Defined benefit plans guarantee a specified monthly payment at retirement, based on factors like salary history and years of service. These plans shift the investment risk to the employer, providing predictable income for retirees without requiring them to manage investments. Explore the rest of this article to understand how defined benefit plans work and their advantages for your retirement planning.

Table of Comparison

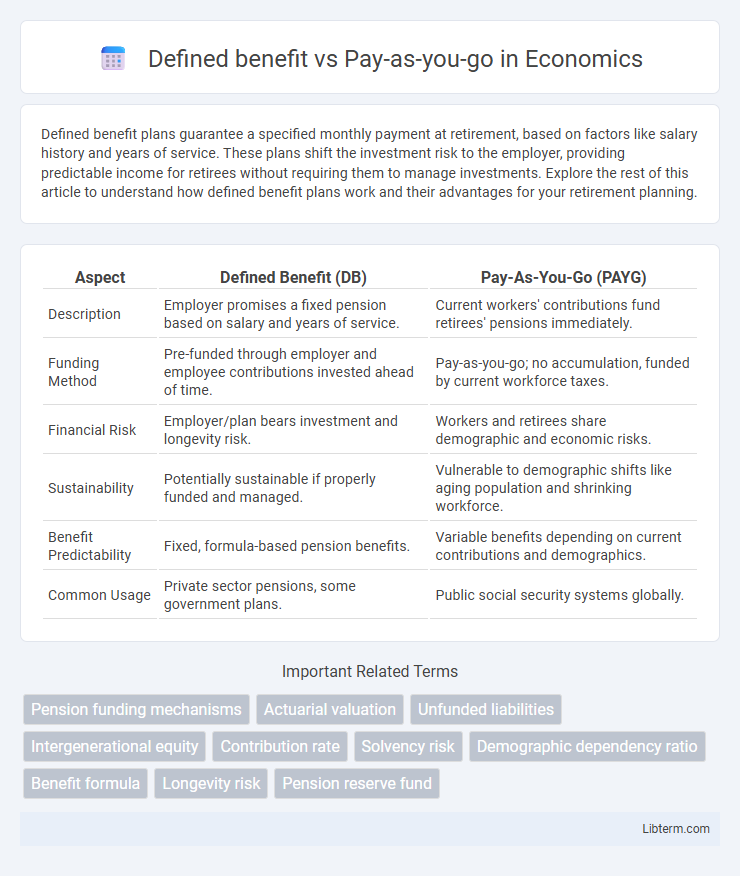

| Aspect | Defined Benefit (DB) | Pay-As-You-Go (PAYG) |

|---|---|---|

| Description | Employer promises a fixed pension based on salary and years of service. | Current workers' contributions fund retirees' pensions immediately. |

| Funding Method | Pre-funded through employer and employee contributions invested ahead of time. | Pay-as-you-go; no accumulation, funded by current workforce taxes. |

| Financial Risk | Employer/plan bears investment and longevity risk. | Workers and retirees share demographic and economic risks. |

| Sustainability | Potentially sustainable if properly funded and managed. | Vulnerable to demographic shifts like aging population and shrinking workforce. |

| Benefit Predictability | Fixed, formula-based pension benefits. | Variable benefits depending on current contributions and demographics. |

| Common Usage | Private sector pensions, some government plans. | Public social security systems globally. |

Introduction to Pension Systems

Defined benefit pension systems guarantee retirees a fixed payment based on salary and years of service, providing predictable income security. Pay-as-you-go pension schemes finance current retirees' benefits directly from workers' contributions, relying on the active workforce and demographic balance. Understanding these core structures highlights the financial sustainability challenges and risk distribution inherent in pension system design.

What is a Defined Benefit Plan?

A Defined Benefit Plan is a retirement plan where an employer guarantees a specified monthly benefit upon retirement, calculated using factors such as salary history and years of service. This plan places the investment risk on the employer, who is responsible for ensuring sufficient funds to pay the promised benefits. Unlike Pay-as-you-go systems, Defined Benefit Plans rely on pre-funded contributions and actuarial assumptions to secure long-term financial stability for retirees.

