Basel II establishes international banking regulations focused on risk management, capital adequacy, and supervisory review to ensure financial stability across global markets. It introduces three pillars: minimum capital requirements, supervisory review processes, and market discipline through disclosure. Discover how Basel II impacts your financial institution's operations and risk strategies in the rest of the article.

Table of Comparison

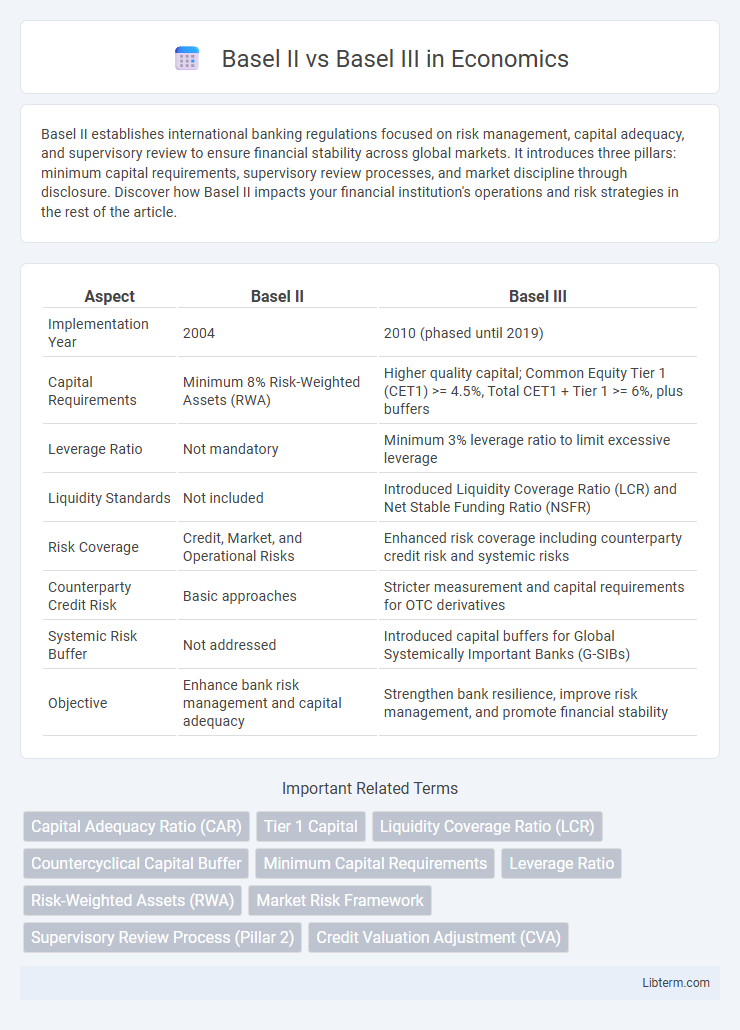

| Aspect | Basel II | Basel III |

|---|---|---|

| Implementation Year | 2004 | 2010 (phased until 2019) |

| Capital Requirements | Minimum 8% Risk-Weighted Assets (RWA) | Higher quality capital; Common Equity Tier 1 (CET1) >= 4.5%, Total CET1 + Tier 1 >= 6%, plus buffers |

| Leverage Ratio | Not mandatory | Minimum 3% leverage ratio to limit excessive leverage |

| Liquidity Standards | Not included | Introduced Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) |

| Risk Coverage | Credit, Market, and Operational Risks | Enhanced risk coverage including counterparty credit risk and systemic risks |

| Counterparty Credit Risk | Basic approaches | Stricter measurement and capital requirements for OTC derivatives |

| Systemic Risk Buffer | Not addressed | Introduced capital buffers for Global Systemically Important Banks (G-SIBs) |

| Objective | Enhance bank risk management and capital adequacy | Strengthen bank resilience, improve risk management, and promote financial stability |

Introduction to Basel Accords

Basel II introduced a more risk-sensitive framework emphasizing three pillars: minimum capital requirements, supervisory review, and market discipline, aiming to enhance banking sector stability. Basel III built on Basel II by increasing capital quality and quantity, introducing leverage and liquidity ratios to address systemic risks exposed during the 2008 financial crisis. Both accords are standards set by the Basel Committee on Banking Supervision to strengthen regulation and risk management in international banking.

