The Harrod-Domar model emphasizes the relationship between savings, investment, and economic growth, proposing that a nation's growth rate depends on its savings rate and capital output ratio. It highlights the critical role of investment in driving output increases and suggests that insufficient savings can hinder sustainable development. Explore the full article to understand how this model applies to your economic analysis and development strategies.

Table of Comparison

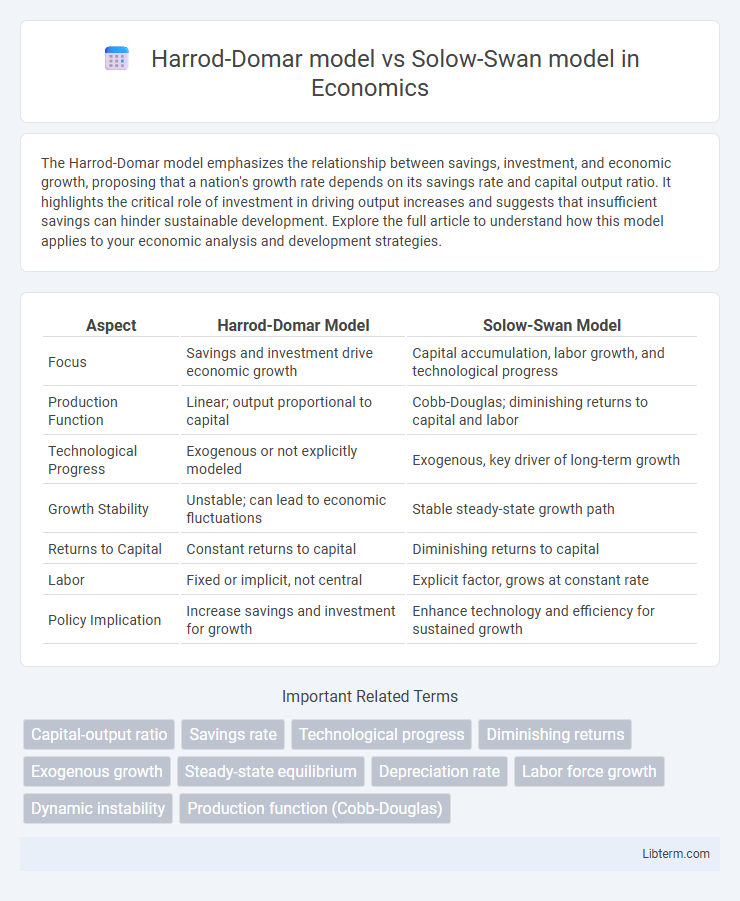

| Aspect | Harrod-Domar Model | Solow-Swan Model |

|---|---|---|

| Focus | Savings and investment drive economic growth | Capital accumulation, labor growth, and technological progress |

| Production Function | Linear; output proportional to capital | Cobb-Douglas; diminishing returns to capital and labor |

| Technological Progress | Exogenous or not explicitly modeled | Exogenous, key driver of long-term growth |

| Growth Stability | Unstable; can lead to economic fluctuations | Stable steady-state growth path |

| Returns to Capital | Constant returns to capital | Diminishing returns to capital |

| Labor | Fixed or implicit, not central | Explicit factor, grows at constant rate |

| Policy Implication | Increase savings and investment for growth | Enhance technology and efficiency for sustained growth |

Introduction to Economic Growth Models

The Harrod-Domar model emphasizes the role of investment and savings in determining economic growth, highlighting the instability of growth rates due to fixed capital-output ratios. In contrast, the Solow-Swan model incorporates technological progress and capital accumulation, demonstrating how economies converge to a steady-state growth path through diminishing returns to capital. These foundational models provide contrasting frameworks for understanding the drivers of long-term economic development.

Overview of the Harrod-Domar Model

The Harrod-Domar model emphasizes the role of savings and investment in determining economic growth, highlighting a fixed relationship between capital accumulation and output growth. It assumes a constant capital-output ratio and a steady savings rate, which dictates the economy's growth path but can lead to instability if actual growth deviates from the warranted growth rate. This model contrasts with the Solow-Swan model by its lack of technological progress and diminishing returns to capital, focusing more on the short-term dynamics of growth rather than long-term steady-state equilibrium.

