When there's no budget constraint, you can explore top-tier options without compromising on quality or features. This freedom allows you to choose premium products or services tailored precisely to your needs, maximizing value and performance. Discover how to make the most of unlimited resources by reading the full article.

Table of Comparison

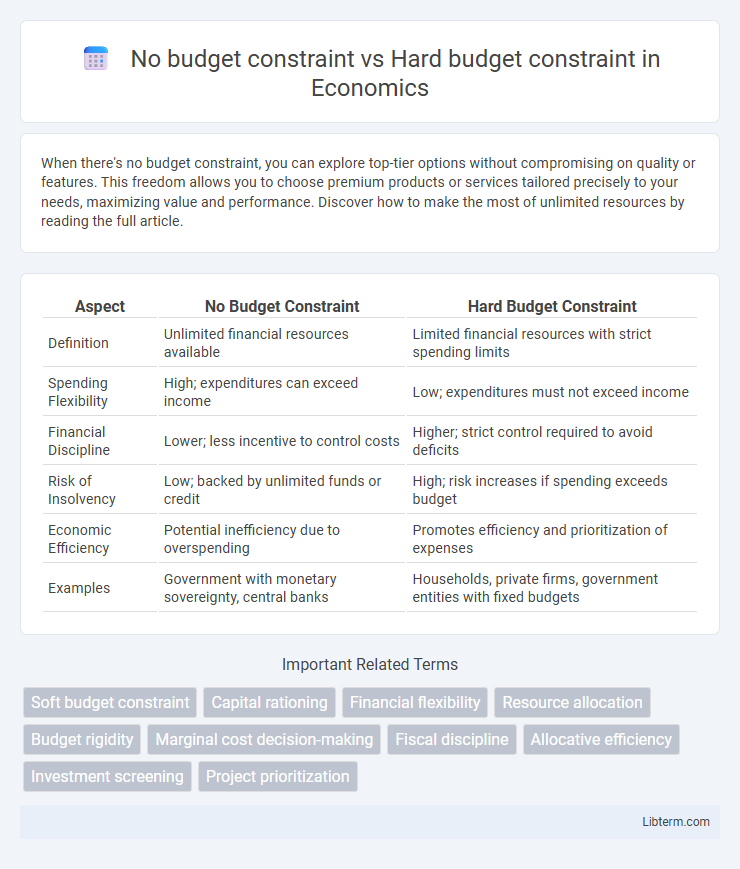

| Aspect | No Budget Constraint | Hard Budget Constraint |

|---|---|---|

| Definition | Unlimited financial resources available | Limited financial resources with strict spending limits |

| Spending Flexibility | High; expenditures can exceed income | Low; expenditures must not exceed income |

| Financial Discipline | Lower; less incentive to control costs | Higher; strict control required to avoid deficits |

| Risk of Insolvency | Low; backed by unlimited funds or credit | High; risk increases if spending exceeds budget |

| Economic Efficiency | Potential inefficiency due to overspending | Promotes efficiency and prioritization of expenses |

| Examples | Government with monetary sovereignty, central banks | Households, private firms, government entities with fixed budgets |

Defining No Budget Constraint vs Hard Budget Constraint

No budget constraint refers to a financial scenario where spending limits are non-existent, allowing for unlimited resources to be allocated as needed. In contrast, hard budget constraint imposes strict financial limits that must be adhered to without exceeding the allocated budget. These definitions highlight the fundamental difference in financial flexibility and resource allocation strategies between unconstrained and strictly regulated budgeting environments.

Key Characteristics of Each Budget Constraint

No budget constraint scenarios allow unlimited spending, enabling maximum resource allocation without financial limits, fostering aggressive investment and risk-taking. Hard budget constraints enforce strict spending limits, requiring operations and decisions to align precisely with available financial resources, promoting efficiency and cost control. Key characteristics include flexibility and scalability under no budget constraints versus rigidity and prioritization under hard budget restrictions.

Theoretical Foundations and Economic Implications

No budget constraint models assume agents have unlimited financial resources, enabling optimization of utility without spending limits, which simplifies theoretical analysis in microeconomics and consumer theory. Hard budget constraints impose strict spending limits, reflecting realistic economic scenarios where agents maximize utility subject to income restrictions, influencing demand functions and resource allocation. These contrasting assumptions critically affect predictions of consumer behavior, market equilibrium, and policy design within economic frameworks.

Impact on Organizational Decision-Making

No budget constraint allows organizations to pursue innovative projects and strategic initiatives without financial limitations, fostering creativity and long-term planning. Hard budget constraints force decision-makers to prioritize resources strictly, emphasizing cost-efficiency and immediate financial returns. This financial discipline often results in conservative choices, limiting risk-taking and potentially stifling growth opportunities.

Consequences for Financial Accountability

No budget constraint allows organizations to allocate resources flexibly but often reduces the urgency for strict financial oversight, potentially leading to inefficiencies and overspending. Hard budget constraint enforces strict spending limits, promoting rigorous financial accountability and ensuring funds are used according to predefined priorities. Organizations operating under hard budget constraints often develop stronger cost-control mechanisms and performance monitoring systems to prevent budget overruns.

Influence on Public vs Private Sector Management

No budget constraint allows public sector managers to pursue broader policy goals without immediate financial limits, fostering innovation and long-term planning, unlike the private sector where hard budget constraints enforce cost efficiency and profitability focus. Hard budget constraints compel private organizations to optimize resource allocation, drive performance metrics, and maintain competitive advantage, whereas public entities with flexible budgets may face challenges in accountability and fiscal discipline. The divergence in budgetary flexibility significantly shapes decision-making processes, operational strategies, and stakeholder accountability in public versus private sector management.

Risks and Benefits of No Budget Constraint

No budget constraints allow for greater flexibility in project scope and innovation, reducing risks related to underfunding and project failure. However, the absence of financial limits can lead to inefficient resource allocation, increased costs, and potential overspending risks. Benefits include enhanced creativity and ability to respond to unforeseen challenges without financial restrictions, while risks involve lack of accountability and possible budget mismanagement.

Challenges Presented by Hard Budget Constraint

Hard budget constraints impose strict financial limits that can hinder project scalability and innovation by forcing organizations to prioritize essential expenditures and cut discretionary spending. These constraints often lead to resource allocation challenges, increased pressure on operational efficiency, and difficulty in managing unexpected costs or investment opportunities. Navigating hard budget constraints demands rigorous cost management strategies and careful planning to optimize limited funds without compromising project quality or strategic goals.

Real-World Examples and Case Studies

No budget constraint scenarios often appear in large-scale projects like space exploration missions where funding limits are flexible, enabling extensive research and innovative technology development. Hard budget constraints are common in startups and public sector projects, such as municipal infrastructure improvements, where limited resources demand precise cost control and prioritization, as demonstrated by case studies of city-wide transportation upgrades under strict municipal budgets. Comparative analysis of tech industry R&D departments reveals that budget flexibility encourages rapid innovation, while rigid constraints promote cost-efficiency and risk management.

Policy Recommendations and Strategic Insights

Policy recommendations under no budget constraints emphasize maximizing social welfare through comprehensive investments in public goods, innovation, and infrastructure, unrestricted by financial limits. Hard budget constraints necessitate prioritizing cost-effectiveness, targeting high-impact and scalable interventions to optimize resource allocation and fiscal sustainability. Strategic insights highlight the importance of adaptive budgeting frameworks and performance-based monitoring to balance ambition with accountability under varying fiscal conditions.

No budget constraint Infographic

libterm.com

libterm.com