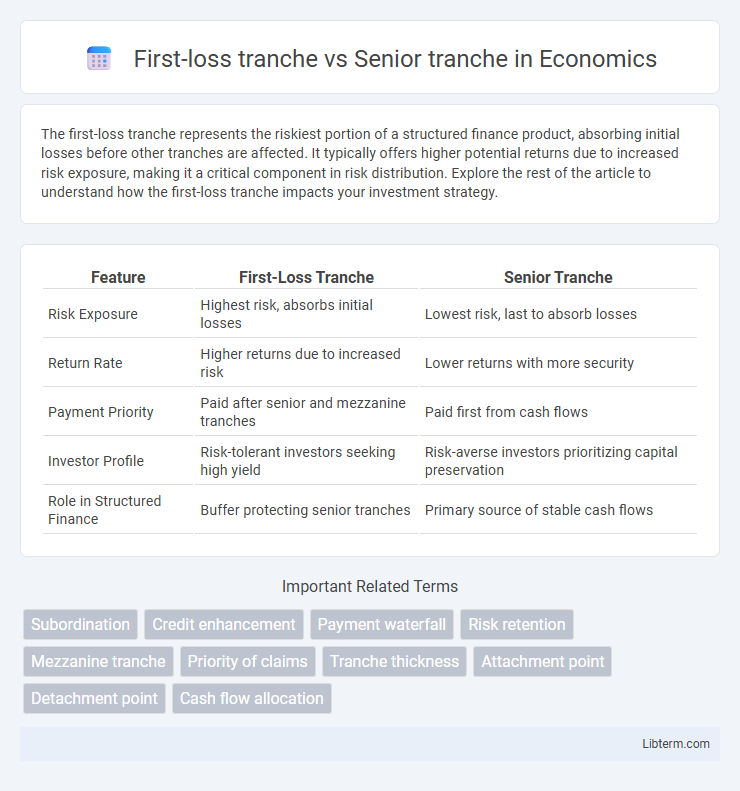

The first-loss tranche represents the riskiest portion of a structured finance product, absorbing initial losses before other tranches are affected. It typically offers higher potential returns due to increased risk exposure, making it a critical component in risk distribution. Explore the rest of the article to understand how the first-loss tranche impacts your investment strategy.

Table of Comparison

| Feature | First-Loss Tranche | Senior Tranche |

|---|---|---|

| Risk Exposure | Highest risk, absorbs initial losses | Lowest risk, last to absorb losses |

| Return Rate | Higher returns due to increased risk | Lower returns with more security |

| Payment Priority | Paid after senior and mezzanine tranches | Paid first from cash flows |

| Investor Profile | Risk-tolerant investors seeking high yield | Risk-averse investors prioritizing capital preservation |

| Role in Structured Finance | Buffer protecting senior tranches | Primary source of stable cash flows |

Introduction to Tranche Structures

Tranche structures divide debt or securities into different layers based on risk and priority of payment, with the first-loss tranche absorbing initial losses and carrying higher risk for higher returns, while the senior tranche enjoys priority in payments and lower risk exposure. These layers enable investors to tailor exposure according to their risk tolerance, with the senior tranche typically holding investment-grade status due to its subordinate protection. Understanding the distinctions between first-loss and senior tranches is crucial for evaluating risk distribution and return profiles in structured finance products.

What is a First-Loss Tranche?

A first-loss tranche is the riskiest portion of a structured finance deal, absorbing initial losses before other tranches are affected, which offers higher potential returns due to increased risk exposure. It acts as a protective buffer for senior tranches, safeguarding them from default by covering early-stage losses in asset-backed securities like collateralized loan obligations (CLOs) or mortgage-backed securities (MBS). Investors in first-loss tranches accept a higher probability of principal loss in exchange for priority in gain participation and enhanced yield.

Understanding Senior Tranche Basics

The senior tranche in structured finance holds the highest credit rating and priority in repayment, reducing risk exposure compared to the first-loss tranche which absorbs initial losses. Senior tranche investors receive fixed interest payments and principal before any payouts to subordinate tranches, enhancing their security. This seniority results in lower yields but increased appeal to risk-averse investors seeking stable returns.

Key Differences: First-Loss vs Senior Tranche

The first-loss tranche absorbs initial losses in a structured finance deal, acting as the highest-risk layer with higher potential returns due to its subordinated position. The senior tranche holds the highest priority for payment and enjoys lower credit risk, making it more attractive to conservative investors. Key differences lie in risk exposure, payment priority, and yield, with first-loss tranches bearing greater risk and volatility compared to the more stable and secure senior tranches.

Risk Allocation Across Tranches

First-loss tranches absorb initial losses, making them the highest-risk segment in structured finance, while senior tranches have priority repayment and lower risk due to their protection from early defaults. Risk allocation across tranches ensures that investors with different risk appetites and return expectations can participate, with first-loss tranches offering higher yields to compensate for greater exposure to credit events. The structuring of these tranches balances risk and reward, enhancing overall portfolio stability by isolating potential defaults primarily within the subordinated layers.

Return Profiles: First-Loss vs Senior Investors

First-loss tranches absorb initial losses in a structured finance deal, offering higher return profiles to compensate for elevated risk exposure. Senior tranches benefit from priority claim on cash flows and principal repayments, resulting in lower risk and correspondingly lower returns. Investors in first-loss tranches seek higher yields with greater volatility, while senior tranche investors prioritize capital preservation and stable income streams.

Credit Enhancement and Subordination

The first-loss tranche provides credit enhancement by absorbing initial losses, thus protecting the senior tranche from default risk and enhancing its creditworthiness. Subordination creates a hierarchy in which the first-loss tranche bears losses first, serving as a buffer for the senior tranche, which benefits from lower risk and higher credit ratings. This structure effectively mitigates credit risk for senior tranche investors through the capital allocated to subordinate positions.

Investor Suitability: First-Loss and Senior Tranches

First-loss tranches are typically suited for high-risk tolerant investors seeking higher yields and willing to absorb initial losses in structured finance products. Senior tranches attract conservative investors prioritizing capital preservation, as they have priority in payment and lower default risk. Understanding the risk-return profile and investor objectives is essential for selecting between first-loss and senior tranche investments.

Real-World Examples in Structured Finance

In structured finance, the first-loss tranche absorbs initial defaults, providing a cushion that protects senior tranches, as seen in mortgage-backed securities during the 2008 financial crisis where first-loss tranches suffered heavy losses while senior tranches remained largely intact. Auto loan ABS deals demonstrate how first-loss tranches take early credit hits, allowing senior tranches to maintain higher credit ratings and attract conservative investors. European CLOs illustrate this structure with equity or first-loss tranches yielding high returns due to increased risk, contrasted by senior tranches with investment-grade ratings and lower yields.

Conclusion: Choosing the Right Tranche

Selecting the appropriate tranche depends on an investor's risk tolerance and return expectations, with the first-loss tranche offering higher potential yields but absorbing initial losses, while the senior tranche provides greater protection with lower risk and more stable returns. Institutional investors seeking safer investments often prefer senior tranches due to their priority in cash flow distribution and reduced credit risk. Balancing portfolio objectives with tranche characteristics ensures optimized risk-adjusted performance in structured finance investments.

First-loss tranche Infographic

libterm.com

libterm.com