Cost of carry refers to the expenses involved in holding a financial asset over a period, including storage fees, interest rates, and insurance. Understanding these costs is crucial for traders and investors to accurately price futures contracts and optimize investment strategies. Explore the rest of the article to learn how cost of carry impacts your trading decisions.

Table of Comparison

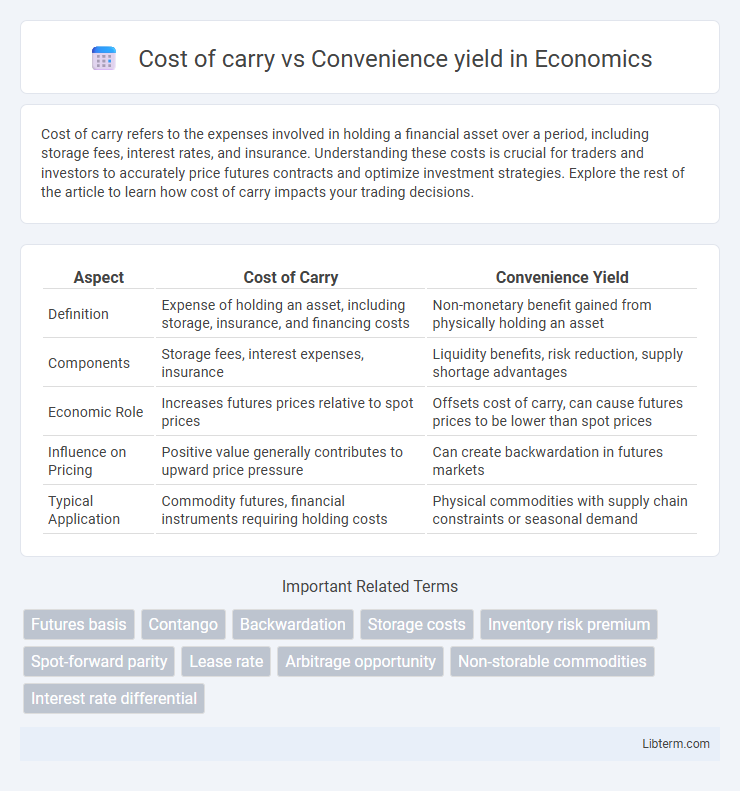

| Aspect | Cost of Carry | Convenience Yield |

|---|---|---|

| Definition | Expense of holding an asset, including storage, insurance, and financing costs | Non-monetary benefit gained from physically holding an asset |

| Components | Storage fees, interest expenses, insurance | Liquidity benefits, risk reduction, supply shortage advantages |

| Economic Role | Increases futures prices relative to spot prices | Offsets cost of carry, can cause futures prices to be lower than spot prices |

| Influence on Pricing | Positive value generally contributes to upward price pressure | Can create backwardation in futures markets |

| Typical Application | Commodity futures, financial instruments requiring holding costs | Physical commodities with supply chain constraints or seasonal demand |

Introduction to Cost of Carry and Convenience Yield

Cost of carry represents the net expense of holding a physical commodity or financial instrument over time, including storage fees, insurance, interest, and financing costs. Convenience yield reflects the non-monetary benefits or advantages of physically possessing the asset, such as ensuring supply availability or avoiding shortages. Understanding the balance between cost of carry and convenience yield is essential for pricing futures contracts and making informed trading decisions.

Defining Cost of Carry in Financial Markets

Cost of carry in financial markets refers to the total expenses incurred to hold a position in an asset over a period, including interest, storage, insurance, and financing costs. It represents the difference between the asset's spot price and its futures price, adjusted for the cost of financing until contract maturity. Convenience yield measures the non-monetary benefits or advantages of physically holding the asset, often inversely related to the cost of carry.

Understanding Convenience Yield

Convenience yield represents the non-monetary benefits of physically holding a commodity, such as ensuring production continuity or avoiding stockouts, which influence futures pricing beyond the cost of carry. Unlike the cost of carry, which includes storage, insurance, and financing expenses, convenience yield reflects the value of immediate availability and market conditions like scarcity. Understanding convenience yield is crucial for accurately pricing futures contracts and interpreting market signals in commodities trading.

Key Components Influencing Cost of Carry

The cost of carry primarily includes storage costs, financing expenses, and insurance fees required to hold an asset until its delivery date. Convenience yield represents the non-monetary benefits of holding the physical commodity, often influenced by factors such as scarcity, demand volatility, and inventory levels. A higher convenience yield can reduce the overall cost of carry, impacting futures pricing and arbitrage opportunities.

Factors Affecting Convenience Yield

Convenience yield is influenced by factors such as inventory levels, demand for immediate physical possession, and market volatility, which directly impact the benefits of holding the underlying asset. High inventory shortages or supply disruptions typically increase convenience yield, reflecting the premium for owning the asset amid scarcity. Market conditions, including storage costs and interest rates, also affect the relative importance of convenience yield compared to cost of carry in futures pricing.

Relationship Between Cost of Carry and Commodity Prices

The relationship between cost of carry and commodity prices is critical in futures markets, where the cost of carry includes storage, insurance, financing, and other holding costs. Convenience yield represents the non-monetary benefits of physically holding a commodity, often causing futures prices to be lower than spot prices when convenience yield exceeds cost of carry. This dynamic directly influences the basis, shaping the pricing structure and arbitrage opportunities in commodity markets.

Practical Examples: Cost of Carry vs Convenience Yield

The cost of carry includes expenses such as storage, insurance, and financing fees required to hold an asset, which are often evident in commodities like oil or gold where traders pay for warehousing and interest on borrowed funds. Convenience yield represents the non-monetary benefits of physically holding an asset, such as ensuring supply continuity during shortages, commonly observed in agricultural products where immediate availability can prevent production delays. For example, during a wheat shortage, a farmer holding physical inventory gains a convenience yield that may offset or exceed the storage cost, whereas in normal markets, the cost of carry generally dominates as holding inventories incurs net expenses.

Cost of Carry, Convenience Yield, and Futures Pricing

Cost of carry represents the total cost incurred to hold an asset, including storage, financing, and insurance, directly influencing futures pricing by determining the forward price above spot price. Convenience yield reflects the non-monetary benefits of physically holding the asset, such as ensuring supply or avoiding stockouts, which can reduce the futures price relative to the cost of carry. The interplay between cost of carry and convenience yield shapes the basis and convergence behavior between futures and spot prices in commodity markets.

Implications for Traders and Investors

Cost of carry represents the total expenses incurred to hold an asset, including storage, financing, and insurance, directly impacting futures pricing and trading strategies. Convenience yield reflects the non-monetary benefits of physically holding an asset, such as ensuring supply during shortages, and influences the basis between spot and futures prices. Traders and investors must weigh cost of carry against convenience yield to optimize arbitrage opportunities, manage risk, and enhance portfolio returns.

Conclusion: Balancing Cost of Carry and Convenience Yield

Balancing cost of carry and convenience yield is essential for accurate commodity pricing and effective risk management in futures markets. The cost of carry includes storage, financing, and insurance expenses, while convenience yield reflects the non-monetary benefits of physical ownership, such as ensuring supply security. Optimal market decisions arise from analyzing the interplay between these factors, where a higher convenience yield can offset cost of carry, influencing whether futures prices trade at a premium or discount to spot prices.

Cost of carry Infographic

libterm.com

libterm.com