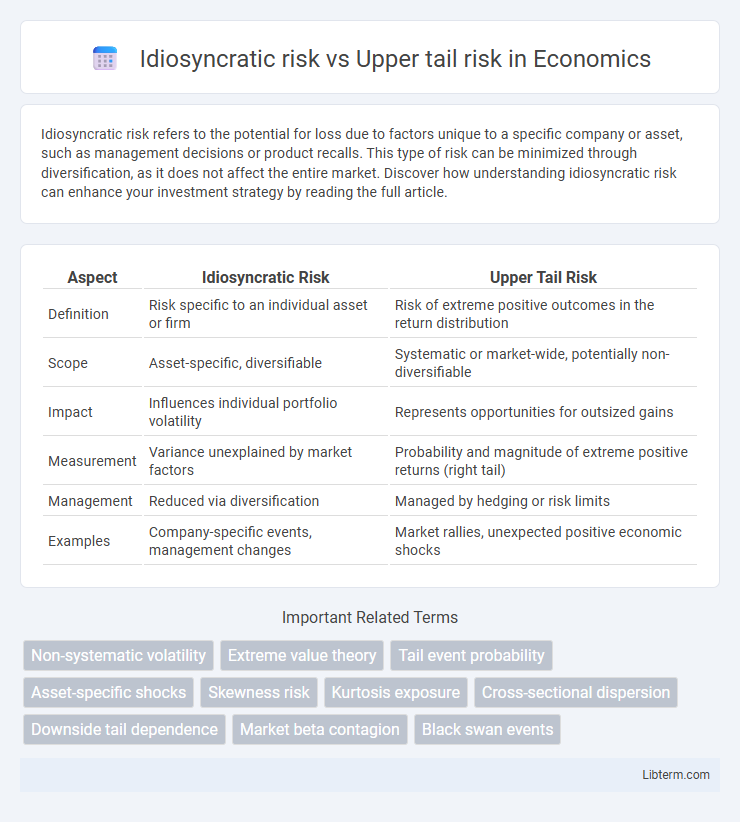

| Aspect | Idiosyncratic Risk | Upper Tail Risk |

|---|---|---|

| Definition | Risk specific to an individual asset or firm | Risk of extreme positive outcomes in the return distribution |

| Scope | Asset-specific, diversifiable | Systematic or market-wide, potentially non-diversifiable |

| Impact | Influences individual portfolio volatility | Represents opportunities for outsized gains |

| Measurement | Variance unexplained by market factors | Probability and magnitude of extreme positive returns (right tail) |

| Management | Reduced via diversification | Managed by hedging or risk limits |

| Examples | Company-specific events, management changes | Market rallies, unexpected positive economic shocks |

Understanding Idiosyncratic Risk: A Primer

Idiosyncratic risk refers to the variability in an asset's returns caused by factors unique to a specific company or industry, distinguishable from market-wide risks. Understanding idiosyncratic risk is essential for portfolio diversification, as it can be mitigated through holding a broad range of securities, unlike upper tail risk which relates to extreme, rare events causing significant losses. Investors quantify idiosyncratic risk using measures like the asset-specific variance and beta-adjusted models to tailor risk management strategies effectively.

Defining Upper Tail Risk in Financial Contexts

Upper tail risk in financial contexts refers to the probability and impact of extreme positive returns that significantly exceed expected outcomes, often associated with rare, high-impact events. Unlike idiosyncratic risk, which is specific to individual assets or companies, upper tail risk captures the potential for outsized gains or losses driven by market-wide phenomena or systemic shocks. Investors must evaluate upper tail risk to optimize portfolio strategies for capturing rare but substantial profit opportunities or mitigating the effects of extreme market movements.