Overview of the Solow-Swan Model

The Solow-Swan model emphasizes long-term economic growth driven by capital accumulation, labor force growth, and technological progress, assuming diminishing returns to capital and labor. It incorporates an exogenous technological advancement factor, which enhances productivity independently of capital and labor inputs, contrasting with the Harrod-Domar model's focus on fixed savings rates and capital-output ratios. The model predicts convergence to a steady-state growth path where output per worker grows at the rate of technological progress, highlighting the critical role of innovation in sustained economic development.

Core Assumptions: Harrod-Domar vs. Solow-Swan

The Harrod-Domar model assumes a fixed capital-output ratio and constant savings rate, emphasizing the role of investment in driving economic growth but lacks technological progress and labor growth dynamics. In contrast, the Solow-Swan model incorporates variable capital and labor growth rates, with technological progress as an exogenous factor, allowing for diminishing returns to capital and steady-state equilibrium. These core assumptions make the Harrod-Domar model more rigid, while the Solow-Swan model provides a flexible framework for long-term economic growth analysis.

Mathematical Formulation: Comparing the Equations

The Harrod-Domar model is governed by the equation \( g = \frac{s}{k} - d \), where \( g \) is the growth rate of GDP, \( s \) is the savings rate, \( k \) is the capital-output ratio, and \( d \) is the depreciation rate, emphasizing a fixed capital-output ratio and linear growth dynamics. The Solow-Swan model uses the Cobb-Douglas production function \( Y = K^\alpha (AL)^{1-\alpha} \), incorporating labor \( L \), technology \( A \), and capital \( K \) with diminishing returns characterized by \( 0 < \alpha < 1 \), leading to a steady-state growth that depends on exogenous technological progress. While the Harrod-Domar model predicts potentially unstable growth paths due to its inflexible assumptions, the Solow-Swan model mathematically ensures convergence to a steady state by allowing variable capital-output ratios and endogenous adjustment of capital per effective worker over time.

Role of Savings and Investment

The Harrod-Domar model emphasizes the crucial role of savings and investment in determining economic growth by linking the savings rate directly to the growth rate via the capital-output ratio. In contrast, the Solow-Swan model incorporates a more complex interaction where savings influence growth through capital accumulation but acknowledges diminishing returns and technological progress as key factors. While Harrod-Domar assumes fixed capital-output ratios and constant returns to scale, the Solow-Swan model allows for variable capital efficiency, making investment a fundamental but not sole driver of long-term growth.

Technological Progress and Capital Accumulation

The Harrod-Domar model emphasizes the critical role of capital accumulation in driving economic growth but assumes a fixed technological level, limiting its long-term growth predictions. In contrast, the Solow-Swan model integrates technological progress as an exogenous factor, allowing for sustained growth even when capital accumulation faces diminishing returns. This inclusion of technological advancement in the Solow-Swan framework provides a more comprehensive explanation of productivity improvements and long-term economic expansion.

Implications for Developing Economies

The Harrod-Domar model emphasizes the critical role of savings and investment rates in driving economic growth, suggesting that underinvestment leads to stagnation, which guides developing economies to prioritize capital accumulation. In contrast, the Solow-Swan model introduces technological progress and labor growth as key drivers of long-term growth, highlighting the inevitability of diminishing returns to capital and the importance of innovation and human capital development in developing countries. These differing implications shape policy focus, with Harrod-Domar urging increased investment and Solow-Swan advocating for balanced growth strategies incorporating technology adoption and education improvements.

Limitations and Criticisms of Both Models

The Harrod-Domar model faces criticism for its rigid assumptions of fixed capital-output ratios and constant savings rates, leading to unrealistic predictions about economic growth stability. The Solow-Swan model, while more flexible with variable capital-output ratios, is limited by its reliance on exogenous technological progress and neglects factors like human capital and institutional influences. Both models oversimplify complexities of economic dynamics, failing to fully capture real-world growth determinants such as innovation, labor quality, and policy impacts.

Conclusion: Key Differences and Policy Relevance

The Harrod-Domar model emphasizes fixed savings rates and capital-output ratios, highlighting growth instability and the need for investment-driven economic policies. In contrast, the Solow-Swan model incorporates technological progress and variable savings, predicting steady-state growth and endorsing policies promoting innovation and capital accumulation. Policymakers favor the Solow-Swan framework for its long-term growth insights and flexibility in addressing technological change and diminishing returns.

Harrod-Domar model Infographic

libterm.com

libterm.com