Oligopoly is a market structure characterized by a small number of firms dominating the industry, leading to limited competition and potential price control. Companies in an oligopoly often engage in strategic decision-making, considering rivals' actions before adjusting prices or output. Discover how oligopolies influence your market choices and economic outcomes by reading the rest of this article.

Table of Comparison

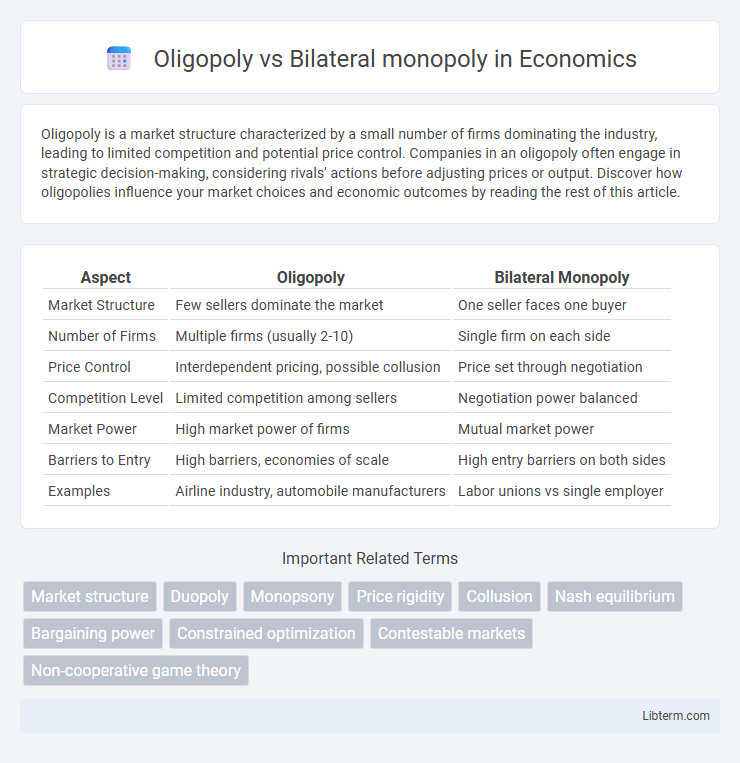

| Aspect | Oligopoly | Bilateral Monopoly |

|---|---|---|

| Market Structure | Few sellers dominate the market | One seller faces one buyer |

| Number of Firms | Multiple firms (usually 2-10) | Single firm on each side |

| Price Control | Interdependent pricing, possible collusion | Price set through negotiation |

| Competition Level | Limited competition among sellers | Negotiation power balanced |

| Market Power | High market power of firms | Mutual market power |

| Barriers to Entry | High barriers, economies of scale | High entry barriers on both sides |

| Examples | Airline industry, automobile manufacturers | Labor unions vs single employer |

Understanding Market Structures: Oligopoly and Bilateral Monopoly

Oligopoly features a market dominated by a few firms whose pricing and output decisions significantly impact each other, leading to strategic behavior and potential collusion. Bilateral monopoly arises when a single seller faces a single buyer, creating a unique price-setting dynamic driven by bargaining power between the two entities. Understanding these market structures is essential for analyzing competitive behaviors, market efficiency, and regulatory implications in economics.

Defining Oligopoly: Key Characteristics

Oligopoly is a market structure characterized by a small number of large firms dominating the industry, resulting in limited competition and interdependent decision-making. Firms in an oligopoly often exhibit price rigidity, where prices remain stable due to mutual awareness of competitive reactions, and product differentiation may vary from homogeneous to highly differentiated goods. Strategic behaviors such as collusion, price leadership, and non-price competition like advertising are common features influencing market outcomes.

Bilateral Monopoly Explained: Core Features

A bilateral monopoly occurs when a single seller (monopolist) faces a single buyer (monopsonist), creating a unique market structure characterized by mutual interdependence. Core features include price negotiation power concentrated on both sides, limited market competition, and outcomes determined through bargaining rather than pure market forces. The equilibrium price and quantity result from strategic interaction between the monopolist supplier and monopsonist buyer, often leading to negotiated contracts.