Key Differences Between Idiosyncratic and Upper Tail Risks

Idiosyncratic risk refers to the risk specific to a single asset or company, arising from factors unique to that entity, such as management decisions or product failures, and can be mitigated through diversification. Upper tail risk involves extreme positive outcomes in the distribution of returns, representing rare but highly beneficial events like significant market gains or unexpected windfalls. The key difference lies in idiosyncratic risk being asset-specific and typically negative, while upper tail risk pertains to the extreme positive edge of the return distribution, often highlighting opportunities rather than threats.

Examples of Idiosyncratic Risk in Real Markets

Idiosyncratic risk in real markets refers to risks unique to a specific company or industry, such as a sudden CEO resignation at Apple or a product recall by Tesla. These individual events cause stock price fluctuations independent of the broader market, contrasting with upper tail risk, which involves extreme market-wide events like financial crises or market bubbles bursting. Investors mitigate idiosyncratic risk through diversification, while upper tail risk often requires strategies like options or hedging to limit exposure to rare but severe losses.

How Upper Tail Risk Manifests in Asset Returns

Upper tail risk manifests in asset returns through extreme positive deviations that significantly exceed typical expected gains, often driven by rare but highly profitable events or market rallies. This risk captures the potential for outsized returns beyond normal market behavior, contrasting with idiosyncratic risk which relates to firm-specific uncertainties that can affect returns independently. Investors aiming to capitalize on upper tail risk must focus on assets or strategies with asymmetric payoff profiles that exhibit fat-tailed distributions in their return history.

Measuring and Quantifying Both Risk Types

Idiosyncratic risk is quantified using metrics such as stock-specific volatility and the residual variance obtained from factor models like the Capital Asset Pricing Model (CAPM). Upper tail risk is measured through tail risk indicators including Value at Risk (VaR), Conditional Value at Risk (CVaR), and extreme quantile analysis on portfolio returns to assess potential losses in worst-case scenarios. Statistical tools like skewness, kurtosis, and extreme value theory (EVT) models further enhance the quantification and differentiation of idiosyncratic and upper tail risks in financial portfolios.

Portfolio Diversification: Mitigating Idiosyncratic vs. Upper Tail Risks

Portfolio diversification effectively mitigates idiosyncratic risk by spreading investments across multiple assets, reducing the impact of any single asset's poor performance. In contrast, upper tail risk, which involves extreme positive outcomes, is less about avoidance and more about capturing rare high returns through strategic asset allocation. Optimizing a portfolio requires balancing broad diversification to minimize idiosyncratic losses while maintaining exposure to assets with potential for significant upside.

Practical Implications for Investors and Risk Managers

Idiosyncratic risk, specific to individual assets, can be mitigated through diversification, reducing exposure to company-specific shocks but requiring careful portfolio construction. Upper tail risk involves extreme market movements typically affecting multiple assets simultaneously, demanding strategies like stress testing, tail risk hedging, and dynamic asset allocation to protect against systemic events. Investors and risk managers must balance these risks by combining diversification with proactive measures against rare but severe losses to optimize risk-adjusted returns.

Case Studies: Idiosyncratic vs. Upper Tail Risk Events

Case studies highlighting idiosyncratic risk events often involve company-specific shocks such as corporate fraud scandals or sudden CEO departures, which severely impact the individual firm's stock price without broadly affecting the market. Upper tail risk events, exemplified by financial crises or natural disasters, cause widespread market disruptions and extreme losses across multiple sectors simultaneously. Analyzing the 2008 Lehman Brothers collapse reveals idiosyncratic risk amplified into systemic upper tail risk, illustrating the interplay and differences between these two risk types.

Future Trends in Risk Assessment and Management

Future trends in risk assessment emphasize advanced data analytics and machine learning to enhance the differentiation between idiosyncratic risk, which affects individual assets, and upper tail risk, representing extreme market events. Integration of real-time data and stress-testing models enables more dynamic management of portfolio vulnerabilities linked to both risk types. Increased regulatory focus and adoption of scenario analysis tools are driving improved strategies to mitigate unexpected, high-impact financial disruptions.

Idiosyncratic risk Infographic

libterm.com

libterm.com