Monetary policy shapes the economy by controlling money supply and interest rates to maintain price stability and promote growth. Central banks adjust these levers to influence inflation, employment, and overall economic performance. Discover how these mechanisms impact your financial decisions in the rest of this article.

Table of Comparison

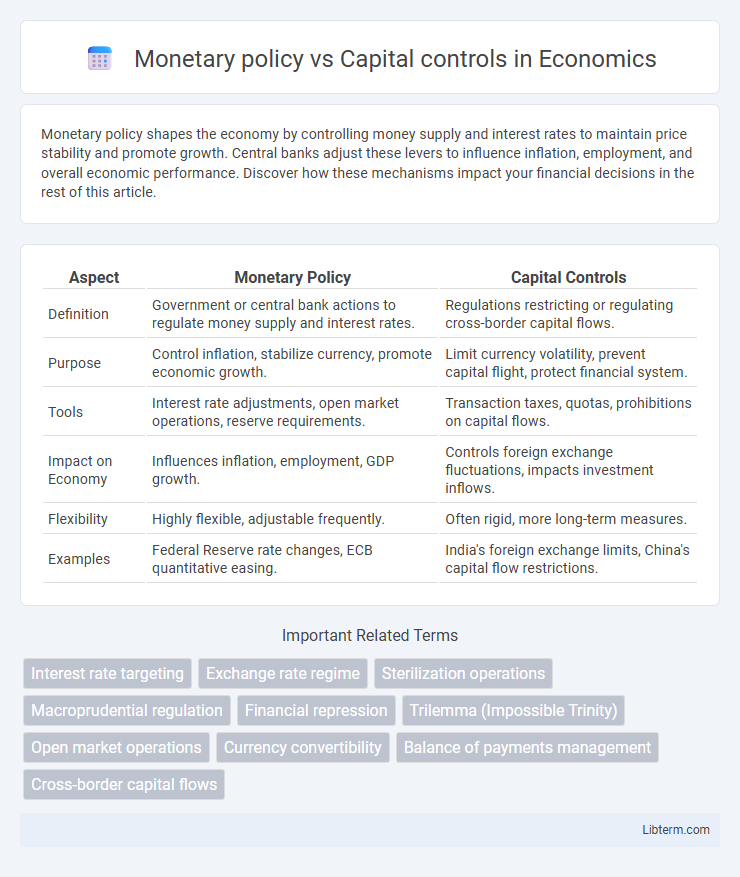

| Aspect | Monetary Policy | Capital Controls |

|---|---|---|

| Definition | Government or central bank actions to regulate money supply and interest rates. | Regulations restricting or regulating cross-border capital flows. |

| Purpose | Control inflation, stabilize currency, promote economic growth. | Limit currency volatility, prevent capital flight, protect financial system. |

| Tools | Interest rate adjustments, open market operations, reserve requirements. | Transaction taxes, quotas, prohibitions on capital flows. |

| Impact on Economy | Influences inflation, employment, GDP growth. | Controls foreign exchange fluctuations, impacts investment inflows. |

| Flexibility | Highly flexible, adjustable frequently. | Often rigid, more long-term measures. |

| Examples | Federal Reserve rate changes, ECB quantitative easing. | India's foreign exchange limits, China's capital flow restrictions. |

Introduction to Monetary Policy and Capital Controls

Monetary policy involves the regulation of a country's money supply and interest rates by the central bank to achieve macroeconomic objectives such as controlling inflation, managing employment levels, and stabilizing the currency. Capital controls refer to government-imposed measures that restrict or regulate the flow of foreign capital in and out of the domestic economy to prevent excessive volatility and safeguard financial stability. Both tools are critical in shaping economic conditions, with monetary policy influencing demand and inflation, while capital controls address external vulnerabilities and maintain exchange rate stability.

Defining Monetary Policy: Tools and Objectives

Monetary policy involves the regulation of money supply and interest rates by central banks to achieve macroeconomic objectives such as controlling inflation, managing employment levels, and stabilizing currency value. Key tools include open market operations, discount rates, and reserve requirements, which influence liquidity and credit availability in the economy. Capital controls, in contrast, restrict cross-border capital flows to maintain financial stability and protect domestic markets from volatile foreign investment movements.

