Transfer pricing determines the value assigned to transactions between related business entities, impacting tax obligations and profit allocation across jurisdictions. Accurate and compliant transfer pricing strategies mitigate risks of penalties and double taxation while ensuring alignment with international regulations. Explore this article to understand how optimizing your transfer pricing can enhance financial transparency and efficiency.

Table of Comparison

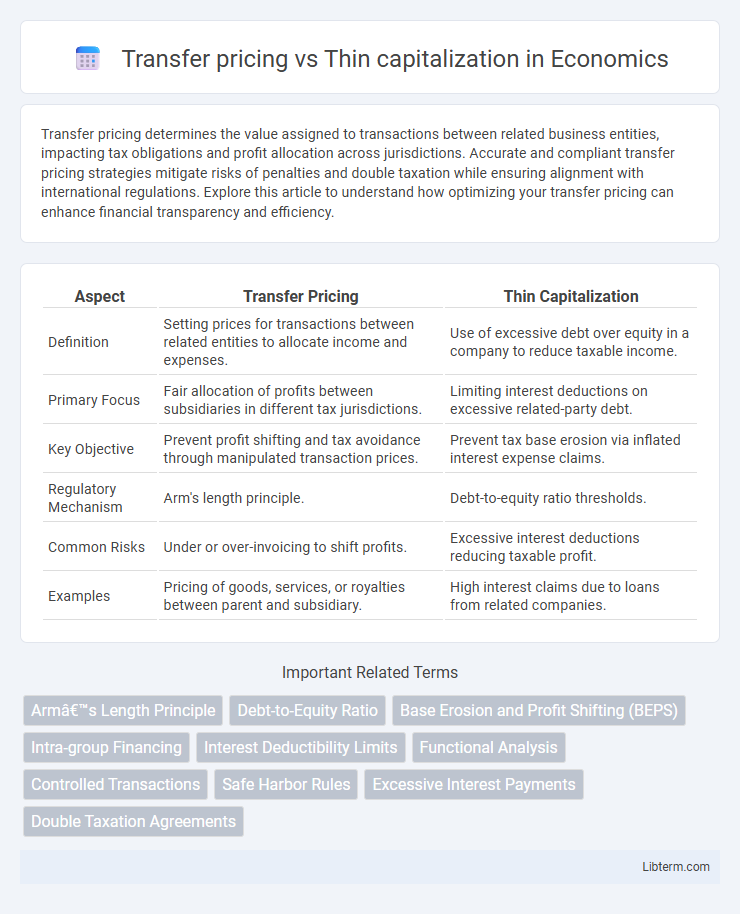

| Aspect | Transfer Pricing | Thin Capitalization |

|---|---|---|

| Definition | Setting prices for transactions between related entities to allocate income and expenses. | Use of excessive debt over equity in a company to reduce taxable income. |

| Primary Focus | Fair allocation of profits between subsidiaries in different tax jurisdictions. | Limiting interest deductions on excessive related-party debt. |

| Key Objective | Prevent profit shifting and tax avoidance through manipulated transaction prices. | Prevent tax base erosion via inflated interest expense claims. |

| Regulatory Mechanism | Arm's length principle. | Debt-to-equity ratio thresholds. |

| Common Risks | Under or over-invoicing to shift profits. | Excessive interest deductions reducing taxable profit. |

| Examples | Pricing of goods, services, or royalties between parent and subsidiary. | High interest claims due to loans from related companies. |

Introduction to Transfer Pricing and Thin Capitalization

Transfer pricing refers to the rules and methods for pricing transactions between related entities within a multinational corporation to ensure compliance with tax regulations and prevent profit shifting. Thin capitalization involves limiting the amount of debt a company can use to finance its operations to avoid excessive interest deductions that erode the taxable base. Both concepts address tax base erosion but focus respectively on intra-group transaction pricing and the capital structure's impact on taxable income.

Defining Transfer Pricing: Key Concepts

Transfer pricing refers to the pricing of goods, services, or intangibles transferred between related entities within a multinational corporation, ensuring transactions reflect market value for tax and reporting purposes. Key concepts include arm's length principle, comparability analysis, and documentation requirements to prevent profit shifting and tax base erosion. Thin capitalization, distinct from transfer pricing, involves the extent of debt financing within a company and its impact on tax deductibility of interest expenses.