Major Differences Between Oligopoly and Bilateral Monopoly

Oligopoly is a market structure characterized by a few large firms that dominate the industry, influencing prices and output through interdependent decision-making, whereas a bilateral monopoly consists of a single seller (monopolist) and a single buyer (monopsonist) negotiating terms. In an oligopoly, multiple firms compete and may engage in collusion to control the market, while in a bilateral monopoly, the negotiation power is shared exclusively between the single seller and buyer, often leading to price determination through bargaining. The key difference lies in the number of market participants: oligopoly involves multiple sellers facing many buyers, whereas bilateral monopoly features one seller and one buyer, creating a unique dynamic in price and output decisions.

Price Determination in Oligopoly Markets

Price determination in oligopoly markets is influenced by the interdependence of a few dominant firms, leading to strategic pricing behaviors such as price rigidity, collusion, or price leadership. Firms often avoid aggressive price competition to maintain stable profits, resulting in prices that are higher than in perfectly competitive markets but lower than in monopolies. Unlike bilateral monopolies where a single buyer and a single seller negotiate prices, oligopolies rely on competitive strategies and market signals to set prices collectively.

Bargaining Power in Bilateral Monopoly

In a bilateral monopoly, bargaining power is uniquely balanced between the sole seller and sole buyer, each possessing significant leverage due to their exclusive market positions. This mutual dependency forces both parties to negotiate terms carefully, often resulting in price and quantity outcomes that reflect a compromise rather than market dictates. Unlike oligopoly markets where multiple sellers compete and bargaining power varies among firms, the bilateral monopoly's concentrated power dynamics intensify negotiations and strategic interactions.

Real-World Examples of Oligopoly

Oligopoly markets feature a few dominant firms, as seen in the airline industry where companies such as American Airlines, Delta, and United control major routes and pricing power. Technology sectors like smartphone manufacturing also illustrate oligopolies, with Apple, Samsung, and Huawei holding significant market shares and influencing innovation trends. Unlike the bilateral monopoly scenario where a single seller faces a single buyer, these oligopolies operate in competitive environments with multiple sellers and buyers affecting market dynamics.

Case Studies of Bilateral Monopoly Scenarios

Bilateral monopoly occurs when a single seller (monopoly) faces a single buyer (monopsony), creating a unique market structure seldom found but significant in industries like utility services and labor unions negotiating with a sole employer. Case studies include the U.S. automotive industry in the 20th century, where the United Auto Workers union (monopsony) negotiated with major car manufacturers (monopoly) for wages and conditions, and natural gas markets where single suppliers contracted with single buyers, highlighting price and quantity negotiation dynamics. These scenarios demonstrate how power balance, negotiation outcomes, and economic efficiency differ drastically compared to oligopoly markets, where multiple sellers dominate one or several buyers.

Impacts on Consumers and Market Efficiency

Oligopoly markets often result in higher prices and reduced output compared to perfect competition due to firms' strategic interdependence, which may harm consumer welfare but can foster innovation through competitive pressures. Bilateral monopoly, characterized by a single supplier and a single buyer, tends to create market inefficiencies such as bargaining delays and price distortions, potentially restricting consumer access and diminishing overall economic efficiency. Both market structures can lead to suboptimal allocation of resources, but oligopolies generally provide more innovation incentives, whereas bilateral monopolies emphasize negotiation dynamics affecting pricing and quantity decisions.

Policy Implications and Regulatory Challenges

Oligopoly markets feature few dominant firms whose strategic interactions complicate antitrust enforcement and require policies that prevent collusion and promote competition. Bilateral monopolies consist of a single seller and buyer, creating unique regulatory challenges in price-setting and negotiation leverage that demand tailored interventions to ensure fair market outcomes. Regulatory frameworks must balance fostering competitive behaviors in oligopolies with minimizing exploitation risks inherent in bilateral monopolies.

Oligopoly Infographic

libterm.com

libterm.com