Yield spread refers to the difference between the yields of two different debt instruments, often used to gauge the risk or return comparison between bonds with varying maturities or credit qualities. Understanding yield spreads helps you assess market sentiment, economic conditions, and investment opportunities by analyzing the relative cost of borrowing. Explore the full article to learn how yield spreads impact your investment decisions and market strategies.

Table of Comparison

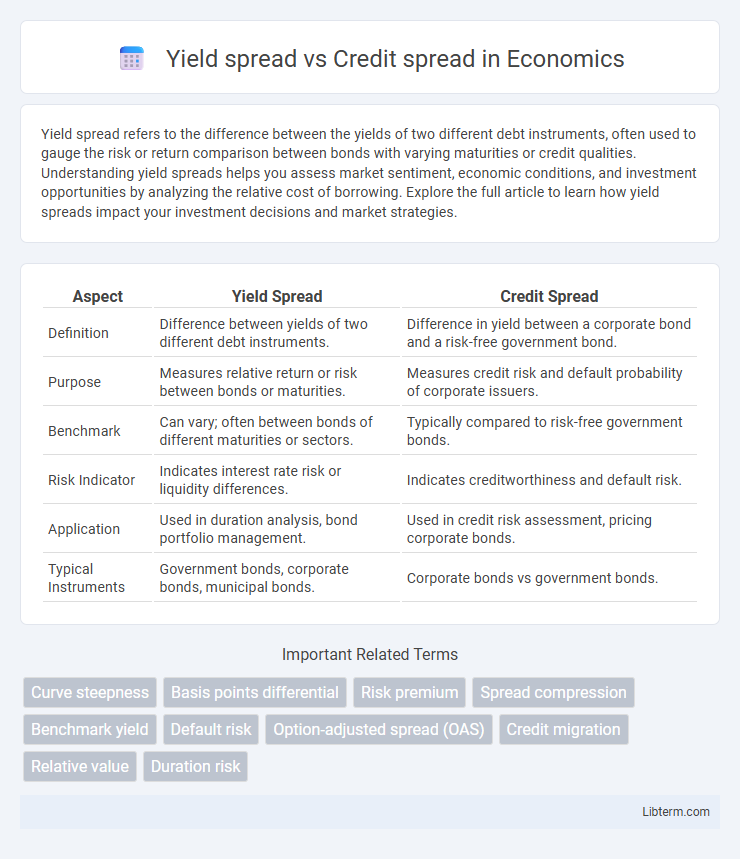

| Aspect | Yield Spread | Credit Spread |

|---|---|---|

| Definition | Difference between yields of two different debt instruments. | Difference in yield between a corporate bond and a risk-free government bond. |

| Purpose | Measures relative return or risk between bonds or maturities. | Measures credit risk and default probability of corporate issuers. |

| Benchmark | Can vary; often between bonds of different maturities or sectors. | Typically compared to risk-free government bonds. |

| Risk Indicator | Indicates interest rate risk or liquidity differences. | Indicates creditworthiness and default risk. |

| Application | Used in duration analysis, bond portfolio management. | Used in credit risk assessment, pricing corporate bonds. |

| Typical Instruments | Government bonds, corporate bonds, municipal bonds. | Corporate bonds vs government bonds. |

Introduction to Yield Spread and Credit Spread

Yield spread measures the difference in yields between two bonds, often reflecting risks such as interest rate changes and liquidity variations. Credit spread specifically captures the yield difference between a corporate bond and a comparable government bond, indicating credit risk or default likelihood. Both spreads provide investors key insights into market risk perceptions and potential returns.

Defining Yield Spread: Key Concepts

Yield spread represents the difference in yields between two debt securities, typically reflecting variations in interest rates, credit risk, and liquidity. It compares the yield of a bond to a benchmark interest rate or another bond, highlighting the risk premium demanded by investors. Unlike credit spread, which isolates credit risk, yield spread captures a broader spectrum of factors influencing bond yields.

