The random walk hypothesis suggests that stock prices move unpredictably, following a path that resembles a random walk, making future price movements impossible to forecast accurately. This theory implies that past price patterns and trends do not provide reliable information for predicting future market behavior. Discover how this concept impacts investment strategies and market analysis in the rest of the article.

Table of Comparison

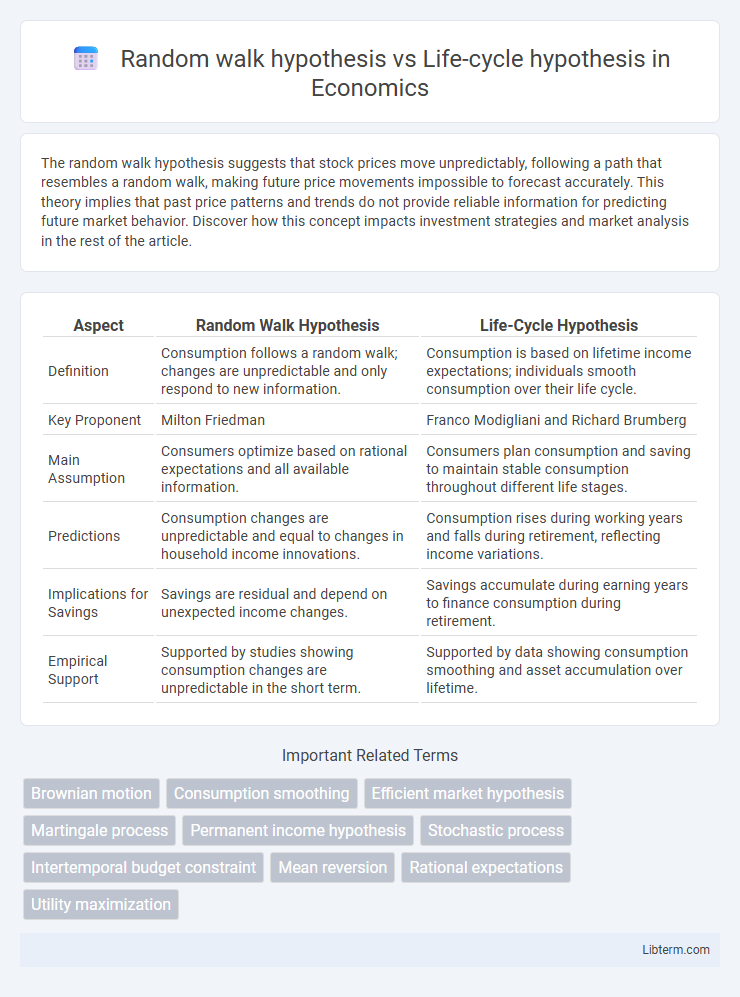

| Aspect | Random Walk Hypothesis | Life-Cycle Hypothesis |

|---|---|---|

| Definition | Consumption follows a random walk; changes are unpredictable and only respond to new information. | Consumption is based on lifetime income expectations; individuals smooth consumption over their life cycle. |

| Key Proponent | Milton Friedman | Franco Modigliani and Richard Brumberg |

| Main Assumption | Consumers optimize based on rational expectations and all available information. | Consumers plan consumption and saving to maintain stable consumption throughout different life stages. |

| Predictions | Consumption changes are unpredictable and equal to changes in household income innovations. | Consumption rises during working years and falls during retirement, reflecting income variations. |

| Implications for Savings | Savings are residual and depend on unexpected income changes. | Savings accumulate during earning years to finance consumption during retirement. |

| Empirical Support | Supported by studies showing consumption changes are unpredictable in the short term. | Supported by data showing consumption smoothing and asset accumulation over lifetime. |

Introduction to Financial Behavior Theories

The Random Walk Hypothesis asserts that stock prices evolve unpredictably, reflecting all available information and making future price movements independent of past trends. The Life-Cycle Hypothesis explains consumption and saving behavior based on individuals' expected lifetime income, suggesting people smooth consumption over time by borrowing and saving. Both theories contribute to understanding financial behavior by highlighting different mechanisms--market efficiency in asset pricing and intertemporal resource allocation in personal finance.

Overview of the Random Walk Hypothesis

The Random Walk Hypothesis posits that stock prices evolve according to a random walk and thus cannot be predicted based on past price movements, implying market efficiency. This theory suggests that future changes in stock prices are independent of past trends, making technical analysis ineffective for forecasting. Empirical studies support the hypothesis by demonstrating that price changes follow a martingale process, reinforcing the idea that markets rapidly incorporate new information.

