The barter system is an ancient economic practice where goods and services are exchanged directly without using money. This method relies heavily on the double coincidence of wants, meaning both parties must have something the other desires. Explore the rest of the article to understand how the barter system evolved and its relevance in today's economy.

Table of Comparison

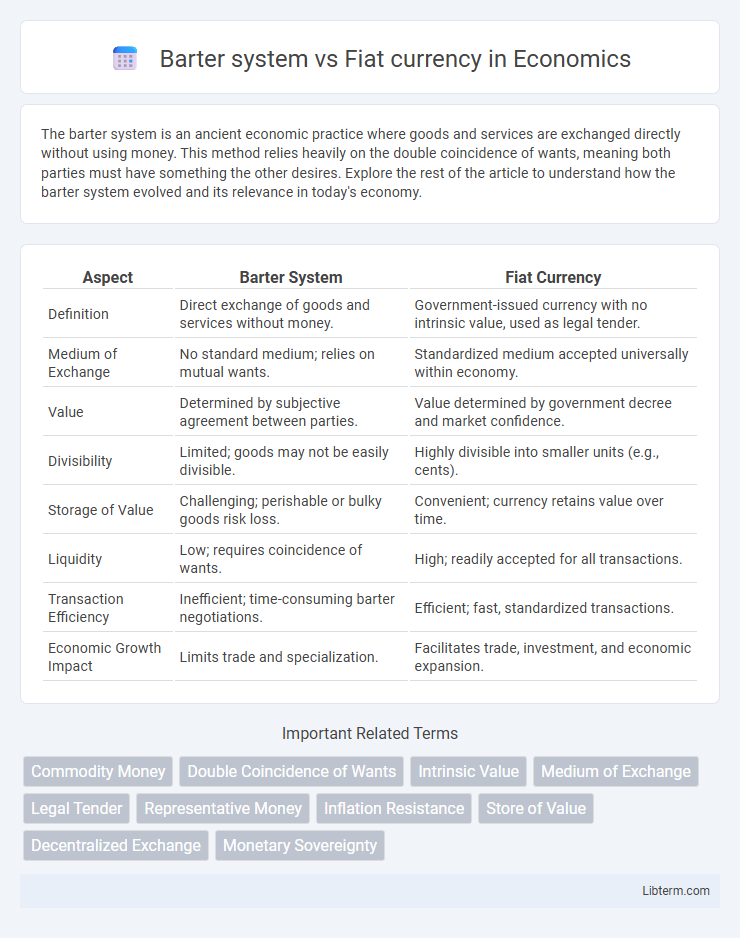

| Aspect | Barter System | Fiat Currency |

|---|---|---|

| Definition | Direct exchange of goods and services without money. | Government-issued currency with no intrinsic value, used as legal tender. |

| Medium of Exchange | No standard medium; relies on mutual wants. | Standardized medium accepted universally within economy. |

| Value | Determined by subjective agreement between parties. | Value determined by government decree and market confidence. |

| Divisibility | Limited; goods may not be easily divisible. | Highly divisible into smaller units (e.g., cents). |

| Storage of Value | Challenging; perishable or bulky goods risk loss. | Convenient; currency retains value over time. |

| Liquidity | Low; requires coincidence of wants. | High; readily accepted for all transactions. |

| Transaction Efficiency | Inefficient; time-consuming barter negotiations. | Efficient; fast, standardized transactions. |

| Economic Growth Impact | Limits trade and specialization. | Facilitates trade, investment, and economic expansion. |

Introduction to Barter System and Fiat Currency

The barter system involves the direct exchange of goods and services without using money, relying on the mutual needs of trading parties. Fiat currency, on the other hand, is government-issued money not backed by a physical commodity but established as legal tender by regulation. This transition from barter to fiat currency enabled more efficient trade, standardized value measurement, and facilitated complex economic systems worldwide.

Historical Evolution of Trade and Money

The barter system, dating back to ancient civilizations, involved direct exchange of goods and services but was limited by the double coincidence of wants. The emergence of fiat currency, first seen in ancient China during the Tang Dynasty, revolutionized trade by providing a widely accepted medium of exchange backed by government authority rather than intrinsic value. This transition enabled complex economies by facilitating standardized transactions, promoting economic growth, and supporting the development of banking and financial institutions.

How the Barter System Works

The barter system operates by directly exchanging goods and services without the use of money, relying on a double coincidence of wants where both parties must have something the other desires. This system often involves negotiation to determine fair value and quantities for the trade, making transactions slower and less efficient compared to using fiat currency. Bartering is limited by the difficulty of matching needs and the lack of a standardized medium of exchange or store of value.

Key Features of Fiat Currency

Fiat currency is government-issued money not backed by a physical commodity but by the trust and authority of the issuing government. It enables standardized valuation, widespread acceptance, and ease of transactions compared to the barter system, which requires a double coincidence of wants. Key features include its legal tender status, controlled supply through monetary policy, and stability maintained by central banks to support economic growth.

Advantages of Barter Systems

Barter systems enable direct exchange of goods and services without the need for a medium like fiat currency, promoting a straightforward and tangible trade process. This method reduces dependency on monetary systems, minimizing issues related to inflation, currency devaluation, and monetary policy fluctuations. Barter transactions can enhance local economies by supporting community trade networks and encouraging resourcefulness among participants.

Benefits of Using Fiat Currency

Fiat currency offers significant advantages over the barter system by providing a universally accepted medium of exchange that simplifies transactions and eliminates the need for a double coincidence of wants. It enhances economic efficiency through standardized value measurement, facilitating pricing, accounting, and financial planning. Fiat currency also enables governments to implement monetary policies that stabilize economies and control inflation, features unattainable in barter systems.

Limitations of Barter Exchanges

Barter exchanges face significant limitations including the double coincidence of wants, where both parties must have mutually desired goods or services simultaneously. The lack of a standardized unit of value complicates pricing and equitable trade, leading to inefficiencies in transactions. Furthermore, barter systems make it difficult to store wealth or conduct complex, large-scale economic activities compared to fiat currency.

Disadvantages of Fiat Money

Fiat currency faces significant drawbacks such as susceptibility to inflation due to excessive government printing, eroding the purchasing power of money over time. It relies heavily on trust in the issuing authority, making it vulnerable to political or economic instability that can undermine confidence. Unlike tangible assets or barter goods, fiat money has no intrinsic value, which can lead to rapid depreciation during financial crises.

Impact on Modern Economies

The barter system limited economic growth due to inefficiency and lack of a standardized medium of exchange, hindering large-scale trade and specialization. Fiat currency revolutionized modern economies by facilitating complex transactions, enabling monetary policy, and supporting financial systems that drive economic expansion. The widespread use of fiat money promotes liquidity, price stability, and international trade, essential for global economic integration.

Future Outlook: Barter vs Fiat Currency

The future outlook of barter systems versus fiat currency highlights increasing interest in decentralized and digital alternatives to traditional money, driven by blockchain technology and mobile platforms. While fiat currency remains dominant in global economies due to government backing and regulatory frameworks, barter systems are gaining traction in niche communities seeking direct value exchange without intermediaries. Innovations like digital barter platforms could complement fiat currency by enabling more flexible, trustless trade in localized or crisis scenarios.

Barter system Infographic

libterm.com

libterm.com