Understanding Pay-as-you-go Schemes

Pay-as-you-go (PAYG) schemes finance current retirees' benefits using contributions from current workers, creating an intergenerational transfer of funds. Unlike defined benefit plans that rely on pre-funded reserves, PAYG schemes depend on the demographic balance between active contributors and pensioners, making sustainability sensitive to population aging and workforce size fluctuations. Understanding PAYG involves analyzing contribution rates, replacement ratios, and the dependency ratio to evaluate long-term fiscal viability.

Key Differences between Defined Benefit and Pay-as-you-go

Defined benefit pension plans guarantee a fixed payout upon retirement, determined by salary history and years of service, whereas pay-as-you-go systems fund current retirees' benefits through current workers' contributions without accruing individual balances. Defined benefit plans require careful actuarial assumptions to maintain solvency, while pay-as-you-go relies heavily on demographic trends and workforce size to remain sustainable. The financial risk in defined benefit plans is primarily borne by the employer or fund manager, whereas in pay-as-you-go schemes, the risk shifts to future contributors and beneficiaries.

Funding Mechanisms Explained

Defined benefit plans are funded through employer and employee contributions invested over time to generate returns that finance future pension liabilities. Pay-as-you-go systems rely on current workers' contributions to pay retirees' benefits directly, without accumulating a dedicated fund. This difference in funding mechanisms affects the sustainability and risk distribution of each pension scheme.

Advantages of Defined Benefit Plans

Defined benefit plans provide guaranteed retirement income based on salary and years of service, offering predictable financial security for retirees. They shift investment risk from employees to employers, ensuring stable benefits regardless of market fluctuations. These plans often include cost-of-living adjustments, helping retirees maintain purchasing power over time.

Pros of Pay-as-you-go Systems

Pay-as-you-go (PAYG) systems offer the advantage of immediate funding through current contributions, which helps maintain liquidity and reduces the need for large upfront capital reserves. These systems automatically adjust to demographic changes and economic conditions, as benefits are financed by the working population, ensuring sustainability without heavy investment risk. Furthermore, PAYG schemes promote intergenerational solidarity by linking the welfare of retirees with the active workforce, enhancing social cohesion and support.

Challenges and Risks: Defined Benefit vs Pay-as-you-go

Defined benefit pension plans face significant challenges from demographic shifts, including increased life expectancy and aging populations, which escalate long-term funding liabilities and risk underfunding. Pay-as-you-go systems rely heavily on current workforce contributions, making them vulnerable to economic downturns, declining birth rates, and shrinking labor pools that threaten sustainability. Both models must address risks related to fiscal pressure and generational equity to ensure reliable retirement income for future beneficiaries.

Global Examples and Case Studies

Defined benefit pension systems, as seen in Canada and Germany, guarantee a fixed retirement income based on salary and years of service, backed by employer or government funds, ensuring predictable payouts but facing sustainability challenges amid aging populations. Pay-as-you-go (PAYG) schemes, prevalent in countries like France and Brazil, finance current retirees through contributions from the active workforce, emphasizing intergenerational fiscal balance but risking deficits during demographic shifts. Case studies reveal that Germany's transition to partially funded models aims to stabilize long-term liabilities, while Brazil's reforms address the fiscal strain from a growing retiree ratio relative to contributors.

Future Trends in Pension Models

Future trends in pension models show a gradual shift from traditional defined benefit schemes toward hybrid and pay-as-you-go systems to address demographic changes and fiscal sustainability. Advances in technology and data analytics enable more personalized and flexible retirement plans that can adjust to longevity risk and economic fluctuations. Governments and private sectors increasingly prioritize sustainability and risk-sharing mechanisms to secure retirement income in aging populations.

Defined benefit Infographic

libterm.com

libterm.com