Key Objectives of Basel II and Basel III

Basel II aims to enhance risk sensitivity in banking regulation by improving minimum capital requirements, supervisory review processes, and market discipline through standardized risk assessment frameworks. Basel III strengthens the global regulatory framework by introducing higher capital quality and quantity standards, enhanced liquidity requirements, and leverage ratio limits to improve bank resilience and reduce systemic risk. Both frameworks focus on promoting financial stability but Basel III responds to the 2008 financial crisis with more robust measures for risk management and loss absorption capacity.

Risk Management Frameworks Compared

Basel II introduced a three-pillar approach emphasizing minimum capital requirements, supervisory review, and market discipline, focusing on credit, market, and operational risks. Basel III enhanced this framework by increasing capital quality and quantity, introducing leverage ratios, and implementing liquidity standards to address systemic risks revealed during the 2008 financial crisis. The evolution from Basel II to Basel III reflects a shift towards stronger risk sensitivity, improved stress testing, and enhanced transparency within global banking regulations.

Capital Adequacy Requirements

Basel II established minimum capital adequacy requirements by focusing on three pillars: minimum capital requirements, supervisory review, and market discipline, emphasizing risk-weighted assets to determine capital reserves. Basel III enhanced these standards by increasing the quality and quantity of capital, introducing a leverage ratio, and adding capital conservation buffers and countercyclical buffers to strengthen banks' resilience to financial stress. The transition from Basel II to Basel III results in higher common equity tier 1 capital requirements and more stringent risk management frameworks for global banking institutions.

Leverage Ratio: Basel II vs Basel III

The Leverage Ratio under Basel II was less defined, focusing primarily on risk-weighted assets with limited control over total exposure, whereas Basel III introduced a strict minimum leverage ratio of 3% to constrain excessive borrowing and improve bank resilience. Basel III's leverage ratio encompasses all on- and off-balance sheet exposures, promoting greater transparency and reducing reliance on risk-weighted assets that may understate actual leverage. This enhancement aims to prevent the build-up of systemic risk by ensuring banks maintain sufficient capital buffers regardless of asset risk profiles.

Liquidity Standards and Reforms

Basel II primarily emphasized credit risk and market risk management without comprehensive liquidity standards, while Basel III introduced stringent liquidity reforms including the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to enhance short-term and long-term liquidity risk resilience. Basel III's liquidity standards aim to ensure banks maintain sufficient high-quality liquid assets (HQLA) to cover net cash outflows during 30-day stress scenarios, addressing gaps exposed by the 2008 financial crisis. These reforms significantly strengthen banking sector stability by promoting better liquidity risk management and reducing systemic vulnerabilities.

Supervisory Review Processes

Basel II emphasizes the Supervisory Review Process (Pillar 2) to ensure banks maintain adequate capital beyond minimum regulatory requirements by assessing internal risk management systems. Basel III enhances these processes by introducing stricter capital adequacy standards, leverage ratios, and liquidity coverage requirements to strengthen overall financial stability. Supervisory authorities under Basel III conduct more rigorous stress testing and continuous monitoring to address systemic risks and promote resilience in the banking sector.

Market Discipline and Transparency

Basel III enhances market discipline and transparency by introducing more stringent disclosure requirements compared to Basel II, including detailed risk exposure and capital adequacy reports. It mandates banks to provide granular information on leverage ratios, liquidity coverage, and risk-weighted assets, fostering better-informed market participants. These measures aim to improve risk assessment and promote financial stability by increasing the quality and extent of public disclosures.

Implementation Challenges and Global Impact

Basel II introduced a risk-sensitive framework emphasizing credit, market, and operational risks but faced implementation challenges due to its complexity and reliance on banks' internal models, resulting in inconsistent global application. Basel III addressed these issues by enhancing capital requirements, introducing leverage and liquidity ratios, and promoting stronger risk management, yet its implementation encountered difficulties tied to the increased regulatory burden and capital adequacy calculations. Globally, Basel III fostered greater financial stability and resilience but required prolonged adaptation periods and significant compliance costs, with varying impacts across developed and emerging markets.

Future Outlook for Banking Regulation

Basel III introduces more stringent capital requirements and liquidity standards compared to Basel II, aiming to enhance the resilience of banks against financial shocks. The future outlook for banking regulation emphasizes further refinement of risk management frameworks, with increased focus on stress testing, leverage ratios, and the integration of macroprudential policies. Ongoing advancements in technology and data analytics are expected to drive more dynamic regulatory approaches, improving transparency and stability in the global financial system.

Basel II Infographic

libterm.com

libterm.com