Understanding Capital Controls: Types and Purposes

Capital controls encompass regulatory measures such as transaction taxes, limits on foreign exchange transactions, and restrictions on capital inflows and outflows designed to stabilize a country's financial system. These controls help manage exchange rate volatility, prevent excessive currency speculation, and protect domestic economies from abrupt capital flight. Unlike monetary policy, which adjusts interest rates and money supply, capital controls directly influence the volume and nature of cross-border financial flows to maintain economic stability.

Historical Context: Evolution of Policy Approaches

Monetary policy and capital controls have evolved as critical tools for managing economic stability and growth, with monetary policy primarily involving interest rate adjustments and money supply regulation since the early 20th century. Capital controls gained prominence in the post-World War II era under the Bretton Woods system to restrict volatile cross-border capital flows and protect emerging economies from financial crises. The 1990s marked a shift as many countries liberalized capital accounts, but recurrent crises triggered renewed interest in capital controls as a complementary policy to monetary measures for safeguarding financial stability.

Key Differences Between Monetary Policy and Capital Controls

Monetary policy involves managing interest rates and money supply by central banks to influence economic activity, inflation, and employment, whereas capital controls regulate cross-border capital flows to stabilize financial markets and prevent currency volatility. Key differences include their objectives, with monetary policy targeting macroeconomic stability and growth, while capital controls primarily focus on managing external financial risks and protecting domestic economies from abrupt capital movements. Implementation methods vary as monetary policy adjusts tools like reserve requirements and open market operations, whereas capital controls enforce restrictions such as taxes on foreign investments or limits on currency exchange.

Interaction and Overlap: When Policies Converge

Monetary policy and capital controls intersect when central banks adjust interest rates or reserve requirements to influence capital flows, thereby stabilizing exchange rates and controlling inflation. Both tools can be coordinated to manage currency volatility and external shocks, especially in emerging markets where excessive capital movement risks economic instability. Their overlap enables policymakers to fine-tune financial conditions, balancing domestic economic goals with global financial integration.

Impact on Economic Stability and Growth

Monetary policy influences economic stability and growth by adjusting interest rates and controlling money supply, which directly affects inflation, consumption, and investment levels. Capital controls regulate cross-border financial flows, mitigating volatile capital movements and protecting economies from external shocks that can destabilize markets. While monetary policy offers tools for managing domestic economic cycles, capital controls provide a buffer against global financial volatility, both playing crucial roles in sustaining long-term economic growth and stability.

Case Studies: Global Applications and Outcomes

Monetary policy, implemented through interest rates and money supply adjustments, has been pivotal in countries like the United States and Eurozone for stabilizing inflation and stimulating growth, as seen during the 2008 financial crisis recovery. Capital controls, such as those employed by Malaysia during the 1997 Asian Financial Crisis, effectively limited currency volatility and prevented capital flight, demonstrating their role in crisis management. Comparative analysis indicates that while monetary policy offers broad macroeconomic influence, targeted capital controls can provide immediate relief in volatile capital markets, with mixed long-term effects on foreign investment and economic growth.

Challenges and Criticisms of Each Approach

Monetary policy faces challenges such as time lags in effect, limited impact during liquidity traps, and the risk of inflation or asset bubbles from excessive easing. Capital controls encounter criticisms for potentially deterring foreign investment, causing market distortions, and often being circumvented by sophisticated investors. Both approaches struggle with balancing economic stability while maintaining investor confidence and require careful calibration within global financial integration.

Future Trends in Monetary Policy and Capital Controls

Future trends in monetary policy emphasize increased reliance on digital currencies and advanced data analytics to enhance precision in inflation control and economic stabilization. Capital controls are expected to evolve with more targeted, technology-driven measures to manage cross-border financial flows and mitigate systemic risks without stifling investment. Central banks and regulatory authorities are likely to integrate these innovations, balancing monetary autonomy with global financial integration.

Monetary policy Infographic

libterm.com

libterm.com