Understanding Credit Spread: Core Principles

Credit spread represents the difference in yield between a corporate bond and a comparable maturity government bond, reflecting the additional risk premium investors demand for bearing credit risk. It captures the issuer's default risk, liquidity risk, and overall financial health, making it a key indicator for credit analysts and fixed-income investors assessing bond valuation and risk. Yield spread is a broader term that can include factors beyond credit risk, such as interest rate risks and market conditions, while credit spread specifically isolates the compensation for credit risk exposure.

Major Differences Between Yield Spread and Credit Spread

Yield spread measures the difference between the yields of two different debt instruments, often government bonds of varying maturities, reflecting interest rate risk and market expectations. Credit spread specifically quantifies the additional yield a corporate or non-government bond offers over a risk-free government bond due to credit risk and the issuer's default probability. The major difference lies in yield spread encompassing broad market factors including liquidity and interest rate changes, while credit spread exclusively isolates credit risk premium.

Factors Influencing Yield Spreads

Yield spreads are influenced by factors such as interest rate risk, inflation expectations, and overall economic conditions, reflecting the compensation investors demand for holding different maturities or credit qualities. Credit spreads primarily depend on the issuer's creditworthiness, default risk, and changes in credit ratings, signaling the premium over risk-free rates required for bearing credit risk. Market liquidity, supply and demand dynamics, and macroeconomic developments also play crucial roles in shaping both yield and credit spreads.

Factors Impacting Credit Spreads

Credit spreads are influenced primarily by the issuer's creditworthiness, economic conditions, and market liquidity, reflecting the compensation investors demand for default risk above risk-free rates. Yield spreads measure the difference between yields of different debt instruments regardless of credit quality, often impacted by interest rate expectations and maturity differences. Factors such as changes in credit ratings, corporate earnings, and macroeconomic indicators significantly impact credit spreads, whereas yield spreads respond more broadly to shifts in monetary policy and market risk sentiment.

Practical Applications in Fixed Income Investing

Yield spread measures the difference in yields between two fixed income securities, often used to assess relative value and market sentiment, while credit spread specifically reflects the additional yield demanded for bearing credit risk between corporate bonds and risk-free government bonds. Investors utilize yield spreads to gauge economic conditions and interest rate risk, whereas credit spreads help in evaluating issuer creditworthiness and default risk. Portfolio managers apply these spreads to optimize bond selection, manage risk exposure, and enhance returns through strategic allocation in varying credit qualities and maturities.

Measuring Risk: Yield Spread vs. Credit Spread

Yield spread measures the difference in yields between two debt instruments, often used to assess relative interest rate risk across maturities or entities. Credit spread specifically quantifies the premium investors demand for bearing default risk, reflecting the difference between a corporate bond's yield and a risk-free government bond yield of comparable maturity. Comparing yield spread and credit spread helps investors distinguish between interest rate risk and default risk when evaluating bond investments.

Market Conditions Affecting Spreads

Yield spreads and credit spreads widen or narrow primarily due to changes in market liquidity, interest rate expectations, and economic uncertainty. During periods of economic stress or rising default risk, credit spreads typically widen as investors demand higher compensation for increased risk, while yield spreads expand in response to shifting benchmark rates and overall bond market volatility. Central bank policies and macroeconomic data releases also influence these spreads by altering risk perceptions and funding costs across credit markets.

Conclusion: Choosing the Right Spread for Analysis

The choice between yield spread and credit spread depends on the specific financial analysis goals and the types of bonds involved. Yield spread provides a broad measure of risk difference between two bonds by comparing their yields, while credit spread specifically isolates issuer credit risk by comparing a corporate bond's yield to a risk-free benchmark. For assessing creditworthiness and default risk, credit spread offers a more precise metric, whereas yield spread is useful for evaluating overall market risk and interest rate movements.

Yield spread Infographic

libterm.com

libterm.com