Understanding Thin Capitalization: An Overview

Thin capitalization occurs when a company is financed through a relatively high level of debt compared to equity, raising concerns about excessive interest deductions and tax avoidance. Transfer pricing and thin capitalization rules both aim to prevent profit shifting, but thin capitalization specifically targets the debt-to-equity ratio to limit base erosion through inflated interest expenses. Regulatory frameworks often impose debt-to-equity ratio thresholds to ensure that interest payments remain at arm's length, promoting fair taxation across jurisdictions.

Core Differences Between Transfer Pricing and Thin Capitalization

Transfer pricing involves setting prices for transactions between related entities to allocate income and expenses, while thin capitalization addresses the debt-to-equity ratio to prevent excessive interest deductions. Transfer pricing rules focus on the arm's length principle to ensure fair market value, whereas thin capitalization limits tax benefits derived from high debt levels. Both mechanisms aim to prevent tax base erosion, but they target different aspects of intercompany financial arrangements and tax planning.

Regulatory Frameworks Governing Transfer Pricing

Regulatory frameworks governing transfer pricing establish guidelines to ensure that intercompany transactions reflect arm's length principles, preventing profit shifting and tax base erosion. These regulations typically require documentation substantiating transfer prices and impose penalties for non-compliance, aligning with OECD guidelines and local tax laws. Thin capitalization rules complement transfer pricing regulations by limiting deductible interest on related party loans to curb excessive debt financing that could distort taxable income.

Rules and Regulations Concerning Thin Capitalization

Thin capitalization rules restrict excessive debt financing by limiting the deductibility of interest expenses on related-party loans to prevent tax base erosion. Transfer pricing regulations ensure that intercompany transactions, including loans, are conducted at arm's length prices reflecting market conditions. Tax authorities enforce strict documentation and compliance requirements for thin capitalization to combat profit shifting and maintain fair taxation.

Tax Avoidance Risks: Transfer Pricing vs Thin Capitalization

Transfer pricing and thin capitalization both present significant tax avoidance risks by allowing multinational corporations to manipulate taxable income through intra-group transactions and excessive debt financing. Transfer pricing risks arise when related entities set prices for goods or services to shift profits to low-tax jurisdictions, distorting taxable income and eroding tax bases in higher-tax countries. Thin capitalization risks emerge when companies load subsidiaries with disproportionate debt to maximize interest deductions, reducing taxable profits and potentially triggering anti-avoidance rules designed to limit excessive interest expenses.

Compliance Challenges for Multinational Companies

Multinational companies face significant compliance challenges in transfer pricing due to complex regulations requiring transactions between affiliated entities to be conducted at arm's length prices, necessitating meticulous documentation and benchmarking analyses. Thin capitalization rules further complicate compliance by limiting deductible interest expenses on related-party loans, forcing multinationals to carefully structure their debt-to-equity ratios to avoid tax adjustments or penalties. Ensuring adherence to both transfer pricing and thin capitalization guidelines demands robust internal controls, continuous monitoring of intercompany transactions, and alignment with varying jurisdictions' tax authorities.

Recent Global Trends in Transfer Pricing and Thin Capitalization

Recent global trends in transfer pricing emphasize enhanced transparency through Country-by-Country Reporting and stricter documentation requirements to curb profit shifting by multinational corporations. Simultaneously, thin capitalization rules have evolved with tightened debt-to-equity ratios and limitations on interest deductibility to prevent excessive tax base erosion from related-party financing. The OECD's BEPS Action Plan continues to drive alignment of transfer pricing guidelines and thin capitalization standards, promoting fair taxation and reducing aggressive tax planning worldwide.

Strategies for Effective Risk Management

Transfer pricing strategies for effective risk management emphasize alignment with OECD guidelines to ensure compliance and avoid tax penalties, leveraging advanced data analytics for accurate pricing and documentation, and maintaining transparent intercompany agreements. Thin capitalization risk management involves optimizing debt-to-equity ratios to meet local regulatory thresholds, employing robust financial modeling to anticipate tax disallowance risks, and structuring financing arrangements that balance interest deductibility with operational flexibility. Integrating these approaches reduces audit exposure and enhances global tax efficiency by addressing cross-border transfer pricing adjustments and capitalization limits simultaneously.

Transfer pricing Infographic

libterm.com

libterm.com