Fundamentals of the Life-Cycle Hypothesis

The Life-Cycle Hypothesis (LCH) posits that individuals plan their consumption and savings behavior over their lifetime to smooth consumption, accumulating savings during earning years and dis-saving during retirement. This theory contrasts with the Random Walk Hypothesis, which suggests asset prices follow an unpredictable path reflecting all available information. Key fundamentals of the LCH include optimization of lifetime utility, intertemporal budget constraints, and the role of age and income expectations in consumption decisions.

Key Assumptions of Each Hypothesis

The Random Walk Hypothesis assumes that stock prices follow an unpredictable path driven by new, random information, implying that past prices and trends cannot predict future movements. In contrast, the Life-Cycle Hypothesis assumes individuals plan consumption and savings based on expected lifetime income, balancing resources to smooth consumption over different life stages. While the Random Walk Hypothesis focuses on market efficiency and randomness of price changes, the Life-Cycle Hypothesis centers on rational economic behavior over a person's lifetime.

Empirical Evidence Supporting the Random Walk Hypothesis

Empirical evidence supporting the Random Walk Hypothesis includes studies showing stock prices follow a martingale process, where price changes are independent and unpredictable based on past data. Early seminal works by Fama (1970) and subsequent analyses of market efficiency indicate price movements reflect all available information, aligning with the weak-form Efficient Market Hypothesis. Contrarily, the Life-cycle Hypothesis, focused on consumption smoothing over a lifetime, lacks direct relevance to asset price behavior, emphasizing savings and spending patterns rather than market price randomness.

Empirical Validation of the Life-Cycle Hypothesis

Empirical validation of the Life-Cycle Hypothesis (LCH) demonstrates consistent patterns of consumption smoothing and saving behaviors across different age cohorts, supporting its predictive power regarding household financial decisions. Studies utilizing longitudinal data reveal that individuals accumulate wealth during their working years and decumulate during retirement, aligning with Modigliani's framework, whereas the Random Walk Hypothesis often struggles to account for these age-related consumption trends. The LCH's empirical robustness is bolstered by evidence from cross-sectional surveys and macroeconomic consumption data, which highlight systematic deviations from the martingale property implied by random walk models in aggregate consumption dynamics.

Contrasting Random Walk and Life-Cycle Approaches

The Random Walk Hypothesis posits that asset prices follow an unpredictable path, reflecting all available information instantly, making future price movements independent of past trends. In contrast, the Life-Cycle Hypothesis explains consumption and saving behavior as a function of an individual's age, income, and wealth accumulation, emphasizing systematic planning over time. The key difference lies in randomness versus planned financial behavior: the Random Walk assumes market unpredictability, while the Life-Cycle model assumes purposeful adjustments to consumption based on expected lifetime resources.

Implications for Investors and Financial Planners

The Random Walk Hypothesis suggests that stock prices follow an unpredictable path, implying that investors cannot consistently outperform the market through stock selection or market timing. In contrast, the Life-cycle Hypothesis emphasizes the importance of investors' changing consumption and savings patterns over their lifetime, guiding financial planners to tailor investment strategies based on age and risk tolerance. Understanding these models helps investors balance between passive, diversified portfolios aligned with market efficiency and dynamic planning that accommodates life-stage financial needs.

Criticisms and Limitations of Both Hypotheses

The Random Walk Hypothesis faces criticism for its assumption of market efficiency, often neglecting investor behavior and information asymmetry, which leads to oversimplified predictions of stock price movements. The Life-Cycle Hypothesis is limited by its reliance on rational and stable consumer behavior, ignoring external shocks such as economic crises or changing demographics that significantly impact saving and consumption patterns. Both hypotheses struggle with empirical inconsistencies and fail to fully capture the complexities of real-world financial decision-making and market dynamics.

Conclusion: Integrating Insights from Both Models

The Random Walk Hypothesis and Life-Cycle Hypothesis offer complementary insights into consumer behavior, with the former emphasizing the unpredictability of asset prices driven by new information and the latter focusing on systematic patterns in consumption smoothing over a lifetime. Integrating these models highlights how short-term market randomness coexists with long-term consumption planning influenced by income expectations and retirement considerations. This synthesis enhances understanding of economic agents' decision-making, informing more accurate financial models and policy designs that reflect both immediate market dynamics and lifecycle consumption strategies.

Random walk hypothesis Infographic

libterm.com

libterm.com